Historically, Emerging and Frontier markets may have been associated with instability, volatility and a lack of certainty. However, today many emerging economies are actually less volatile than developed ones, enjoy SUBSTANTIALLY lower levels of debt and far better fiscal accounts.

In fact, although Zimbabwe recently announced it had only $217 in the government checking account, we’d like to remind readers that they’re about $122,600,000,000,000 ahead of the US! NO, we’re not suggesting investing in Zim, but rather just making a point…

A recent Bloomberg article provides us with some good detail on frontier markets performance in 2012. We’ve been sharing our thoughts on why these markets usually out-perform with our readers for years.

Frontier funds’ 24 percent average return last year compares with 14 percent for U.S. funds, 16 percent in both Japan and emerging markets, and 17 percent in Europe, according to data compiled by Bloomberg.

Investing and living with “familiar”

The term “sheeple”, which is aptly used to describe most of the inhabitants of this rock, is used so often for a reason; the tendency amongst humans to stick with the known, to graze where the herd grazes, and rest with the flock is well-known.

Familiarity is how we conduct our lives. Familiarity itself engenders complacency. Complacency in times of upheaval is beyond dangerous…it’s complete folly.

for most of us it’s more comfortable to live in a country where the same language is spoken, shop in supermarkets which sell products we’re accustomed to, eat familiar food and invest in companies and markets we’re familiar with…nothing unusual about any of that.

It is largely why most US investors will continue to put all their retirement savings into “the land of the fleeced and home of the (coming) rage”.

(Side note: Mark just sent me this. It’s a link to an article, which unless one is in complete denial, will be recognized for what it really is. The coming theft by the US Government of citizens retirement/401k accounts…in all, $19.4 trillion. The doors are rapidly swinging shut, yet most will fail to see the writing on the wall and will simply “hope” that it won’t happen, DESPITE them telling the public in no uncertain terms that it is coming.)

This instinct, that of favouring the familiar over the unknown, has led to an over-valuation of domestic markets versus many emerging and frontier markets. This provides opportunities for those who, like your editors, are comfortable “grazing in a different field”.

It is the premise behind our short Yen position first detailed in a post aptly entitled, “Betting on an Inevitable and Overlooked Crisis“. It is also typical of the asymmetric trade setups we look for. That Yen trade by the way is looking better and better every day!

An Attractive grazing field

So, where should an adventurous investor with a penchant for decent returns look? How about Cambodia!

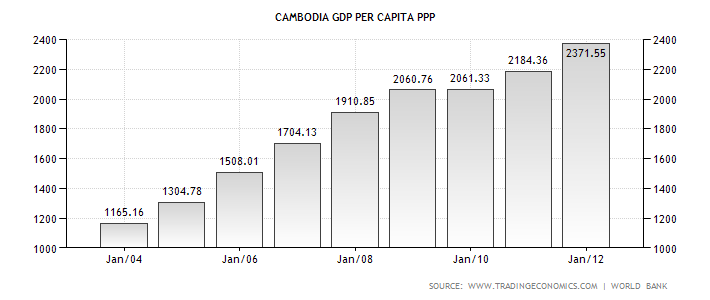

With a GDP per capita of just US$2,300, Cambodia is a poor country, make no mistake about it. Yet just 10 years ago per capita income was just US$1,000. This means that the Cambodians have enjoyed a 230% increase in income, and thus a vastly improved lifestyle in just one decade. Of course we’re benchmarking to the not-so-mighty greenback here, so we have to consider that as well, but it’s still a nice bump.

Look around and ask yourself if you are living in a country where incomes have doubled over the last 10 years..? Where economic freedoms have been increasing, opportunities expanding, and where living standards are rising rapidly.

Cambodia is such a country. Among ASEAN countries only Laos is set to have faster growth than Cambodia, forecasted at 7.5% for 2013-2014. Cambodia’s 2012 growth was an estimated 6.6%, with a forecast of 6.7% for this year and 7% for 2014.

We love macro tail winds. One of those tailwinds is demographics. Like it or not as we get old we aren’t particularly good at working and contributing to economic growth. Instead most in the West tend to retire to the porch, sip scotch, play golf and visit the doctor. Economies filled with old people are not so good for the balance sheet.

So, you might notice a certain trend in our investing thesis. We are discriminatory. We discriminate against ageing demographics, we discriminate against investing our capital in countries and companies that we don’t believe will make us wealthier, and we discriminate against “stupid” people. Capitalism works like that.

So you could say that Cambodia is the opposite of, say Japan…

Japan, now there is a tail wind we want to be involved with, but from a decidedly different angle. With adult diaper sales now exceeding infant diaper sales, and 26% of their population now over 65 years of age we’re betting on a giant fiscal SPLAT in the land of the rising sun.

Incidentally, I am presently working with some friends on a means of accessing the commercial side of this market for retail investors. If…and it’s still an “if” at this stage that we can do it, the potential payoff could be absolutely HUGE. It’ll definitely be something that our CPAN members get shown first if we can put it together.

Back to Cambodian demographics… Due in no small part to the mad man Pol Pot and his genocidal atrocities, Cambodia carries essentially no demographic baggage. The average age is around 25. As you can imagine, the skills shortage is simultaneously a MASSIVE problem and also one of the BIGGEST OPPORTUNITIES for intrepid entrepreneurs.

Overall the opportunities in Cambodia are profound. The entire supply chain is largely missing. Agriculture, manufacturing, and tourism are all growth sectors. Adding value and capacity along the chain will make someone very rich. Additionally, Cambodia has open sea access, with reasonable port infrastructure.

One of the easiest ways we’ve found to make money almost anywhere is to find a successful player in a particular market, then finance them when they decide to expand into a similar market that is yet untouched.

On that note a Cambodian company which we have been following for some time is Acleda Bank. It’s Cambodia’s largest commercial bank, and it has been very successful in both Cambodia and recently Laos. We have detailed this company before in these musings.

Acleda have recently inked a deal with the IFC (International Finance Corporation), a World Bank development lender. Under the terms of the deal the IFC will provide US$ 2M to Acleda to set up a micro-finance institution in Myanmar, which is another market we are actively researching a number of private equity deals in (our CPAN members have already participated in one).

This micro-finance unit will have an initial paid-up capital of US $10M, and will advance funds to individuals and SME’s. At least 5 branches will be opened in Yangon and Bagan.

With 126,237 registered SMEs in Myanmar this is a sector set to explode. SMEs in Myanmar account for 99.4% of all companies across all sectors, so we’re talking about almost the entire Myanmar economy, which is in desperate need for capital.

Southeast Asia if open for business. For those of you who are serious about placing capital in this region Mark and I are hosting a Meet Up in Phnom Penh in April. Executives from businesses in the country, frontier hedge fund managers, local lawyers and real estate professionals and local and expat entrepreneurs will be speaking directly with our small group.

I invite you to join us before we fill up the remaining 15 or so slots, and I look forward to meeting those of you who are already coming. Details for our Cambodia: Boots on the Ground Meet Up can be found here.

– Chris

“It’s up to history to judge” – Pol Pot

Chris comment: “Indeed it is!”

This Post Has 2 Comments

When I read your blog I switch the word “Cambodia” to “the Philippines” and take all the great advice and run with it! Another great post. Thanks

Easton,

Agreed that the Philippines are intriguing as well. The stock market there has been on fire, and is of course much more developed than Cambodia’s. I would consider the Philippines an emerging market as opposed to a frontier market at this point though.

We’ll be there in the next couple months to check it out on the ground for future opportunities.

Cheers,

Mark