I woke this morning to gale force winds and sideways rain slapping my bedroom window. Yuk I thought, as I crawled out of bed to check the markets, the same way I start every week day. What I could not have known was the shock and awe about to greet me! The weather outside was NOTHING compared with the devastation which had taken place as I slept.

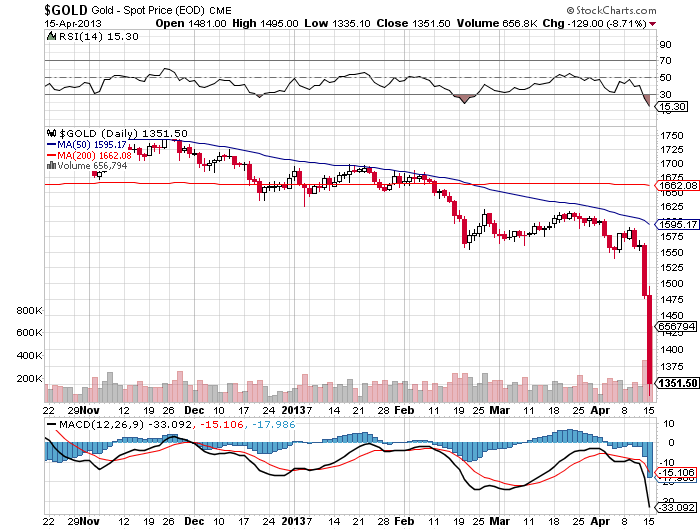

Across the world computers and their “algos” had spat, gurgled and executed sell order upon sell order, driving markets down in earnest. Much of the damage was inflicted on the gold and silver markets, which experienced their deepest 1-day decline in 30 YEARS!

The selling began on Friday with a massive 125-tonne sell order from a large investment bank. According to the CME:

“The gold futures markets opened in New York on Friday, 12th April to a monumental 3.4 million ounces (100 tonnes) of gold selling of the June futures contract in what proved to be only an opening shot. The selling took gold to the technically very important level of $1,540, which was not only the low of 2012, it was also seen by many as the level which confirmed the ongoing bull run which dates back to 2000. In many traders minds it stood as a formidable support level… the line in the sand.”

Understanding how important these technical levels are is crucial when trying to get your mind around how a market can melt up or down. Those involved in the “paper market” often use leverage, or “borrowed” money to increase the amount of their bets. When stops (orders that are executed when a pre-determined price is achieved) are hit, which often coincide with popular technical “support” or “resistance” levels, their computer models tell them to sell. This creates a self-fulfilling prophecy. Every technical trader out there knows that the 50% Fibonacci retracement levels for gold are sitting at $1,296 and the 61.8 retracement level is $1,152…so, what do you think happened when those levels were hit? You know the answer now!

When these levels are breached it matters not what the fundamentals are, as the sluice gates are opened, creating another swathe of selling. This is known as CGLB (computer generated lemming behaviourism). It is the modern day equivalent of pouring gasoline on a fire. Just remember that this can happen in a market on the way up too, where those who are “short” are also positioned with stop orders.

More from the CME:

“Two hours later the initial selling, rumoured to have been routed through Merrill Lynch’s floor team, by a rather more significant blast when the floor was hit by a further 10 million ounces of selling (300 tonnes) over the following 30 minutes of trading. This was clearly not a case of disappointed longs leaving the market – it had the hallmarks of a concerted ‘short sale’, which by driving prices sharply lower in a display of ‘shock & awe’ – would seek to gain further momentum by prompting others to also sell as their positions as they hit their maximum acceptable losses or so-called ‘stopped-out’ in market parlance – probably hidden the unimpeachable (?) $1540 level.”

I also found the following extract very interesting:

“The selling was timed for optimal impact with New York at its most liquid, while key overseas gold markets including London were open and able feel the impact. The estimated 400 tonne of gold futures selling in total equates to 15% of annual gold mine production – too much for the market to readily absorb, especially with sentiment weak following gold’s non performance in the wake of Japanese QE, a nuclear threat from North Korea and weakening US economic data. The assault to the short side was essentially saying ‘you are long… and wrong’…”

Additionally, US investment bank Goldman Sachs just the other day recommended its customers sell gold, which sparked an early sell-off. These guys couldn’t have had any insider knowledge, surely!?

Look, you don’t have to be an olfactologist (I made that up, I think) to know something smells ROTTEN here!

On that note, direct from Bloomberg it was recently reported that the FOMC minutes were pre-released to a select group of connected parties, including congressional staff members and lobbyists for some of Wall Street’s largest firms, including Goldman Sachs, Citigroup, Barclays Capital and the Carlyle Group.

In particular, US Congressman Grayson points out that the FOMC leak that went to Goldman Sachs further stated, and I KID YOU NOT:

“We recommend initiating a short COMEX gold position…”

The market is rigged, period, full-stop! The F’d up part is that these guys NO LONGER EVEN TRY TO HIDE IT!

These people don’t give a crap about you, your family, your life savings or even your life itself. You are a MILK COW, and you will be “milked” for everything that you have if you let them get away with it.

Now, back to gold for a minute… Ask yourself this question: If you held such an enormous gold position as the initial 125 tonne order that started yesterday’s landslide, which equated to roughly $6B, WHY ON EARTH would you hit the bids and not at least try and get the best price possible? If you are after profit you would sell repeatedly, but in a fashion so as to NOT severely disrupt the market. After all, you’re hurting yourself by slamming the market and driving price down. Clearly it was intentional.

However, consider this little tidbit… While precious metals traders screens resemble a Sunday Catholic Mass, sporting a sea of red candles, REAL bullion dealers, the guys that actually sell the shiny stuff, are reporting difficulty in filling orders, as “real” physical gold and silver has been disappearing at a record pace from their shelves. If you can find bullion to buy you will be paying a massive premium to the paper market price. Don’t believe me, just go to Kitco or some other dealer of physical metals, check out the prices for a one ounce coin, gold or silver.

In other words, there is a MASSIVE disconnect between the paper markets and the physical markets.

Consider the following “acronym events” as I call them, which have just recently taken place in the markets. Tell me if these are bullish or bearish for the precious metals:

- RIO – This weekend, the world’s second largest copper mine – Rio Tinto’s Kennecott in Utah – had a massive landslide, taking out 16% of US silver production and 7% of US gold production for years, if not forever at that site. And this, on the heels of last week’s indefinite delay of Barrick’s massive Pascua Lama gold/silver project on the border of Argentina and Chile.

- BOJ – The Bank of Japan has decided to push the limits of Keynesian thinking by embarking on a program to double their monetary base within 2 years.

- FED – Purchasing $85 billion a month of US Bonds.

- PRC – Bad GDP numbers are being blamed on the crushing of commodities, including the precious metals. Now, given the playbook of central bankers around the world I ask you: What do you do if you’re a central banker and GDP slips? Why it’s an easier answer than you might think… You either call on an alien invasion to boost government spending (Paul Krugman’s idea) or you just “print up” some GDP. That’s much easier and less likely to cause mass hysteria anyway.

Bureaucrats have shown their willingness to steal directly from your bank account. It’s just a matter of time before they raid your pension fund, your 401k, your super annuation, etc.

Then of course we have “Baby Doughboy”, who has just threatened to stop threatening. Whether or not this kid is bluffing or not I have no idea, but it’s certainly NOT bearish gold.

As if all this was’nt enough, the gentle folks who were out to enjoy the Boston Marathon yesterday had their worlds torn apart instead. Rather than regaling what you’ve likely already heard on the televisions and news sources, below I copy an email I received from a friend who has an excellent knowledge of geopolitics, due to a background in the US military, and as a foreign Service Officer in the former Soviet Union, mid-east, and sub-saharan Africa. It’s copied in its entirety, and I encourage you to read it through. His analysis is excellent!

“Chris,

Just a heads-up. I was at the Boston Marathon today (designated as the ‘Patriots Day’ holiday in Massachusetts), and uncomfortably close to the bomb blast when it went off. My wife had crossed the finish line (aka ground zero) less than five minutes before the explosions. We had just met up a block away and were with our family when they went off. There was absolutely zero doubt that it was a demolition, and not gunfire. Luckily she didn’t stop at the first aid tent to get some food (which she almost did) or she would have been caught in the middle of it. Nasty little device…typical IEDs that were used in Iraq, loaded with ball bearings. I’ve heard that at least 10 amputations have been conducted at Mass General Hospital today.

So naturally, once the family was safely back in our hotel, my thoughts turned to who the Hell would do something like this. It’s a sporting event, and definitely not politically oriented. As bad as the media is making this out to be, the collateral damage was actually somewhat light. Lots of injuries, but a true pro could have made this much, much worse. Imagine a bomb that, when blown, frightens the crowd and drives it in one direction…into a much larger and coordinated series of detonations. That’s what a true deviant would do.

So, there’s no political message to be sent here. And we’re not dealing with seasoned pros. Why do this now? Who stands to gain from an action like this?

I truly don’t think that this is an act of foreign terrorism (though a look at my Facebook page, which is populated with lots of US military types, makes it clear that lots of people really want it to be). The modus operandi doesn’t make sense, and frankly if AQ or a similar offshoot wanted to scare people they would have aimed for a much higher body count.

I suppose that it could be domestic terrorism. The US government seems to be very sensitive to the threat of an Iraq or Afghan war veteran going ‘off the reservation’. Anything is possible, but again…it doesn’t make sense. Most military guys wouldn’t target a sporting event…they would be more likely to attack a military facility, or a government building (e.g. McVeigh).

Then I think about what else is happening in the world right now. Not just in geopolitics, but within the markets. To me, the -15% sell-off in gold over the past week is a massive story (and not just because I’m long gold!). Lots of people spent the weekend searching for answers on what’s driving this, and the only plausible explanation I’ve found is that at least one central bank (one much larger than Cyprus) is in immediate need of liquidity. In this line of thought, QE has failed to deliver and liquidation of gold is the next step that must be taken to avert disaster, even if the respite is only temporary.

If true, that central bank – and its government – obviously believes that is in a dire situation. They would have to know that overt liquidation of gold would lead to discord, and possibly panic, in the markets if the public became aware of this action. What’s the best way for a government to win the people’s unconditional loyalty and ensure a ‘no questions asked’ level of subservience from the masses? It’s simple, really. Make them feel threatened, and unsafe. Make them believe that their way of life is ‘under attack’, and only the sight of uniformed military personnel and mil-spec SWAT vehicles on their streets will bring that feeling of safety back.

There is no better pre-tense for the increase of gov’t authority than a terrorist attack, even one as low-grade as this one was today.

Now don’t get me wrong…I’m certainly not suggesting that the US government engineered this disaster today in order to bolster its case for increased surveillance and security, and an overall reduction in privacy and civil liberties. To do so would land me firmly in ‘tinfoil hat’ territory, and bring all kinds of accusations of being ‘un-American’, or simply being an enormous idiot.

Besides, everyone knows that governments have never resorted to a ‘false flag’ tactic before. Well, except the Germans with the Reichstag fire. Or Putin with the Moscow apartment bombings. Or the US with Mossadegh in Iran.

I’m not making any accusations here. All I’m saying is that it’s pretty damn convenient for the US government that the people are now going to be clamoring for more ‘protection’ and ‘security’, just as its fiscal position appears to be taking a significant turn for the worse. I find the timing of this event to be very interesting.

Or maybe I’m just pissed off because someone blew an IED less than a block away from my little boy today.”

Wow, right? Whether or not this was a “false flag” event we’ll likely never know, but what this does mean is that the ever growing trend towards turning the US into a full-blown police state will now go into overdrive. Prepare for even greater lock down, I’m sorry to say.

Will the US Government shortly find “evidence” of terrorism linking Boston to Doughboy, or Iran or…or? I don’t pretend to know, but like our friend who was at ground zero, our “spidey senses” are tingling.

Conclusion

Since 1975, there have been 13 bear markets with an average drop of around 14%. This would put gold below the $1,300 level, around $1,280. Gold is presently the most oversold its been in 14 years. So, if you were to look back and consider buying gold 14 years ago you may gain some appreciation for the immense opportunity that is likely presenting itself.

Ok, so what do we do with this information?

We don’t trust the financial system. We are bullish government largesse, bullish central bank non-independence, bullish Keynesian thinking continuing to rule the “elite”monetary halls of power, bullish increasing aggressive militaristic outcomes, and I guess if I was to sum it up, we’re bullish STUPIDITY. It is impossible to be completely objective given that bias. However, when stepping back from the morass, everything right now screams BUY GOLD, and gold has just gone on sale. Forgive the language, but it is a contrarian’s wet dream.

This is why exhaustion is the best market to buy. Finding exhaustion is not a perfect science, and there are many factors to look for. In layman’s terms the easiest I’ve found, after trading for most of my adult life, involves a rapidly-falling price on waning volume, or alternatively a rising price on declining volume.

We may be wrong, as we’ve said buy a couple times now, and we know how that has played out. However, we believe that over the course of the following weeks and possibly months, we will be able to position ourselves to make life-changing returns in these markets.That goes doubly for the junior resource stocks that we are also so fond of.

– Chris

“You are either a contrarian or a victim” – Rick Rule

This Post Has 7 Comments

Hi Chris,

Wondering if either you or Mark have good book/ reading material ideas on history of mining industry, gold, market crashes? I’m looking around for material on cause/effect relationships.

Cheers

Aaron,

The Crash of 1929 by Galbraith; Manias, Panics and Crashes by Kindleberger; Extraordinary Popular Delusions and the Madness of Crowds by Mckay of course, and I liked Against the Gods – The Remarkable Story of Risk by Bernstein.

I don’t know of any specific mining related books, maybe other readers can suggest some.

Hiding behind the “i’m not making any accusations” blanket while offering up a some biased scenarios that certainly seem to implicitly make those accusations is disingenuous, at best. I usually enjoy reading your perspectives, but I can’t help but feel you and your “spidey senses” are firmly in the crazy territory after this post. I’ve removed myself from your distribution list.

All the best to you going forward.

Sorry this upsets you. You’ll notice however that we offered the opinion of someone on the ground in Boston and clearly stated that we have NO IDEA. If that disturbs you I’m not sure what to say.

I say “have a good day”. LOL. Everyone is entitled to their opinion. I see nothing disengenuous about what may or may not have been implied. We respect all of our readers opinions. We certainly have our own as well, and since this is our blog, you’ll get a good dose of ours herein. You can read it, agree or disagree…or not.

Cheers!

“In other words, there is a MASSIVE disconnect between the paper markets and the physical markets.”

Guys,

Let me add my own experience to what you’ve said above.

Every day I check prices on some intended bullion purchases on my favourite online bullion seller’s website (www.silvergoldbull.com). Yesterday, I was watching prices come down on some silver I’ve been thinking about, and toward the end of the day, the website started to get really slow. Many of the items available started to show “Unavailable”. In the course of half an hour, this showed up on most of the Canadian 1 oz silver coins (which are .9999 purity, as opposed to many others which are .999). Today, there are many items showing “Sorry, we’re looking for more stock!”

I’ve never seen that on this website before, so I placed an order for a few bars, and after the longest possible wait before my browser timed out, managed to confirm a transaction. Silver Gold Bull is saying to allow 20 business days for shipping due to the deluge of orders (also unprecedented in my experience).

Through it all, the irony hit me. Here we were in a generational sell-down of precious metals, and it was becoming almost impossible to buy any physical. The disconnect between the two markets is like alternative universes.

Brad,

Thanks for sharing your experience! I’m sure many of our readers have endured the same thing lately, and it is frustrating. But, it shows what is really occurring in the physical market, versus the “sideshow” we see via the manipulated paper market.

Cheers,