I’ve long since argued that democracy isn’t necessary for prosperity. Rather than railing against democracy I merely am making the point that economic liberty is more important to wealth creation than political liberty. It is a market economy that is the key to unlocking wealth.

The reason this is so is because humans are, well, human.

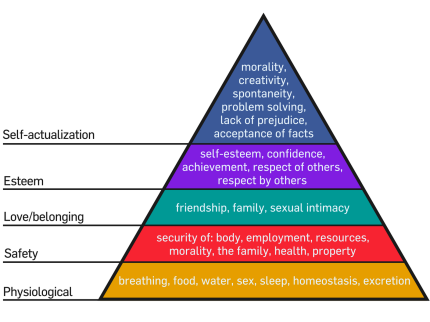

Part of being human involves looking out for our own best interests, and accordingly Maslow’s hierarchy of needs provides a good starting point. Any system that halts the progress of any stage in the above diagram will simultaneously halt wealth creation and any system that assists or allows humans to pursue their own needs, ideas, passions and wants will foster wealth creation.

Over the last 100 years or so Europeans and Americans have been fortunate enough to have been born with their bum in the butter so to speak. They have enjoyed:

- Leadership in economic liberty

- Political liberty

- Superior judicial systems

- High standards of education, and thus leaders in technology

- And also, although it seems laughable when considering FACTA, capital controls, MF Global and any myriad other frauds, a superior financial system with banking, stock exchanges and financial instruments, which ostensibly assisted in the US Dollar and Euro becoming reserve currencies

This superior status has led to all sorts of ludicrous assumptions being made from those who typically know little of history, geopolitics and economics, which typically includes congress, the Troika and entire swathes of the media fed populace. It is how once great powers wither into the dust bowl of history. The populace blissfully unaware of what has happened, or worse yet believing that something has happened to make their lives miserable which is completely divorced from reality.

The media is so astonishingly powerful over a populace fast asleep and trusting. I present one such example: I still come across people telling me about global warming. Haven’t they heard of climate gate? Haven’t they figured out that Al Gore duped the world? Yes, the ice caps are safe and smiling polar bears are to be found frolicking with their little cubs. Turn the heat up.

Looking at the recent G20 meeting it’s astonishing that an air of superiority remains. You can see it written all over the faces of western leaders: “We do things differently” or “we’re smarter, more sophisticated, it’s in our genes”.

I can see how it happens. I recall the first time I visited the Pyramids in Giza. I thought to myself, how the hell did Egyptians build these amazing buildings when today they clearly can’t put up anything that will last more than a few short years? The place is now falling apart. I’m sure at some point Egyptians were nodding appreciatively to one another over a hooka pipe saying “We’re Egyptian, of course we’re smarter, of course we’re better”.

This is what is happening in the West today.

Try starting up and running a new business in Europe. Heck, I’ve a friend who is simply trying to build a home. When you see the enormous barriers to economic activity you begin to understand how this happens. By the time you’ve complied with the hundreds of asinine laws, hired yourself your tradespeople who typically can only now do very specific jobs, for fear of being caught wiring a plug without the correct license to do so, then it’s not hard to see how Europe is decaying with such breathtaking speed. The punitive tax system together with regulation of staggering magnitude have quenched any entrepreneurship, while concessions for what is left are awarded to large corporations in multiple fields of activities. The ability for small business, which is coincidentally the lifeblood of any and every vibrant economy, is stymied.

The truth as always lies in the facts. The West is in its death throes and we see this in Western powers pressuring Russia or striking out in the Middle East. This is an attempt to remain relevant and establish hegemony. Why this desperation?

Consider that in 1990 the combined GDP of the G7 countries stood at US$14.4 trillion. At the same time the “emerging 7” (China, India, Russia, Brazil, Indonesia, Mexico and South Korea) sported a GDP of US$2.3 trillion. Last year the figures stood at US$32 trillion for the G7 and US$35 trillion for the “emerging 7”.

These are massive global shifts that are taking place right in front of us. What this looks like in 10, 20 years time is a factor of that which it is today. Within 15 years the Asian middle class alone will make up over 2/3rds of the global middle class. Today it is 1/3rd.

Our friend Doug Casey likes to joke that Europeans are going to be predominantly used as housemaids for the Chinese. When he says it in front of Europeans and Americans they still laugh. They shouldn’t. It’s happening.

Western politicians, as thick as they may be, can see their power ebbing away at every turn and their reaction has been to drive the dagger deeper into their economies increasing regulation, cramping entrepreneurship, raising taxes, taking on obscene debt loads and centralizing rather than decentralizing their economies.

Consider the points 1 through 5 I’ve made above.

- Leadership in economic liberty. Hong Kong and Singapore are at number 1 and 2 spots respectively with the USA down at 12th spot, trailing Estonia and much of Europe so far down the scale they’re hardly even worth mentioning . Portugal, France, Spain lower down the economic freedom ranking than Rwanda, Kazakhstan.

- Political Liberty. This one I know I’ll get flak for so let me just say this: just because you get to vote for a few podium donuts who are trotted up in front of you every few years, doesn’t mean your vote means a damn.

- Superior Judicial System. Whoa, where to start. The complete dismantling of habeas corpus, militarizing of the police force, civil asset forfeitures, a bought and paid for congress via lobby groups.

- Education. Asia is racing ahead. A recent report produced by Pearson Education in their annual global education performance report shows once again that Asians are racing ahead. I’ll spare you reading the entire report. The top ranking countries are (# 1) South Korea, (#2) Japan, (#3) Singapore and (#4) Hong Kong,

The fact is that the West used to be superior to the rest of the world but the competitive advantage has eroded substantially. At the same time emerging economies have embraced the market economy, strengthened judicial systems, enhanced education and most importantly of all managed to increasingly get out of the way of individuals looking to transact with one another.

Gratefully the world is an incredibly multi cultural place and with a little effort we can invest globally, we can domicile globally and in many instances live in places which please us and these various choices need not be the same. When it comes to investing capital the trends in motion are hard to ignore and this is but one reason that we’re focused on emerging markets and Asia in particular. Given the balance of world population together with the growth and increasing dominance of the emerging markets it is I believe pure folly to ignore.

– Chris

“History is filled with the sound of silken slippers going downstairs and wooden shoes coming up.” – Voltaire

This Post Has One Comment

I just read that China has reminded it’s populace that jumping off buildings is illegal.

With the housing/credit boom continuing to show signs of unraveling here, apparently some “investors” are literally falling from higher rungs of the hierarchy above. Hasn’t that always happened? Especially in Asian cultures? I wonder if the coming debt resets in all economies around the world will play out with economic and social “liberties”, as we CapEx readers know they should be for the quickest recovery, or will our “wise leaders” double down trying to prevent it? Of course we have seen the answer to that already in the West, how it is handled in the developing countries will be telling.

The PBOC’s recent rate cuts tell me that China will fight against the bubble popping. I had really hoped they might allow some creative destruction and try to lightly cushion the fall with their reserves rather than waste them trying to prevent it.

Smarter here but not smart enough, too bad……