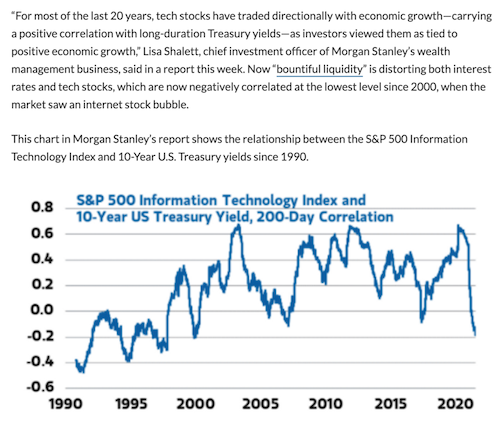

🖥️ LONG TECH STOCKS = LONG BONDS

Morgan Stanley is echoing our thoughts on the relationship between bonds and tech.

To us this highlights how interlinked many markets are and how the general stock market (with its huge weighting in tech/growth stocks) is probably not a great hedge against inflation. From the article:

Perhaps you now are beginning to understand why we are “balls to the wall” long commodity based stocks. Not only do we have extremes in tech, but extremes in bonds. And remember, the bond market is roughly 10x that of the stock market. A shift of capital out of both bonds and “growth” could be in the offing.

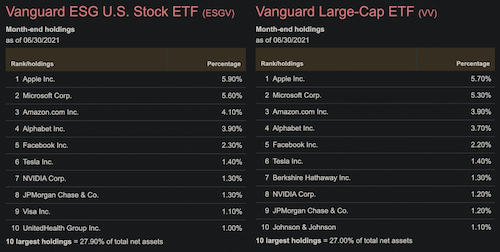

♻️ GREENWASHING: THE TALE OF TWO ETFS

We’ve spent quite a bit of digital ink discussing greenwashing here at Capitalist Exploits. In case you don’t know, greenwashing is the “disinformation disseminated by an organization so as to present an environmentally responsible public image”.

As Chris pointed out in an article about greenwashing (which, ironically, quickly got censored by Facebook, despite it containing no factual errors):

Greenwashing extends way beyond false advertising in consumer goods. It’s made its way into politics, investment products, journalism, and now mainstream opinion in “the West”.

When it comes to investment products, greenwashing has become a yuuge business — to the tune of trillions of dollars. Here’s an illustrative example we came across recently — two ETFs, one branded as an ESG product, the other as… well, just a plain-vanilla ETF.

There’s no meaningful difference between the two when it comes to ETF holdings. Except, you are being charged three times more (0.12% vs. 0.04%) for the “privilege” of investing in a “woke” product.

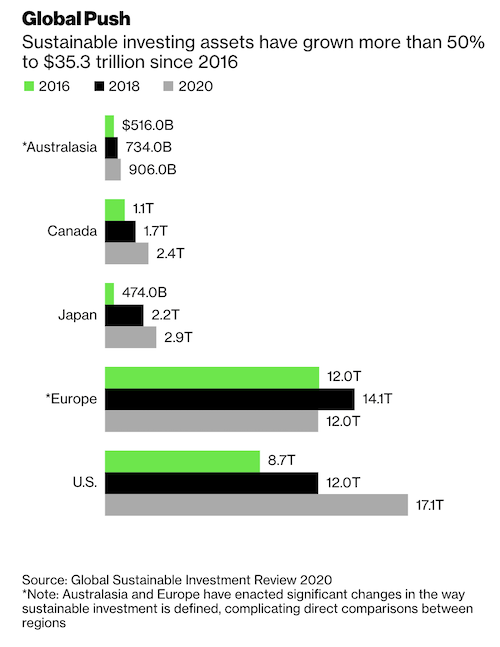

We’re not the only ones disturbed by this, though. Bloomberg reports the pointy shoes over in Europe aren’t too happy about these kinds of greenwashed investments:

Sustainable investment assets fell to $12 trillion in Europe during 2020 from $14 trillion in 2018, the report states. The decline isn’t the result of dampened investor enthusiasm for ESG investments, it’s because policy makers have tightened the parameters for what can be considered a responsible investment, said Simon O’Connor, chair of the GSIA.

That’s just the EU, though. Everywhere else, the greenwashing continues… and the money keeps flowing.

☢️ THE CASE FOR URANIUM IN ONE PICTURE

The fact is that uranium, pound for pound, is quite simply unbeatable as a source of base load power. Yet, it continues to be priced as if we’ll never need it again. It truly is an amazing time to be alive.

📈 INFLATION REDEFINED

Forget everything you know about economics! We now have podium donuts assuring us that people spending money on goods and services will actually lead to a decrease in prices (yes, really!).

☕ MERCH ALERT: BANNED ON FACEBOOK?

Perfect with any drink…