The meltdown in popular growth/tech stocks continues. As you probably know, the ARK Innovation ETF — the barometer of the “growth” movement — got slashed in half in recent months.

But the pain doesn’t end there. One of the best examples of the tech craze must be Peloton, the firm behind the hyped-up exercise bike… or, as our buddy Kuppy likes to call it, “the overpriced clothes rack with a built-in iPad.”

From its December 2020 highs, Peloton’s stock crashed 84% (yes, you read that right). And we’re not sure it’s done yet.

Kuppy wrote an excellent primer on Peloton — and, by extent, the entire Ponzi Sector, as he calls it — a few weeks ago. It’s just as relevant today, and we highly recommend spending some of your precious time on it this weekend.

Here’s a brief excerpt to get you salivating:

Over the past few years, I’ve been highly critical of the Ponzi Sector. This is a whole grouping of companies that has no ability or desire to ever become profitable. Instead, these businesses have focused on rapid revenue growth because the stock market has rewarded them for this growth—especially if there are no profits. In reality, stock promotion is the core business of the Ponzi Sector—it allows the companies to raise capital and fund unprofitable growth, while insiders dump stock at insane valuations. Now, as the Ponzi Sector equities go into free-fall, a problem has emerged.

Read Kuppy’s entire article here.

“INNOVATION” GOES ON SALE

“INNOVATION” GOES ON SALE

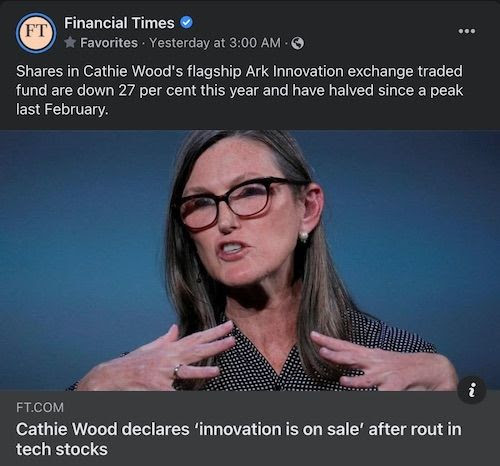

In the midst of all this, it’s amusing (though not at all unsurprising when you consider the massive management fees she’s been raking in) to see Cathie Wood dig in her heels and with a straight face claim the Ponzi sector is now a bargain.

Now, before you put in a buy order, the following tweet really underscores how grossly overvalued these stocks were… and still remain today.

Yeah, we think we’ll pass for now.

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

This week, member Dave came across this rather direct note at what we assume was a local restaurant.

Not one to let a crisis go to waste, CNN came up with a brilliant solution to all these problems. You might want to get a stiff drink for this one…

Like we said, a brilliant idea that hasn’t been tried before. Oh, wait…

AN INCONVENIENT (ACTUARIAL) TRUTH

AN INCONVENIENT (ACTUARIAL) TRUTH

Beyond the Ponzi sector, one other corner of the market we’ve been keeping our collective eyes on here at Capitalist Exploits HQ is insurance.

Now, the word insurance probably brings up images of slick talking salesmen with stern faces telling you in no uncertain terms that your loved ones will eat baked beans and live on a park bench should that parachute cord get stuck.

But in a nutshell, insurance is all about numbers and probabilities. Quant stuff, really. And recently, something interesting has been happening in the dull cubicles of insurance quants.

The CEO of OneAmerica, a $100 billion insurance company, described it as equivalent to a “3 sigma, once in a 200-year catastrophe.”

Chris dedicated an entire article to the worrying trend. It was originally published in Insider Weekly, but we’ve made it freely available here.

WEEK’S HUMOUR

WEEK’S HUMOUR

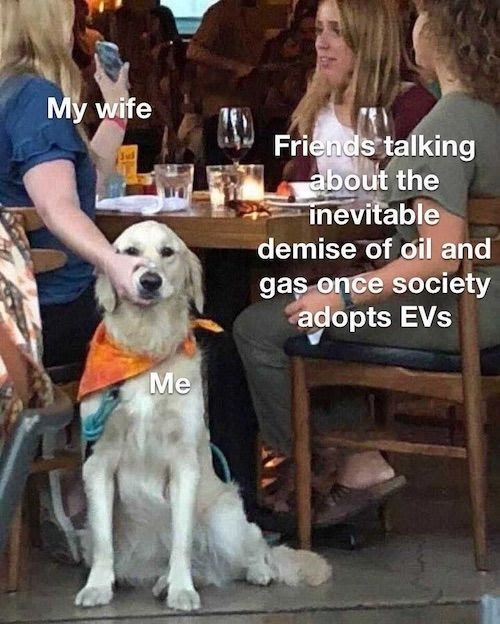

You’ll probably agree it’s hard not to relate with the below picture in today’s ESG, the “world’s running on unicorn farts” world.

Have a great weekend!

– The Team at Capitalist Exploits

P.S. If you’re on GETTR, you can now follow us here.

This Post Has One Comment

Canadian Truckers=GANDHI Moment..!!!

Canadian Truckers =GANdhI Moment..!!!

Canadian Truckers=GANDHi moment..!!!