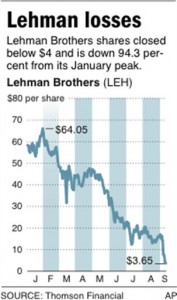

Leverage – It brought down, LTCM, Lehman and recently MF Global. It will probably bring down Deutsche and Credit Anstalt before the final episode of the European sitcom, “We’re all family right?” is released to viewers around the world, likely to the Dire Straits tune Brothers in arms.

The flip side of the coin is that the use of leverage has been behind some of the best trades and investments ever made. Leverage at the right time, in the right market, can be unimaginably rewarding. As an example I provide you with Kyle Bass, who in 2008 began buying CDS (Credit Default Swaps) on Greek debt, selling them as investors rushed in to protect themselves. To give you some perspective on the math, every $1,000 Bass invested turned into $700,000 in profit!

What are we to do with this knowledge of leverage?

I discussed recently 3 life-changing lessons I was fortunate enough to have learned early on in my career. First, do your homework, then trust yourself, and finally, pull the trigger. I know plenty of guys who fail at the last one. Trust me, the world is littered with bankrupt intellectuals.

It’s important for me to understand the fundamental case for an investment, this understanding provides me with the confidence to pull the trigger. I know that using leverage can be an absolutely amazing way to propel my wealth forward, and while I know of some successful trader friends who routinely employ leverage, I personally prefer not to use it very often, waiting instead for a set of circumstances where the risk/reward profile is sufficiently favourable.

It wasn’t always this way. After various early capitalist exploits, which didn’t involve making or losing money, I was baptized into the financial markets with a spectacularly successful trade very early on. Having never in my life traded futures, options on futures or anything of the sort, I bought a series of crude oil options and turned about £ 3000, which was pretty much my life savings at the time, into what could have bought me a small, but nice enough London flat. I did this in just under 18 months by studying the quantitative aspects of the trade, trusting myself and pulling the trigger.

I then proceeded to lose pretty much every cent I made by NOT following the 3 life-changing lessons, which my yet-to-materialize mentor would enlighten me with. It’s probably – scratch that, definitely one of the reasons I am far more prudent with the use of leverage now.

Long- term readers know my opinion of Australian and New Zealand real estate, but the fact is that these markets were the very same markets which just over a decade ago offered a good risk/reward setup. Maybe I’m biased towards real estate since it has been kind to me. That said, I believe that the place to be in real estate now is in Mongolia. By buying Mongolian property I’m buying LEAPS on the Mongolian economy.

Real estate allows for leverage and has many attributes that make it a fabulous vehicle for compounding my returns. I like to think of it as a LEAP on a particular market. An expanding and rapidly growing market causes rising rents/earnings, which acts as a multiplier on valuations.

Rising incomes, double digit yields, and under utilization of credit relative to the Western World are some of the reasons why real estate in Mongolia poses substantially less risk to my capital than most any other real estate market I can think of. Mitigating risk is the FIRST step I take when viewing an investment. Only once I can understand the risks does it make sense to bother looking at the potential rewards… and in Mongolia they are nothing short of breathtaking.

It is why our friend Harris Kupperman is focusing on Real estate in Mongolia, and we think any sane investor looking for exposure to Mongolia should be investigating what Harris is doing, but hey that’s just us. We’ve already made a lot of money investing in his Mongolian Growth Group.

Simply put, real estate in a rapidly expanding economy offers arguably the best leveraged, risk reward setup to take advantage of the incredible growth taking place in Mongolia. When you are getting paid double digit yields in order to hold real estate your risk factor is lowered by each yield point. Buying into select quality real estate there is like buying dividend paying equities that are set to double every year for a number of years going forward.

Mark and I have been doing our DD on various additional investment opportunities in this space which we’ll talk more about later this week.

– Chris

“When you combine ignorance and leverage, you get some pretty interesting results.” – Warren Buffett