In more ways than one…

But first, from Germany.

Achtung!!

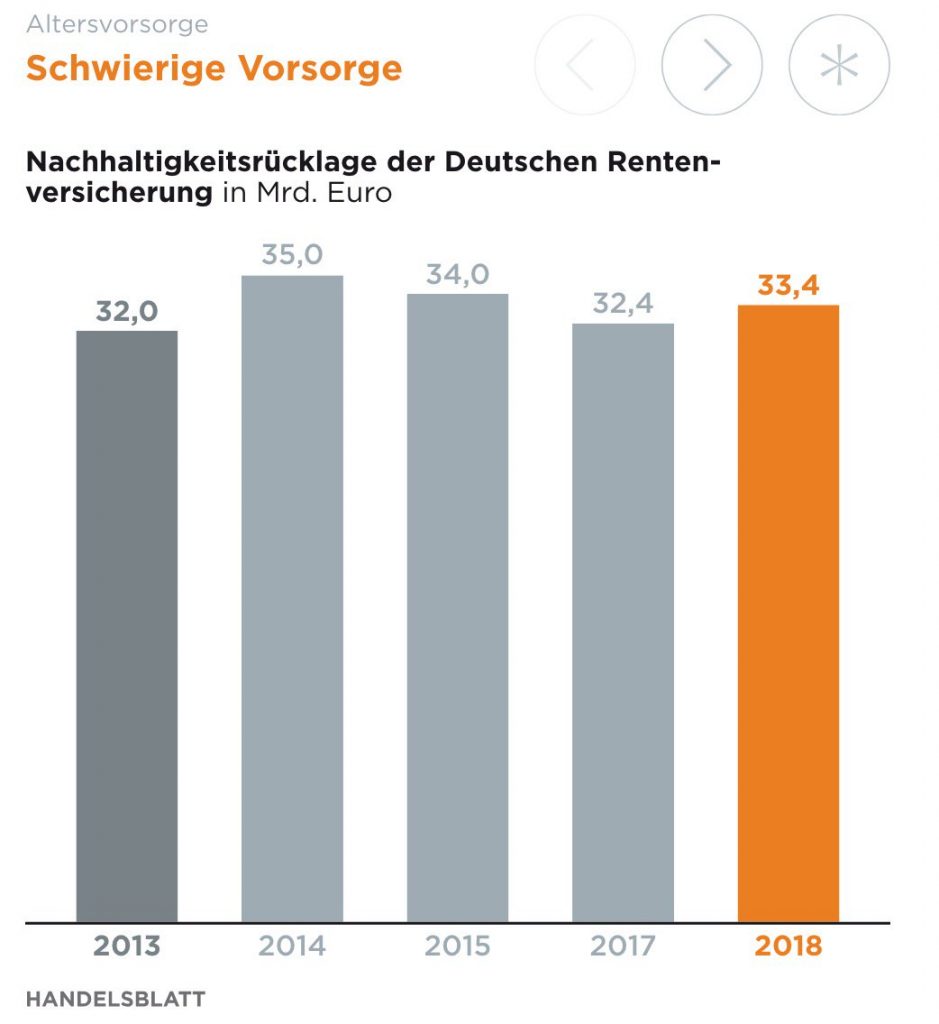

Whoops! Germany’s state pension insurance hemorrhages millions in losses. Nasty!

Why the losses, you may ask?

Tough to make money due to negative interest rates. Who woulda thunk it? Someone tell the ECB.

It’s a conundrum that now, nearly a decade after our central bank overlords decided it was in the best interests of “everyone” to completely distort asset prices, those distortions are manifesting themselves at a level that cannot any longer be ignored. Grab your popcorn. This ought to be fun.

Missed It?

Our head trader wrote about our biltong and boerewors eating friends earlier this week.

The situation in South Africa couldn’t be much worse. Worsened by the fact that the Western media refuses to highlight white genocide — because we all know that it’s only ethnic minorities that can be victims, certainly never white men.

That said, our job here is to make money… and so we’ll do just that. If you haven’t yet, go read it though. I warn you, it’s not pretty. But then again, neither is boerewors.

Kodak Moment?

Krugman, ah, how I miss you.

From the man who promised us the Internet and fax machine would amount to nothing. Kruggie, if you’re reading this, we’re still awaiting the alien invasion so we can all drive Porsches.

Well that does it. I'm buying some more. https://t.co/ecXfpXLh6D

— Capitalist Exploits (@capitalistexp) August 1, 2018

Pop quiz: What’s THE strongest most secure digital network in the world?

And what might such a network be worth?

Apparently zero.

Consider that many are working furiously at an ETF.

And we’re no longer just talking about the hoodie-wearing, pimple-faced kids who need more sunlight. The pointy shoes are entering this space at a serious clip. Which brings us to…..

The #Bitcoin ETF could change the entire landscape of the #cryptocurrency industry providing legitimacy and the ability for investors to add Bitcoin to their retirement portfolio. The global pensions market is $41.3 trillion. Below is what happened when the Gold ETF released 🚀 pic.twitter.com/BVVbcLLVHn

— CryptoCurrency News (@CryptoBoomNews) July 26, 2018

Adios Vanguard

We just issued our first alert for Resource Insider, our recently launched service for accredited investors.

The first deal is a gold play with a massive land package, still completely private, and run by the Michael Jordans of the resource world.

Why mention it?

Well, we may be wrong, but we believe we’re getting close to when the timing to buy the snot out of the gold sector will be upon us offering truly asymmetric opportunities.

Right now, we’re buying into a private company which plans to go public next year. If you hate marketing move right along. But if you’re a rich bugger accredited investor and, like us, believe this space deserves your attention, then go here to learn more.

If you were to ask me when gold really runs…. suck my thumb. 2 years hence.

Reasons are many but here’s anecdotal we’re close to a bottom.

"The $2.3 billion Vanguard Precious Metals and Mining Fund (VGPMX) will be renamed to Vanguard Global Capital Cycles Fund as part of a restructuring intended to broaden the fund's mandate and diversify its portfolio." They don't ring bells at tops&bottoms?https://t.co/cGqBPu9B3E

— fred hickey (@htsfhickey) July 27, 2018

Personally, I think we go lower still. The accelerating trade war will send the greenback higher and gold will likely trade sideways to lower. I know, I know… the gold bulls will hate me for saying so but that’s the way we see it.

Laws are Discretionary

29 minutes long…. and if it doesn’t leave you upset, angry, outraged or all of the above, then you’re crazier than Aunt Marge who we lock under the stairs.

What’s even crazier is that I’ve been told that I’m one of the only finance professionals to have repeatedly and openly spoken out about this trend and it’s ramifications.

That’s sad. Not just because I believe as a fiduciary of capital it’s an obligation, but because many of my friends who manage money (far more than I) quietly acknowledge this but fear losing AUM if they were ever labeled as racist, alt-right, bigots.

We’ve actually reached the point where anyone expressing conservative views is threatened and treated as a Nazi.

Well, the hell with that. Sanity needs to be restored before this goes beyond the point of no return, though I think much of Europe has already done so. Oh, and to those wailing screeching banshees who cry “hate speech” and want their “safe spaces”, let me tell you this…

Free speech, in order to be free, must, by definition, always provide for the ability to offend. And no, I’m not going to go out now and kick a homeless guy and find a baby to punch.

[clickToTweet tweet=”Free speech, in order to be free, must, by definition, always provide for the ability to offend.” quote=”Free speech, in order to be free, must, by definition, always provide for the ability to offend.”]

I think it fitting that the video ends with the late intellectual Christopher Hitchens describing nearly a decade prior EXACTLY what we find happening today.

This is very urgent business ladies and gentleman, I beseech you. Resist it while you still can and before the right to complain is taken away from you, which will be the next thing. You will be told you can’t complain because you’re islamophobic. The term is already being introduced into the culture, as if it was an accusation of race hatred for example or bigotry, whereas certainly it’s the objection to the preachings of very extreme an absolutist religion. Watch out for these symptoms, they’re not just symptoms of surrender.

Very often ecumenically offered to you by men of God in other robes, Christian and Jewish and smarmy ecumenical. These are the ones who will hold open the gates for the barbarians. The barbarians never take a city until someone holds the gates open for them. And it’s your own preachers who will do it for you, your own multicultural authorities who will do it for you. Resist it while you can.

No truer words where spoken.

For more on the topic and how it’s related to the investment markets read:

Which brings me directly to where this we believe will manifest itself most aggressively: Europe.

A Whole New World

Will be upon us if we break here. Looking testy.

And here’s the yuan. 7 is the watch.

Consider yourself warned.

I, Cannae

Chris,

I’ve been following your work for 4 years ever since a friend forwarded me one of your articles. You’re the only financial professional I’ve ever come across (and I’ve been involved in managing my own investments for 30 years now and read most everyone) who so succinctly manages to piece together the social, behavioural, psychological as well as financial pieces of this highly complex world we live in. My profession is that of a psychologist and it’s been incredibly fascinating watching you pull that side of things into global macro elements. My hat off to you.What I’d like though is a personal one on one with you. Do you do any personal consultations?Kurt

Sorry, but if I did that with every request received, my gorgeous wife would become very grumpy, my kids wouldn’t have a Dad, and my dog wouldn’t get walked.

And then, I’d probably not even be writing to you. But rather, I’d be curled up in the foetal position sobbing.

Until next time, thanks for reading.

– Chris