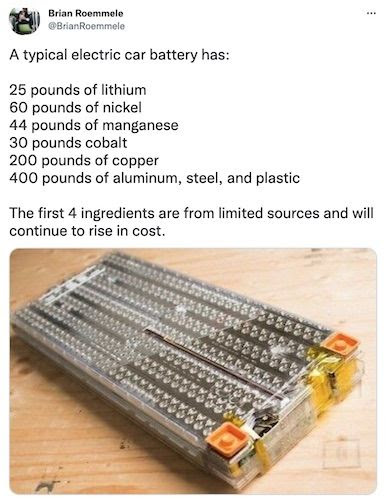

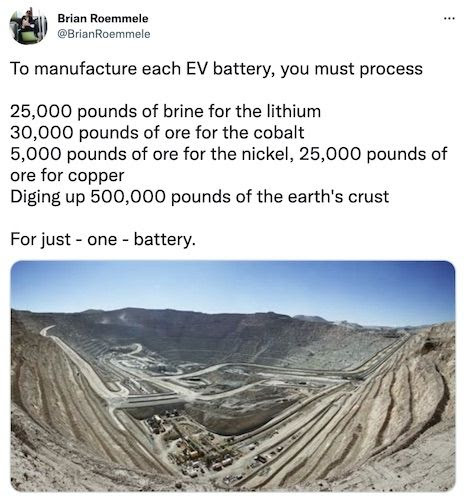

The following sheds some light on how delusional resource intensive the transition to the green economy is.

But wait, there’s more:

Despite what the pointy shoes are saying, the whole “green revolution” is anything but green. In fact, they’re bound to do the following:

- Destroy the environment

- Create shortages

- Destroy free markets and price discovery

- Increase the cost of living

- Impoverish people (unless you sit on the boards of “green” companies)

Chris dedicated an entire article to this very topic (and how to capitalize on it) back in 2020. It was — somewhat ironically — soon censored by the internet overlords at Facebook, but you can still read it here. It’s even more relevant today than it was two years ago.

OIL TO $200?

OIL TO $200?

Speaking of shortages and increases in cost of living…

We’ve been saying for some time now that oil prices are headed one way (and it’s not lower). Business Insider explains why it’s a near certainty now:

Russian oil exports are crucial to global supply, and there are no sources that can compensate for the millions of barrels the country contributes, OPEC’s secretary general has said.

The US is considering whether to ban imports of oil from Russia over its war on Ukraine, and there are fears Russia could redirect its volumes in response to Western sanctions. That has prompted debate as to whether there are alternatives to Russian oil on deck.

“There is no capacity in the world that could replace 7 millions barrels per day,” OPEC chief Mohammed Barkindo told reporters at the Ceraweek conference, according to Reuters.

Now, you might say, “Surely, the West could, at least over time, make up for this shortfall.”

Normally, we’d agree with you. But as we mentioned in a recent Insider Weekly issue, this time is indeed different:

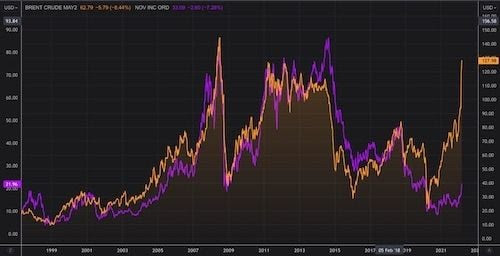

We recall the great bull market in oil from 2003 to mid 2008. It was a little different back then as increases in oil prices were met with “proportionate” increases in capex spending.

However, over the last five or so years there has been a drought of capex spend, as all the bankruptcies in the oil and gas services sector would testify. We get a good pictorial representation of this with the differential between Brent and NOV (the old National Oilwell Varco). NOV is a good proxy for capex spend as it supplies oil and gas equipment and services to oil companies globally. Look at that “gap” — it’s (capex spend and the stock price of NOV) going to play catchup!

Oil at $150 or even $200? Don’t laugh as there just isn’t spare capacity to be bought online to make up for the Russian short fall due to the “capex freeze” over the last few years.

We wish it wasn’t so but it’s hard (if not impossible) to look at the facts and numbers and come to a different conclusion.

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

You might remember we previously shared a comment from Insider member Vitalie who lives in Moldova. Well, that was before the invasion of Ukraine. Vitalie reports things got progressively worse since:

There seems to be a growing wave of panic food buying in my region. Transnistria has imposed a 100% tariff on exports of food; in Romania people are apparently buying sugar, flour and vegetable oil, causing some supermarkets in some cities (apparently not everywhere in Romania) to impose a limit on how much can be bought at a time; and in Moldova, shops have run out of salt because of panic buying, although why having multiple kilograms of salt would help anyone is a big mystery to me (the most likely explanation is the influence of older generations who remember shortages of the 1980s and 1990’s in the USSR and CSI, as well as stories about lack of food during and after WW2). The war in Ukraine has exacerbated food inflation expectations – Ukraine is an important food supplier here.

Apparently, the Russkies have also halted exports of some grains and sugar for a full Soviet-era experience.

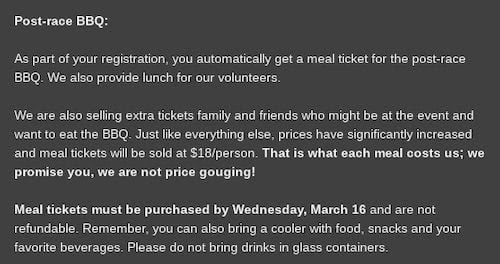

Then member Dylan shared this (the second paragraph is particularly insightful):

We hope Dylan won’t ask for a doggy bag. It might cost him extra, as another member Clint had this to share:

I bought aluminum foil for $15 a roll yesterday. (200 sq ft). Was blown away. I can’t recall the last time I bought this – maybe one a year – but $15 seemed OTT. The smaller 50sqft was $5.95!!

Shocking, but not all that surprising given that Russia is one of the key aluminum producers and aluminum prices are hitting record highs.

COAL: ON A TEAR

COAL: ON A TEAR

Metals are not the only thing that’s been on a tear.

In the last Insider Weekly, we highlighted Terracom, which focuses on coal in South Africa and Australia.

Like most coal stocks, Terracom has moved “a little” over the last 12 months…

However, in the overall scheme of things, these recent moves are insignificant.

SORRY FACEBOOK, BUT WE’RE DOING FINE…

SORRY FACEBOOK, BUT WE’RE DOING FINE…

You can check out all our merch HERE.

Have a great weekend!