We will be travelling to Aspen for our Meet Up this week. In the meantime, below is a thought provoking comment on market volatility from our friend Mark Schumacher from ThinkGrowth, a boutique investment advisory firm.

Hope you enjoy it!

————

The stock market is currently in correction mode. The Dow Jones Industrial Avg. has given back approximately half its gains over the past 12 months and is now down about 1% this year.

In this environment all eyes should be on volatility and ZIV… I know mine are. Historically these corrections and volatility spikes have been very good entry points for purchasing shares in ZIV. My plan is to carefully build a position in ZIV. Although I think this market correction could continue deeper, nobody knows for sure whether this 5 percent correction will end here or turn into a larger, say 10 or 20 percent correction, so I want to build a position in ZIV by taking multiple small steps. That first small step is now.

As a reminder, ZIV performs best after volatility spikes which normally coincides with stock market corrections and other unpredictable scary events. ZIV is an inverse volatility product that benefits from the post-scare ‘return to normal’ in two ways:

- ZIV appreciates as the level of volatility recedes.

- ZIV appreciates daily from contango by rolling its contracts at favorable prices. We’ve covered the basics of contango in past write ups and I don’t want to bog down the big picture with all that detail so I won’t delve deeper. The key thing to keep in mind is that contango kills most volatility products but has the opposite effect on “inverse” products such as ZIV and XIV which benefit from contango. ZIV is almost always in a state of contango (because it utilized futures contracts 4-7 months out) even when contango has disappeared for other volatility products such as XIV (which utilizes contracts 1-2 months out). This is partially why I prefer owning ZIV over XIV.

This next chart shows that four times over the past two years volatility as measured by the vix (green line) spiked above $20 marking good entry points to buy ZIV (blue line), however, the last two years have been relatively calm.

Volatility products like ZIV have only been around for four years, so here’s that chart. Notice that during the massive spike in 2011 ZIV fell only half as much as XIV and generally outperformed XIV even though ZIV only benefits from about 1/3rd as much contango as XIV does. This is due in part to XIV’s higher rate of daily rebalancing decay which is structurally built-in, thus I expect ZIV to continue outperforming especially in choppy or down markets. It’s the safer product to own.

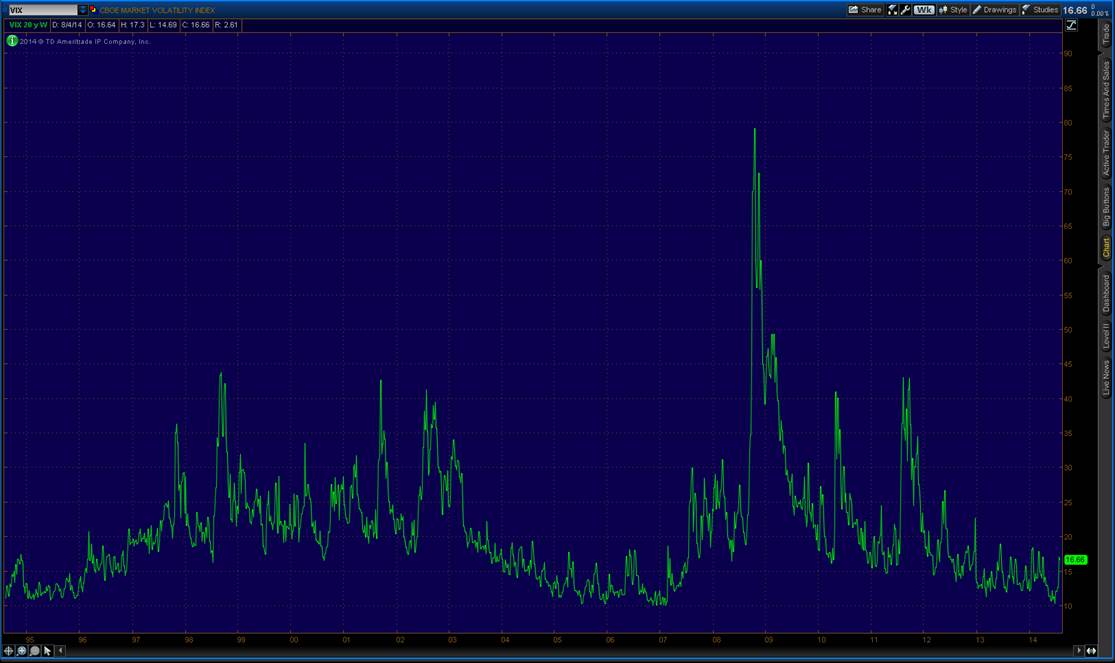

For a true perspective on how high volatility can spike the 20-year chart below is most telling. The only time you want to switch from being long ZIV to long XIV would be when the vix goes parabolic which to me is a level near $35 which it hit several times over past two decades.

I have been patiently waiting for a market correction, or more accurately, for the next spike up in volatility so I could begin rebuilding a position in ZIV which is a great product to own over many years as it spends most of its time appreciating. It rises in markets that are rising, flat or slightly down which is the vast majority of the time and the best time to buy shares is just after implied market volatility spikes which normally occurs during stock market corrections like the one we are experiencing now.

————

We will be back to our regular posting schedule next week.

– Miha

“Never think that lack of variability is stability. Don’t confuse lack of volatility with stability, ever.” – Nassim Nicholas Taleb