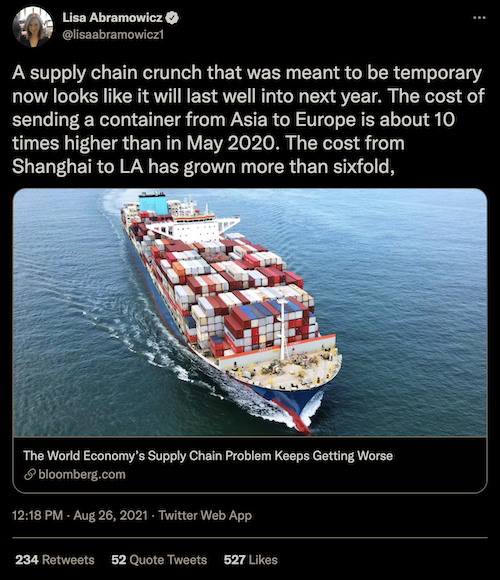

📦 ANOTHER “TRANSITORY” ISSUE THAT WASN’T

Turns out the supply chain shortages that have been plaguing the global economy for the last 12-ish months aren’t as “transitory” as we were told all this time. Who woulda thunk it?

If you’re a long-time reader, this shouldn’t come as a surprise. It’s something we have been highlighting for well over a year now as we saw country after country either willingly or unwillingly but coercively lock down their economies and pha-kup supply chains.

Here’s something we published in Insider Weekly in April 2020 that remains just as relevant today, if not even more:

The lockdowns are likely to lead to a destruction of supply in the short and maybe medium term, while the ongoing issues we have detailed at length in these missives will remain, and accelerate. These are geopolitical tensions, costlier supply chains, a rethinking of and restructuring of JIT (just in time) inventory management. And critically what we believe will be a multi decade long move to “local”.

All of this promises to be inflationary and that’s before we even begin to consider the effects of central bank monetary and government fiscal policy.

Supply constraints are playing out in ways that few appreciate. All that stuff we take for granted on our supermarket shelves has gotta come from somewhere and robots and unicorn farts don’t produce it!

It’s why we continue to be bullish on shipping, commodities, and agriculture.

💰 BARGAINS IN A BUBBLY WORLD

It’s not all bubbly and frothy out there. Stocks in emerging markets are fast approaching generational lows, at least compared to the S&P 500.

We’re old enough to remember when the BRICS were all the rage. Today nobody wants to touch emerging market stocks with a 10ft pole. Which makes us think it’s time to start hunting for bargains.

💡 A LESSON IN PATIENCE

Speaking of patience, this anecdote about Peter Lynch’s famous Magellan Fund is instructive:

Peter Lynch, author of “One Up on Wall Street” ran the Fidelity Magellan fund from 1977-1990. He delivered an outstanding 29% average annual return during that period.

Afterwards, Fidelity conducted a study of the fund. They found that the average investor in the Magellan Fund lost money during Peter Lynch’s tenure! How can that be?

According to Fidelity, investors withdrew from the fund during periods of poor performance. Then they would return to the fund after periods of good performance.

We said it before but it bears repeating: patience (as well as balls of steel, let’s be honest) is key for successful investing. The biggest wins often take way, way longer to play out than you might think (or hope).

🤔 THINGS THAT MAKE YOU GO HMMM…

Call us old fashioned, but we’d rather spend $600,000 on 333 ounces of gold, dirt cheap energy stocks… or literally anything else.