Having lived in several Frontier Markets, I’ve oft observed that when wacky rules are put into place, creating inefficiencies and costing people money, the free market almost always finds a way around it.

This goes for everything from selling vegetables roadside without a permit, hocking gasoline out of soda bottles or even changing currencies…today’s lesson.

I’ve spent some time studying philosophy and history. Look back into any era you choose, and you will find the free market hard at work bypassing bureaucracy. So, despite the increasing trend toward globalization most of the world’s economies and currencies still operate with a parallel “black” or “informal” market.

I discussed aspects of this in my post, “The ‘Informal Economy’ – Makeshift”.

In fact, it is estimated that less than 20 of the world’s economies are free of this parallel, black market phenomena.

Most emerging countries’ have seen their governments attempt to legislate some form of monetary “protection”. This is usually implemented by legally limiting the amount of foreign currency that a person is allowed to hold. This short-sighted (is there really any other kind these days?) policy always leads to unofficial, black market transactions in foreign currencies, namely the USD and EUR.

I think everyone reading this knows what a black market is..? If not, let’s just say that it is an illegal marketplace created in response to government (or other) intervention which produces excess supply or demand for stuff – including currencies. When the price of foreign currency is “set” below the market (street) rate, excess demand is usually generated for that foreign currency.

This causes havoc with prices as well as penalizes those trying to operate in the “legitimate” (read: government sanctioned) economy. The government can confront this dilemma by either devaluing its currency, or (attempt to) maintain strict controls over exchange.

The most common policy tool is to set quotas on the purchase of foreign currency.

Argentina is doing this now. The peso trades at around 4.71 per dollar on the official foreign exchange market and at about 6.20 per dollar on the black market. The government is even forcing its provinces to settle dollar denominated bond interest payments in pesos, which has led to speculation of default and bankruptcies in several of the country’s provinces.

In fact, according to Merco Press, “Moody’s Investor Service announced on Wednesday it has downgraded the issuer and debt ratings of several provinces and cities in Argentina, due to the risks these states may face to access foreign currency and ‘serve their obligations in foreign currency’.”

We can all watch in amusement as this blows up in real-time under our very noses. Go CFK, go!!

But alas, by identifying the path of least resistance we as speculators can save or even make money while the fires burn.

Bank Robbery Mongolia Style

I was recently introduced to how the free market circumvents the Mongolian banking system in certain instances. It’s not always the government that creates opportunities for arbitrage!

While Skype’ing with a friend last week in Ulanbaataar, we got to talking about how the banks commit what could be compared to “highway robbery” when exchanging currency (I’ve heard of rates up to 2.5% being charged!).

Nothing new, as this is the case in most countries. However, in Mongolia it is easy to bypass the banks and save yourself a couple hundred basis points.

Do tell…

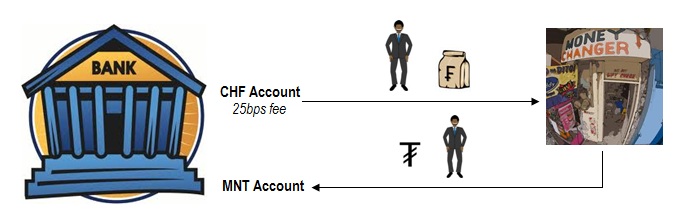

The game plan to prevent getting what amounts to a monetary crew cut goes as follows:Visit your favourite local Mongolian bank and open an account in anything BUT Tugrik (MNT). Lots of banks here offer USD, CHF, JPY, and EUR accounts.

- Withdraw your funds from said account (This is subject to a 25bps transaction fee; the price you pay for saving circa 200bps), and head on down to the local money changer; my favourite operation happens to be on Seoul Street next to Café Tiamo. Slap your wad of foreign currency on the table and tell the attractive gal behind the desk that you are looking for Tugrik.

- Your foreign currency being in high demand by the money changer (this seems to be the usual case in Mongolia) will wield you a good exchange rate.

- Once you receive your “wad” of Tugrik, stroll back over to the bank (or another one, your preference) and open an MNT account to deposit your stash. After you have deposited said funds you can leave the bank knowing you’ve saved a substantial amount for putting in what amounts to just a little leg work, literally.

Since a picture paints a thousand words…

Of course the caveat to this procedure is that you actually have to be in the country to execute. Though, depending on the amount you’re working with, what you save could very well pay for your flight and hotel.

We know the practicality of doing this for most people is nil. The moral of this story is merely to illustrate how market forces WILL correct inefficiencies on their own.

We’re seeing this in many markets, including Argentina right now. Mark will have more on Lat Am Thursday.

– Scott Baker

“If you would be wealthy, think of saving as well as getting.” – Benjamin Franklin

This Post Has 2 Comments

I’m confused… what’s the point of the first step (depositing money in a local bank in USD/EUR/whatever) and paying a fee to withdraw your money? Why not just show up with cash, go to the local money changer to exchange your funds into MNT and THEN open a bank account and deposit your MNT. I do not understand the first point at all…

Try walking into any country these days with $100,000 in cash. Unless you want treatment designed for terrorists you’ll need to wire the cash in.