Today, let’s take a look at one of our favorite (and most obscure) corners of the stock market: offshore drilling stocks.

We believe the upside in these stocks will likely surprise everyone in terms of duration and magnitude.

Right now, the offshore drilling sector is priced as if it’s on the way out and we won’t be needing too many drilling rigs a few years from now.

Take a look at Transocean, a proxy for the average offshore drilling stock:

As you can see from this chart, anyone who bought offshore oil service stocks prior to 2022 has only ever experienced pain and disappointment — and that goes back to early 2008, which is nearly 15 years ago.

No wonder most fund managers won’t touch these stocks with a barge pole.

Yet meanwhile, spending for offshore oil and gas is quietly rocketing higher — independent of the price of oil and gas.

In fact, many of the companies in the sector we’ve been tracking are already at or near full capacity.

And when you listen to industry CEOs (here’s an excellent conversation with the CEO of Tidewater, one of the leading offshore drillers), spending offshore is set to double over the next five years and the margin expansion in offshore drilling companies is likely to be dramatic.

This creates an interesting asymmetry and makes us more excited than an 18-year-old at a Miss Universe wet t-shirt contest.

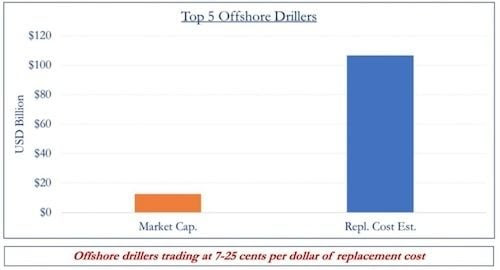

Take a look at this chart showing the gigantic gap between the market cap of the top five offshore drilling companies and their estimated replacement cost:

Right now, offshore drillers are trading for pennies on the dollar. Of course, we doubt their market caps will approach the replacement cost of rigs.

But still — an 85% discount to replacement cost suggests that there is a huge margin of safety and that over the long-term it will be difficult to lose money by investing in a basket of offshore oil drillers.

As Seth Klarman wisely said (emphasis ours):

The best investments have a considerable margin of safety. This is Benjamin Graham’s concept of buying at a sufficient discount that even bad luck or the vicissitudes of the business cycle won’t derail an investment. As when you build a bridge that can hold 30-ton trucks but only drive ten-ton trucks across it, you would never want your investment fortunes to be dependent on everything going perfectly, every assumption proving accurate, every break going your way.

It’s why we keep salivating over offshore drilling stocks and remain long in our Insider service.