In Part One of the interview we were told some of the stories of Carlos’ upbringing in Venezuela and some of the differences in living in Australia as well; we learnt a bit about the Venezuelan economy and hyperinflation; and delved into Bitcoin fundamentals and why Carlos is a believer. In Part Two of the interview, we’ll continue where we left off with his views on Bitcoin and the upcoming Bitcoin Halving; how Carlos and other Venezuelans not only diversify and hedge against inflation, but also the creative ways in how they do it; and finally, how the President, Nicolas Maduro made the DEA’s hitlist, frontrunning the cocaine cartel Cártel de Los Soles, or “Cartel of the Suns”.

In Part One of the interview we closed with “why does crypto matter, even if it does at all”. So let’s continue on exploring crypto and Bitcoin.

So Carlos, when and why did you get involved in cryptocurrencies?

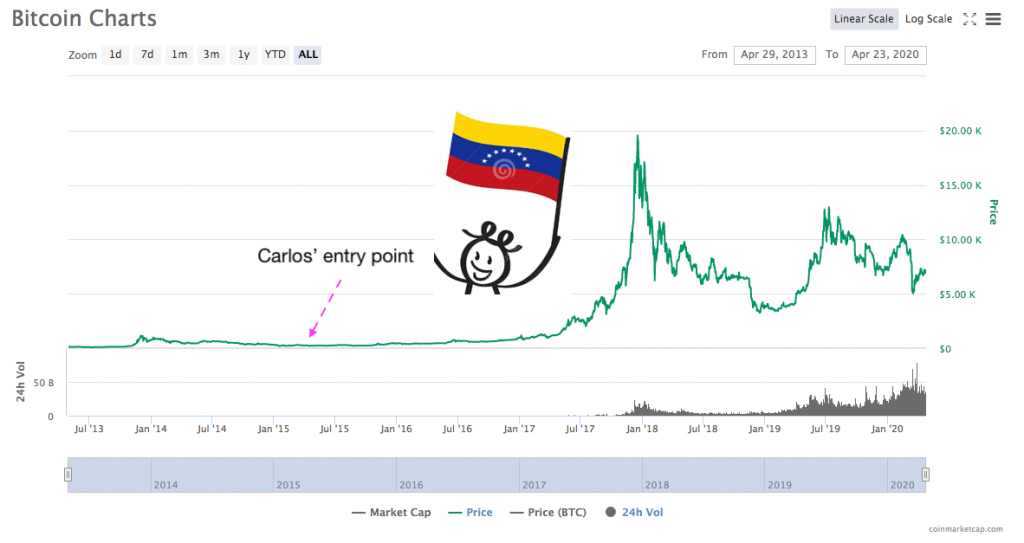

I bought my first BTC in March 2015 at ~$280 USD after about one year’s worth of research. Bitcoin clearly stood out to me and so I was exclusively purchasing Bitcoin.

Growing up in Venezuela was my biggest curse and my biggest blessing.

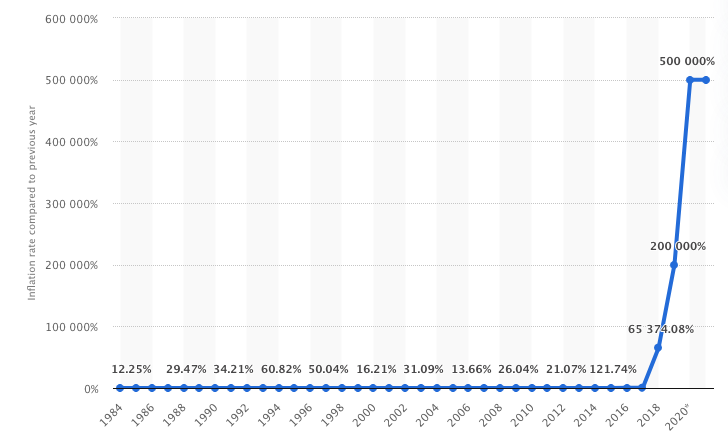

Having lived in an environment where the economy was always on the verge of collapsing made me interested (to say the least) in how money works. Even to the point where I found myself one day asking the the question, ‘What is money?’

As a kid, I always thought of the US dollar as the only way to escape inflation and become wealthy. I used to think that inflation was only a phenomena that would happen in third world countries like Venezuela.

But once I moved out away from home I quickly came to another realisation.

I realised that the dollar was not that different to the Venezuelan Bolivar. I learned that it was also an inflationary currency. By a much lower yearly percentage, but inflationary nonetheless.

As soon as I started earning in dollars (AUD in this case) my brain went straight back into its default mode and I started thinking:

‘If the dollar is the way to hedge against the Bolivar’s inflation, then how can I hedge against the dollar’s inflation?’

Then I remember quite vividly having read ‘The Sovereign Individual’ where I got introduced to the concept of distributed ledgers and digital money (which I honestly didn’t really understand).

I got curious about it and started doing some research. I honestly wasn’t sure of what I was looking at but it seemed like there was something there. It also happened to be about ~70% down from it’s previous all-time high, so I decided to get some so I could play around with it.

At Zerocap we’re big on Bitcoin and also have some exposure to physical gold through PAXG – a liquid, tokenised gold token. In the current market context, which assets should be held to protect against the crisis?

As I mentioned earlier, in my experience, there are three main threats to wealth preservation:

- Confiscation

- Inflation

- Taxation

I think when it comes to what the better asset is to fight any or all of these, gold and Bitcoin have their place in a well thought out wealth preservation strategy.

In a place like Venezuela where electricity shortages are literally scheduled into your routine, you need to be able to access some sort of hard currency.

Furthermore, in a situation in which an authoritarian government (or any kind or government, really) comes in to your home and tries to confiscate all your hard assets, it will give you peace of mind to have your crypto safe in the blockchain where they can’t actually touch them – provided they don’t find a way to access your private keys.

For the youth of Venezuela, activism also increases the chances of direct consequences from the government. The blockchain ledger solves many of these issues to preserve the security of our assets.

What are your thoughts on the upcoming Bitcoin Halving and how do you think this will affect the markets?

From a fundamental perspective, I think the price will go up. Supply will shrink and demand is strong.

That’s what I love about Bitcoin, the plan has been laid out. You know almost exactly when supply will shrink and by how much. Although, I personally think not enough people understand how Bitcoin works (let alone what the halving is), so I don’t think it will have an immediate impact on the price. Whether it’s going to increase in price immediately, or rather the markets will take some time to react, is besides the point. The fundamentals are there, that’s all I care about.

At the pace in which technology moves we could see something better come along and replace Bitcoin in a few years’ time. However, I like to think in terms of fundamentals, which in the case of Bitcoin are solid. More people spend more time connected to the internet than ever before, and that trend is not going to stop growing anytime soon. The world is being digitised as we speak and a virtual world needs a virtual currency. Right now, Bitcoin is it.

What are some of the creative ways that Venezuelans are able to cope with the economic depression?

Venezuela has been in an economic depression for over 15 years now. I don’t think it’ll be much different than it is now.

People will keep buying any non-perishable items they can find and hoard them. As for the luckier and smarter ones they will keep turning to gold and/or crypto, and depending on how the value of the USD holds up maybe some USD.

I know of a particular person who hoards scotch by the case and then sells it when needed. He once said to me ‘it’s the most liquid asset you can hold in this kind of environment’. Classic!

Getting money into the country is pretty hard too. People bring in USD or EUR hiding anywhere from their bras and socks to anywhere else you can imagine. If you would like to look at what an economic depression or collapse looks like, look at Venezuela for some reference as to how bad things can get.

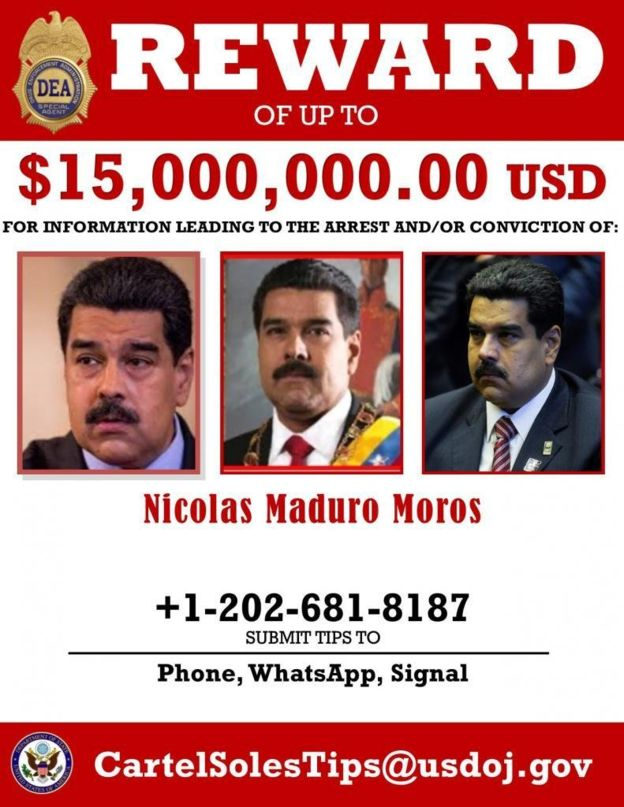

Let’s finish up with something relatively unrelated to Bitcoin. There has been some crazy media about Maduro and how he just made the DEA hit list for narco-terrorism, corruption, drug trafficking and other criminal charges. This is a completely fascinating story as it seems that Maduro and the Cártel de Los Soles, or “Cartel of the Suns” have been running game for the last 20 years. On top of all this, they’ve been in bed with FARC (The Revolutionary Armed Forces of Colombia) all along as well!! What’s the general sentiment amongst the Venezuelans on this? Have they always known or is this news to them as well?

This isn’t breaking news for any Venezuelan. We’ve always known ‘Narcos’ and ‘Guerrilleros’ roam the streets of Venezuela freely. It hadn’t always been like that, but since Maduro got into power that became the norm.

There is an area in Venezuela called El Arco Minero del Orinoco ‘The Mining Arch’, which is located south of the Orinoco river, northeast of the Amazon. It’s one of the world’s largest gold deposits. Diamonds, gold and coltan can be found in the area, among a bunch of other minerals.

What the local news won’t tell you though, is that you can also find the FARC, the Ejército Nacional de Liberación (ELN) or ‘National Liberation Army’ and other armed terrorist groups including the Venezuelan Army in the area fighting an outright war in the area over who gets to keep the gold and diamond deposits.

Murders and kidnappings are a daily occurrence in that area.

My cousin used to live around there, and the stories he tells would make for an epic Netflix series to say the least. As for the sentiment among Venezuelans, I think nobody really cares anymore. Things like this are part of everyday life and everyone is too busy trying to survive.

Personally, when the news came out, all I thought was ‘did it really take the Gringos this long to say something?’. They must really be in need of our resources now.

So how did this all unfold and start with Maduro?

I wasn’t following the news too closely, and nobody really knows what the US Government was up to before publicly putting a price tag on Maduro’s head.

But I’m inclined to believe that the DEA’s capturing of the two nephews of Venezuela’s first lady (cleverly named ‘Narconephews’) a few years back might have had something to do with all this unfolding the way it did.

The article on ‘The Guardian’ reads:

“Flores de Freitas and Campo Flores were arrested in Haiti in November 2015 in a US Drug Enforcement Administration (DEA) sting operation. Prosecutors said in a court filing they tried to make $20m through drug trafficking to help keep their family in power.”

“The nephews of Venezuela’s first lady believed they were so powerful that they could dispatch drug-filled planes from the “presidential hangar” at Caracas airport, US prosecutors have said at the start of a high-profile narcotics trial in New York.”

Take a look at the articles in the links provided. They provide very interesting details and clues as to how everything might have unfolded.

Concluding words

Speaking with Carlos and hearing all the stories certainly leads the mind on a captivating journey of “whoa”.

Living in Australia has been a relatively easy life in comparison, I mean, we’ve had the benefits of rugby; cricket; meat and 3 veg dinners; reasonably well laid out healthcare system available to most; a strong resources sector; a property boom that, like a siren at sea, has called to her watery depths salty investors, a strong banking sector that has primarily invited the majority of the populace into their gilded cage (of stifled innovation); and a music scene that has led to some of the biggest global superstars, like ACDC, Guy Sebastian, and Russell Crowe’s 30 Odd Foot of Grunts. So yeah, it’s been kinda chill in comparison.

Although complacency can lead to all kinds of risks and mispricings and Venezuela is always just a generation away in some parts of the world, particularly in light of Covid-19 and the money printers unleashing the “Brrr”. The story of Venezuela is a stark reminder to hold our governments and central banks accountable, and to position our portfolios for outliers.

ZeroCap helps private clients, high net worth individuals and institutions purchase and custody digital assets. If you would like to know more hit up JD at vip@zerocap.io.