We argued before in these missives that magazine covers are one of the best contrarian indicators out there.

This time around, we take our cues from last weekend’s Super Bowl, namely the myriad of crypto ads.

The fact that it was called “the Crypto Bowl” in the popular press speaks for itself.

On the flip side, how many commercials were there for oil and gas companies (hint: it rhymes with “hero”)?

THE POWER OF DISCIPLINE

THE POWER OF DISCIPLINE

“Discipline is the bridge between goals and accomplishment.” – Jim Rohn

Now, excuse us for going a bit “rah-rah” for a moment, but you’ll see there’s a purpose to it.

When it comes to investing — especially the deep value kind we favor here at Capitalist Exploits HQ — discipline is as important (perhaps even more) as all the hours of research, surgical execution, or anything else you do.

Professor Jordan Peterson commented on the topic:

People wonder why I engage in conflict. I hate conflict. I find it very stressful. But conflict delayed is conflict multiplied.

As the conflict is delayed the reasons multiply. And the persons who are involved demean themselves, get weaker, and less confident. There’s a line in the New Testament where Christ talks about prayer:

“If therefore you are offering your gift at the altar, and there remember that your brother has anything against you, leave your gift there before the altar, and go your way. First, be reconciled to your brother, and then come and offer your gift.”

Resentment is horrible, toxic, and destructive but it’s useful. Resentment can be a gateway to improvement. Or, you can foster it, let it devour you and take you places that no one with a clear mind would want to go.

Resentment is the pathway to Hell, if not managed carefully.

Now, how does it all tie into investing?

In his recent note to investors, Oaktree Capital’s Howard Marks’ discussion on the importance of discipline on when to sell is absolutely excellent. It provides valuable insights into why we may put off “the hard stuff” or even take actions that aren’t necessary.

It’s something we regularly discuss with Insider members and our fund management clients, and we can’t recommend Marks’ thoughts on the topic. After all, he is one of the absolute best deep value investors ever.

“DID YOU JUST SAY EUROPEAN BANKS?”

“DID YOU JUST SAY EUROPEAN BANKS?”

You probably had no idea European banks are trading at the same level they did in 1987…

Now, before you fall off your chair in laughter, remember one thing…

Bull markets begin when the vast majority believes they never will. How many folks do you know who are willing to put up their bullish hand on European banks? None!

If inflation turns out to be less ahem “transitory” than we have been promised by people with shiny teeth and smart suits, and we see a consequent run in bond yields, then these hated and forgotten stocks could dramatically outperform the S&P 500 in the coming years.

Admittedly, you won’t impress anyone at cocktail parties talking about investing in European banks right now (if anything, you might not get invited back). But that’s also exactly why we are intrigued by them.

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

This week Insider member Vitalie reports from Moldova:

Our National Bank (Moldova) is forecasting inflation of 18.8% for 2022, and in January official inflation was already at 16.6%.

Way to give those spineless single-digit-inflation Western countries a run for their money!

WEEK’S HUMOUR

WEEK’S HUMOUR

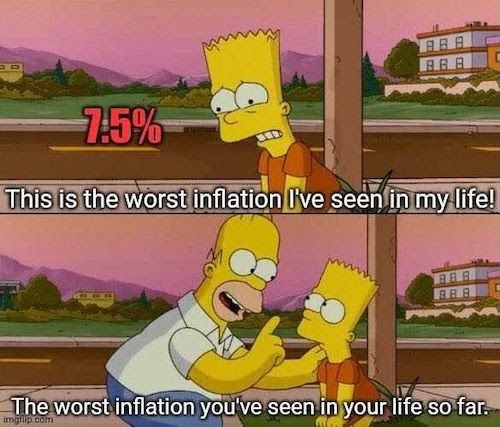

Speaking of inflation…

We live in a world where an entire generation of (younger) investors has never lived through a sustained bear market. The same goes for inflation, too.

Don’t let high inflation ruin your weekend. Have a great one!

– The Team at Capitalist Exploits