R.I.P. OIL?

R.I.P. OIL?

The reports of my death have been greatly exaggerated.

To riff off of this popular quote, reports about the (imminent) “death” of oil in the mainstream press have been greatly exaggerated, too.

For a few years now, we were among the few contrarian voices saying the coming bull market in oil and gas will catch even the biggest bulls by surprise. The thesis, we argued, was simple.

This passage from an old Insider Weekly issue from back in September 2020 sums up our thinking:

Supply destruction has been deep and longer lasting than anyone dares to imagine. Demand doesn’t even need to bounce back. It can simply remain at these levels, and because supply is being so constrained we’re in for a surprise.

At the time, crude oil was at $55. Today, it trades at $86 — the highest level in seven years. And, as our long-time readers will know, we believe it’s got higher to go.

OIL DEMAND CREEPING UP

OIL DEMAND CREEPING UP

Keeping with oil, something else happened this week that nicely dovetails into our bullish case for oil.

From the article:

Global oil demand will exceed pre-pandemic levels this year thanks to growing Covid-19 immunization rates and as recent virus waves haven’t proved severe enough to warrant a return to strict lockdown measures, the International Energy Agency said Wednesday.

In its monthly oil market report, the IEA hiked its oil demand growth forecast for the coming year by 200,000 barrels a day, to 3.3 million barrels a day. The Paris-based agency also raised its demand growth forecasts for 2021 by 200,000 barrels a day to 5.5 million barrels a day.

Remember what we said earlier?

Supply destruction has been deep and longer lasting than anyone dares to imagine. Demand doesn’t even need to bounce back. It can simply remain at these levels, and because supply is being so constrained we’re in for a surprise.

So the demand not only bounced back to pre-Covid levels but continues to rise. And on the supply side, we have a growing lack of appetite for finding and developing new oil reserves to meet that growing demand.

You don’t have to be too quick between the ears to work out that oil prices are heading only one way… and it’s not lower.

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

Member Craig took these photos on his weekly shopping trip at the local Publix store in Tampa, Florida.

We bet shelves with fake “meat” were stocked full.

DON’T WRITE GOLD OFF JUST YET…

DON’T WRITE GOLD OFF JUST YET…

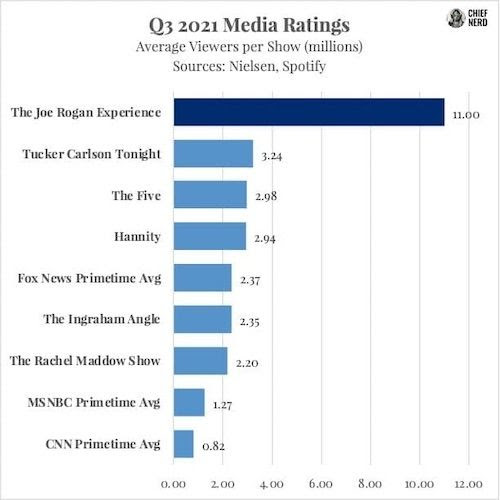

We’re witnessing an unprecedented collapse in trust of the mainstream media.

You might say, “Wait a minute! What does this have to do with investing?”

Here’s how we explained it to Insider Weekly readers last week:

Pretend for a minute you know nothing whatsoever about stock markets, currencies, bonds, or most anything financial. You’re just a normal guy with some money saved up. Maybe a pension plan with your employer, maybe some money in mutual funds, whatever, and your hope is to send your kids to college and save for a retirement without financial stress. You watch the world around you and become increasingly distrustful of… well, everything and maybe even everyone. What do you do?

Ordinarily, we’d say you pull your money out and stash it. Problem is, as much as you hear on CNBC that inflation is first “temporary” and now “transitory” (whatever that means), you can’t ignore the fact that the costs of literally everything are rising and you’ve already begun worrying about having enough money left over each month to contribute to your retirement and kids college fund. What do you do?

The bedrock investment is of course gold. Some say Bitcoin, but when considering a critical tech infrastructure shutdown in the “cyber polygon” vision, then gold physically held certainly beats Bitcoin.

So don’t write off gold just yet.

CHECK OUT OUR MERCH

CHECK OUT OUR MERCH

h/t to member Tatjana for this shirt idea!

Have a great weekend!