LESSONS FROM THE “GROWTH” MANIA

LESSONS FROM THE “GROWTH” MANIA

We can’t stop marveling at the boom and bust cycle that has been unfolding in “growth” stocks.

We promised it would be one for the history books, and here we are today. After an epic boom, we’re now witnessing a bust that’s just as spectacular — and painful for many, as this Wall Street article illustrates.

The stories are as sobering as one might expect:

Do Kim, a 46-year-old accountant in Bucks County, Pa., was all-in on stocks such as Nvidia Corp. and Tesla, building up a combined position in the two companies of more than $2 million, he says. He enjoyed tracking the companies and hung on everything Elon Musk and Nvidia Chief Executive Jensen Huang said. He dove into other stocks, including those of the insurer Lemonade Inc. and Palantir Technologies Inc., while trading options in a bid to juice his returns.

He watched his portfolio skyrocket—until 2022, that is. Throughout the year, he says he was hit with calls from his brokerage firm to post more cash to cover trades he had put on with borrowed money, or options trades that had soured.

Mr. Kim says he ended up losing all of the money he made since the start of the pandemic, accumulating losses of more than $1 million in his brokerage account that even ate into his initial investment. The losses were stressful. At times, he skipped vacations with family to spend time trading and keeping an eye on his portfolio.

“I feel like I lost many years of my life,” Mr. Kim says. “I had so many sleepless nights.”

Going all-in on stocks that were largely fueled by hype (and low interest rate policy) was a recipe for disaster. But more than anything else, stories like these are a reminder of how critical proper risk management is for (long-term) success in investing.

There’s no need to try and be a hero when it comes to position sizing your investments. The beauty of focussing on asymmetric opportunities is that you can keep your positions small enough to not get run over and still win big.

GETTING RUN OVER BY TESLA…

GETTING RUN OVER BY TESLA…

Speaking of risk management and position sizing, let’s look at one of the trades that went against us.

Long-time readers will be familiar with our bearish view on Tesla. Chris wrote about it as far back as 2016, and we bet against Elon Musk’s brainchild in our Insider service.

Now, you probably know that Tesla was one of the biggest beneficiaries of the “growth mania” we touched on above. At some point, the stock sat on an eye-bleeding P/E of 380x and sported the highest market cap for any automaker in history.

But as we’ve learned over the years (and re-learned during this particular “growth” episode), crazy can get crazier than you ever thought. And that goes on both sides of the proverbial coin.

Case in point…

The “growth” hype lifted Tesla 1,300% from COVID lows… and we got run over on our Tesla short.

Luckily, we position-sized it right (less than 1%), so throwing in the towel on that one didn’t hurt too much.

In hindsight, we turned out to be right with our view. Tesla got slashed in half. But as the old chestnut goes — being too early is akin to being wrong.

Onto the next one…

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

First up, a note from Insider member “13th gen:”

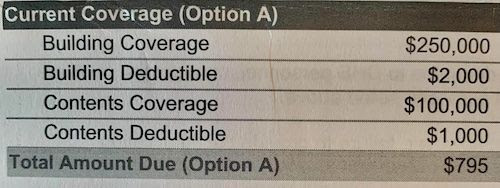

This US federal government flood insurance policy – issued direct through FEMA – cost $684 last year. To renew it this year costs $795. The stated reason is increased costs of building materials and labor to repair my home after a flood. In other words, the US federal government is telling me YOY inflation is 16%.

And a “shrinkflation” report from Kevin, who said, “I probably would not have noticed if they did not change the coloring.”

It took us a few seconds to notice as well.

THE ENRON OF VC

THE ENRON OF VC

Earlier this week, the news from Japan caught our attention:

This part in particular stood out (emphasis ours):

While the valuation of some of the group’s biggest publicly traded investments, such as South Korean ecommerce group Coupang and China’s Didi Global, recovered during the March quarter, analysts said losses in its privately held portfolio were bigger than expected.

Shocking? Not in the slightest. We commented on the poster child of “growth” that is SoftBank occasionally in these missives.

Chris wrote a lengthy article on SoftBank (or “the Enron of venture capital,” as he called it) many eons ago — back in 2019. At the time, he said:

The entire “growth” story, which is to say companies that can continuously grow market share (preferably at a loss) looks to be rolling over.

It’s the classic Ponzi scheme. You always need fresh new capital to pay off the old capital in order for the scheme to continue. When there is no fresh new money, everything reverses and folks quickly realise the value of positive cash flow.

And also:

Is this likely to happen tomorrow? Probably not, and maybe not even for some time. But it absolutely needs to be on your radar because this bad boy is a bug in search of a windshield.

Make no bones about it, SoftBank is in dangerous territory.

Maybe shareholders can get out of this alive but it looks to me like making love with a crocodile. It’d be a heck of a story to tell but only because the odds of coming out alive are so slim.

It took a few years for SoftBank — and the surrounding narrative — to begin falling apart, but it now seems to be gaining momentum.

But perhaps the most baffling (or bizarre) thing about this whole story must be that SoftBank was somehow able to raise over $100 billion from supposedly sophisticated investors with presentations like this one:

GET YOUR MERCH HERE

GET YOUR MERCH HERE

Have a great weekend everybody!