We’ve invested in many early stage businesses at the angel level, and many more private placements – both brokered and non-brokered. It’s easily the most high octane, lucrative area we’ve ever been involved in. We’ve made, lost and made money over the years, and have learned and relearned some lessons. Part of our personal evolution as an investor I guess.

Operating in this space has meant evaluating businesses at a very early stage in their development. Today I’d like to very briefly highlight some key elements, which I think many people miss when investing in private equity in general, but can just as easily be applied to most growth companies.

When a business is in its early stages of what one hopes will be a long and healthy life cycle, there are some key steps the business will typically take:

- Proof of concept

- Expansion of market share

- Expansion of product lines

- Monetization of points 1 through 3

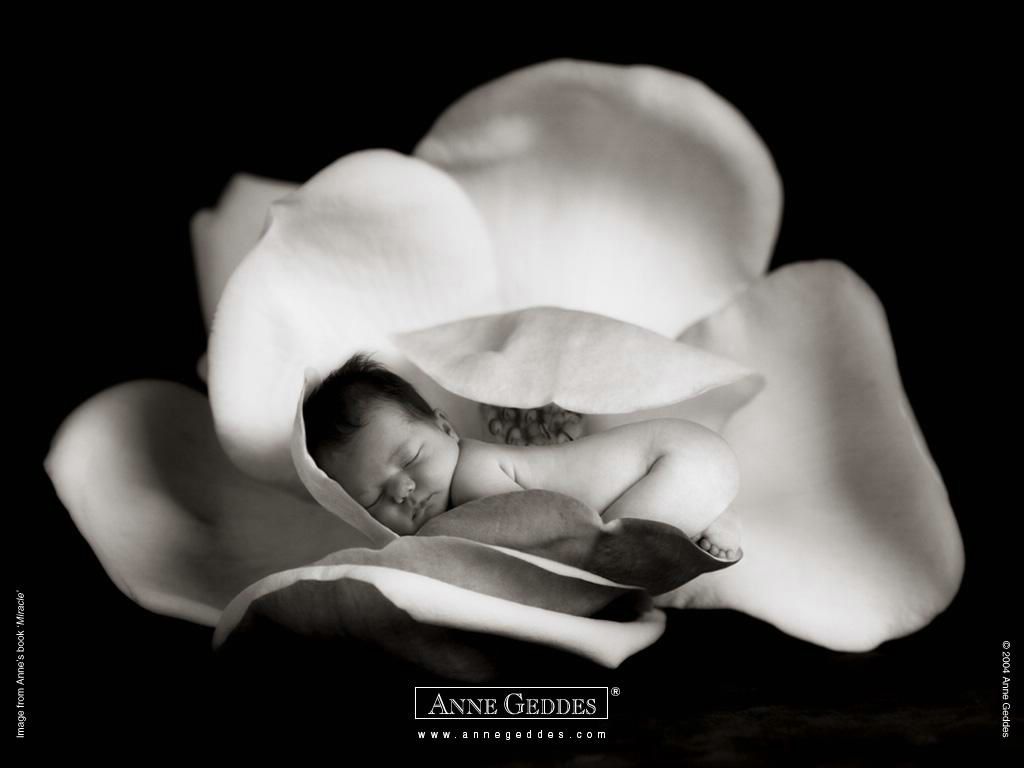

The proof of concept stage enables a business to identify a market niche, test the market, refine services and products, identify and build solid relationships with suppliers and customers. In this stage the company isn’t looking to “make their fortunes,” rather investment is required to determine if the business will actually work. Just like bringing a baby into the world, you need to feed and nourish it. If you do it only half right these things (early stage companies & babies) grow like weeds.

From an investment perspective this is considered the highest risk stage, and the equity is almost always privately held, usually by founders, and or angel investors. I say “considered highest risk” simply because there are at least half a dozen early stage businesses right now that I’m personally aware of which I consider far less risky than buying a 10-year JGB or a 10-year US T-bond, but then in my humble opinion you’d have to be dumb as a box of rocks to be long either.

Once proof of concept is refined, and well… proven, then typically a business will move to capture as much of the market as possible. This is absolutely the case in a “first-mover” situation, but applies in most markets. This expansion of market share normally requires large capital investment. Whether it be a marketing firm, an oil services company or a beer company the principal applies similarly. Revenues are coming in but are directed towards expansion rather than as dividends to shareholders, or set aside as cash reserves or to pay down debt.

The expansion of product lines can be worked simultaneously with the expansion of market share, but are often not. For example, if you’re building the next Coca Cola, then you’d likely sell Coca Cola to your increasing market share, spend your capital on increasing that market share and then expand product lines to those same customers. Fanta, Sprite and additional products can then easily be added to the mix.

At this point the company will likely still be spending heavily, but it will be directed towards different product lines. Revenues are now coming in and the company is fiscally solid, but needs strong guidance to continue achieving.

This is analogous to teenagers who inherently have high energy levels, enthusiasm, and can sometimes convince others that they do in fact know it all. In reality though they’re not there yet, although the energy and enthusiasm helps them blast through barriers. Stupidity, arrogance and naivety can equally impact both teenagers and company’s at this stage. Its why picking management is a key focus.

It is only when points 1 through 3 are well established that a couple of things happen. Capital previously directed towards expansion of market, expansion of product lines, and expansion in staffing tapers off. At the same time that these capital allocations are tapering off, the revenue growth from all of the hard work has begun to fill a company’s coffers.

A company can continue as a profitable enterprise long after its initial growth, if managed properly. The stupendous growth rate seen in the early years is likely history (except for Apple, which for now anyway continues to defy logic). Getting involved late in the game is unlikely to result in the 10x-100x returns that are possible in early stage investments.

This is when we personally begin heading for the exits. We’re content to walk away from a gorgeous maiden that is in its prime. Strangely it’s an easy decision to make.

As an aside, history shows us that people have linear assumptions even while it’s obvious we live in a dynamic world. As such, previous growth rates are built into forward valuation assumptions. This is both proven, stupid and inevitable.

– Chris

“Built to flip’ should not be a dirty phrase or unnatural act. I believe that to succeed today, entrepreneurs must not only aspire to early exits, but design that objective into their corporate structures and corporate DNA.” – ? Basil Peters

This Post Has 2 Comments

Interesting commentary. I’m working with a doctor currently on developing a EHR system that will be focused on a particular niche in the medical world. We are going to use all the research we put together for a presentation that we will use to try and raise capital for our venture from outside investors. I’ve never done this thing before so it is going to be a great learning experience. I have a couple of questions:

1. Do you have any advice or recommended sources I could use to gain knowledge on the process of raising capital for a start up from private investors? I don’t know anyone that has had experience raising money for a start-up venture that I can talk to on a local level so any sources you know of that would help, would be great!! Right now, I’m just putting together basic market information and then I will begin to determine costs and breakeven, etc. and put it into a power point format.

2. Is it easy for investors to exit their position in a private start-up company or does it take some time?

Thanks

Hi Jonathan

1. You could contact angel groups in your respective area. Friends and family is always a good method as well. I would also suggest contacting people within the industry who would likely have a better understanding of the potential and quite often provide valuable perspectives. This you won’t get from angels who are not understanding of the industry.

2. Exits are possibly the most difficult thing to ascertain and one of the biggest risks to any investor. An investor will want to see a clear exit path. Without knowing the mechanics of your business its impossible to assess. If there is any collateral you may want to consider convertible bonds. I discussed them on this post: https://www.capitalistexploits.at/2011/03/one-way-to-solve-the-pre-money-valuation-conundrum/

Chris