I missed you last week, I’m sorry. It’s been busy here at Capitalist Exploits HQ.

Oh, and thank you very much to all who share these articles. It’s greatly appreciated.

In the meantime, we’ve been keeping our eye on events.

Here’s a good one:

https://twitter.com/Schuldensuehner/status/1035828090323316736

And another one:

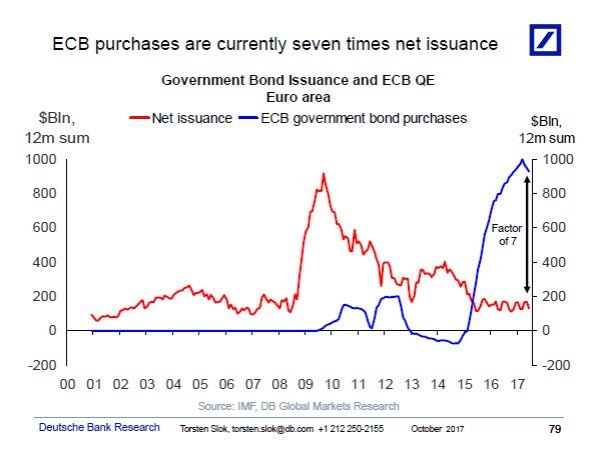

Let this sink in for a second. The ONLY buyer of BTPs is the ECB!

[clickToTweet tweet=”The ECB is now the ONLY buyer of Italy’s government bonds. Let that sink in.” quote=”The ECB is now the ONLY buyer of Italy’s government bonds. Let that sink in.”]

Pray tell, how does Draghi begin tightening… as he’s promised?

We believe that dog won’t hunt.

Repercussions for the dollar will likely be… ahem… not insignificant.

Staying with Europe for a minute…

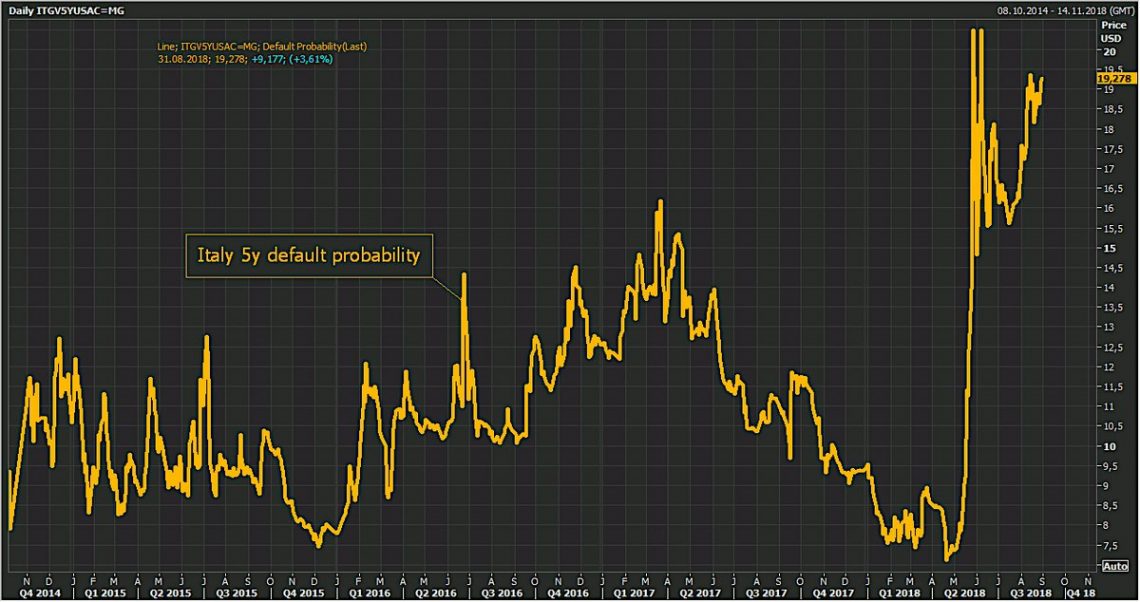

Fitch just downgraded Italy’s outlook to “negative”, and 10-year yields got out of bed.

And credit default swaps got a rise that even an old man with a triple dose of Viagra would have been proud of.

Let’s just say that all is not well in EU land.

No More Tesla, I Promise

Instead: The Enron timeline.

April 17th, 2001: Jeff Skilling, Enron CEO, calls analyst Richard Grubman an asshole on a public earnings call.

July 13, 2001: Skilling announces desire to resign to Kenneth Lay. Lay asks Skilling to take the weekend and think it over. There are two different views on what happened that day. According to Lay, he tried to talk Skilling out of resigning. Skilling says Lay didn’t seem to care and that he offered to stay on for six months. Board member says he recommended the transition period to Lay. Lay claims Skilling wanted an immediate out.

July 24-25, 2001: Skilling meets with analysts and investors in NY. “We will hit those numbers. We will beat those numbers.” Says LJM is stopping and that all other issues are immaterial. “All of these are bunk. Theres are not issues for the stock.”

August 3, 2001: Skilling makes a bullish speech on EES. That afternoon, he lays off 300 employees.

August 11, 2001: Skilling talks to Mark Palmer about preparing press release for resignation.

August 13, 2001: Board Meeting. Rick Buy outlines disaster scenario if Enron’s stock starts to fall. All SPEs crash. Skilling dismisses this. That evening, in board only session, Skilling, in tears, resigns.

August 14, 2001: Skilling’s Resignation Announcement. In evening, analyst and investor conference call. Skilling: “The company is in great shape…” Lay: “Company is in the strongest shape that it’s ever been in.” Lay is named CEO.

August 15, 2001: Jim Chanos thinks the stock is going through the floor and bets aggressively on that. Notes that Skilling’s departure coincided with release of second quarter 10-Q. Enron’s cash flow was a negative $1.3 billion for the first six months. Sherron Watkins, an Enron vice president, writes to Lay expressing concerns about Enron’s accounting practices.

August 22, 2001: Ms Watkins meets with Lay and gives him a letter in which she says that Enron might be an “elaborate hoax.”

September 2001: Skilling sells $15.5 million of stock, bringing stock sales since May 2000 to over $70 million.

September 26, 2001: Employee meeting. Lay tells employees: Enron stock is an “incredible bargain.” “Third quarter is looking great.”

Oct. 16, 2001: Enron reports $618 million third-quarter loss and declares a $1.01 billion non-recurring charge against its balance sheet, partly related to “structured finance” operations run by chief financial officer Andrew Fastow. In the analyst conference call that day, Lay also announces a $1.2 billion cut in shareholders equity.

Oct 17, 2001: A Wall Street Journal article, written by John Emshwiller and Rebecca Smith appears. The article reveals, for the first time, the details of Fastow’s partnerships and shows the precarious nature of Enron’s business. The SEC begins an informal probe of Enron.

Oct 22, 2001: Enron acknowledges SEC inquiry into a possible conflict of interest related to the company’s dealings with the partnerships.

Oct 23, 2001: Lay professes support for Fastow, saying he has the “highest regard” for his character during conference call with analysts, and employee meeting: “Andy has operated in the most ethical and appropriate manner possible.”

Oct 23, 2001: In a massive shredding operation, Arthur Anderson destroys one ton of Enron documents.

Oct 24, 2001: Enron ousts Fastow.

Oct 26 – 29, 2001: In vain Lay calls top government officials to solicit help for Enron, including Alan Greenspan, Paul O’Neill, and Donald Evans, respectively the Chairman of the Fed, the Treasury secretary, and the commerce secretary.

Oct 31, 2001: Enron announces the SEC inquiry has been upgraded to a formal investigation.

Nov 8, 2001: Enron files documents with SEC revising its financial statements for past five years to account for $586 million in losses. The company starts negotiations to sell itself to Dynergy, a smaller rival, to head off bankruptcy.

Nov 9, 2001: Dynergy agrees to buy Enron for about $9 billion in stock and cash.

Nov 19, 2001: Enron restates its third quarter earnings and discloses it is trying to restructure a $690 million obligation to could come due Nov. 27.

Nov 28, 2001: Enron shares plunge below $1.

Nov 29, 2001: Dynergy withdraws from the deal.

Dec 2, 2001″: Enron files for Chapter 11 bankruptcy protection, at the time the largest bankruptcy in US history.

See? I promised you nothing at all to do with Tesla… and I delivered.

Mayday, Mayday!

The difference between genius and stupidity is that genius has its limits. Which brings me to one Theresa May. A lass so thick she manages to make unbelievably stupid people everywhere look like geniuses.

Last week, in response to the marxist policies being implemented at what can only be described as a “dizzying pace” in South Africa (a topic we covered both here and here), May championed the move to trampling over private property rights (the very foundation of Western civilisation) and stealing land from a minority group due to their skin colour. Actually, if we think about it, the very definition of racism.

This, in the name of “diversity”, is yet another nonsense word that clutters our lives like the cholesterol in Michael Moore’s arteries.

While meeting with South African president Cyril Ramaphosa she simply smiled (I think it’s a smile, though it’s hard to tell) while Ramaphosa delivered this beauty:

We will deal with the issue in a way that ensures that the economy is not harmed, agriculture production increases, and we will focus on food security … we can reassure you that we are as responsible as we were when we solved the apartheid nightmare,

If you believe that… well, I’ve a bridge to sell you.

And showing just how out of touch May is, she went on to say:

By 2022, I want the UK to be the G-7’s number one investor in Africa, with Britain’s private sector companies taking the lead,

Well, sugarplum what you want and what business owners are prepared to risk are NOT the same thing.

If you want to put yourself in the shoes of an investor looking at South Africa, particular in the mining sector, then go read our recent article on this very topic. Someone please forward it to May. She needs an edumacation.

Sadly, it gets worse because this dolt of a woman is the one tasked with leading our pasty friends out of the grips of the death star, a process we know fondly as Brexit. Except she loves the death star and really doesn’t want to let it go.

Nike Enters Politics

BREAKING: Nike had been paying Colin Kaepernick all along, waiting for the right moment. That moment is now, as he becomes the face of the company’s 30th anniversary of the “Just Do It” campaign. pic.twitter.com/uccpDStbq5

— Darren Rovell (@darrenrovell) September 3, 2018

Soooo let me get this straight. Kaepernick gets paid to represent his movement, which Nike piggybacks on to sell shoes made in Indonesian sweatshops, to Americans who think they’re “woke”? Got it.

Why is this interesting?

Because increasingly business in the US of A is no longer divorced from politics. It’s a disturbing trend. From Starbucks “Diversity” training, to Chick-Fil-A, The Red Hen restaurant banning Sarah Sanders, to the CEO of Camping World telling Trump supporters to take a hike… and many, many more. It is simply a trend worth understanding in our humble opinion.

What this means is that the politicians will increasingly use businesses as a tool to fight their battles. It’s likely a very powerful and “smart” strategy for a politician. For an economy, however, it’s breathtakingly stupid and dangerous, which won’t stop it from happening.

– Chris

“History repeats itself, first as tragedy, second as farce.” — Karl Marx