MAGAZINE COVERS STRIKE AGAIN

MAGAZINE COVERS STRIKE AGAIN

Ah, what would we do without magazine covers?

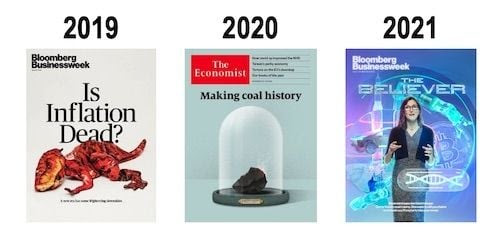

We previously highlighted a number of instances where a mere glance at the newsstands could have alerted you to major market turning points. From a pick up in inflation that blindsided the pointy shoes to the fall of “exponential growth” (and with it Cathie Wood’s ARKK).

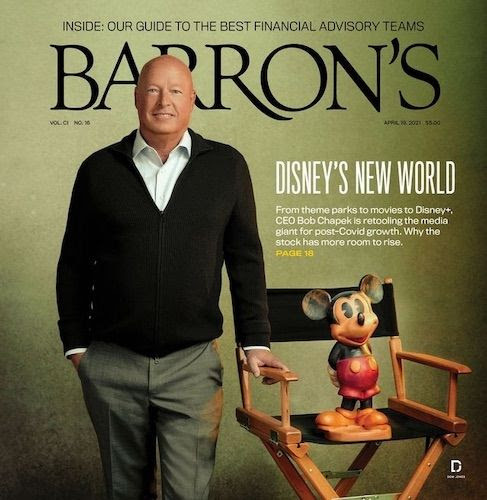

Furthermore, the good folks at Barron’s would’ve also steered you clear of the disaster that is Disney stock (h/t to @stockjock84 for bringing this one to our attention).

Since the day this was published in April 2021, Disney got slashed in half, while the S&P 500 is down “just” about 10%.

Part of our job here at Capitalist Exploits is finding where TO BE invested. But the other — equally important — part is ensuring we’re not anywhere near where we should NOT BE.

And when it comes to that, magazine covers seem to be one of the best contrarian indicators out there.

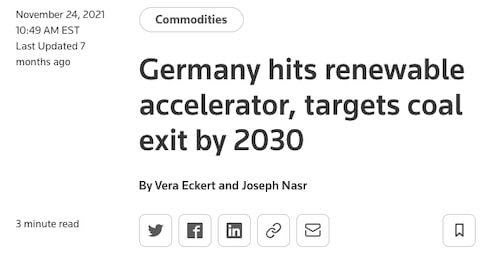

HOW DO YOU SAY “STUPID” IN GERMAN?

HOW DO YOU SAY “STUPID” IN GERMAN?

In the West today people with no experience in energy, let alone business, now make the decisions for both.

These central planners have decided that “renewable energy,” which doesn’t produce much energy and isn’t renewable, is the way to go (and don’t you dare disagree, you right-wing extremist).

And here we are, six months later:

Just months after declaring war on fossil fuels (including coal) and shutting down the last couple of nuclear plants in the country, the sauerkraut-eating pointy shoes are now being forced to fire up dirty coal again.

We’re at a loss for words.

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

Insider member Mike shared this photo from a supermarket in the land down under:

AU$11.99 (or about $8) for a head of local lettuce? Ouch!

Another member, Andreas, chimed in from Guatemala:

Observation today in Guatemala in a La Torre supermarket: regular price of yoghurt, local produce, up to 38 Q from 27 Q a few months ago

But fear not, the pointy shoes have already come up with an ingenious solution to address this:

Yep, pouring more gasoline on fire should definitely help.

BEWARE OF PONZIS

BEWARE OF PONZIS

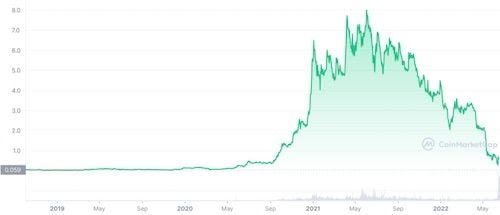

Over in the crypto markets, Ponzis are blowing up. The biggest one so far is Celsius, though by the time you read this, there might be others. After all, Ponzis tend to fail in clusters.

You might wonder who was buying this garbage? The answer: your pension funds.

From FT:

Canada’s second-largest pension fund has said its inaugural investment in the digital asset sector reflects a belief that blockchain technology will shake up the financial industry, even as cryptocurrencies attract mounting regulatory scrutiny.

Caisse de Dépôt et Placement du Québec (CDPQ), the US$300bn Canadian pension fund manager, on Tuesday joined WestCap, the fund set up by former Airbnb and Blackstone executive Laurence Tosi, in leading a funding round for Celsius Network — a crypto lending platform that has been targeted by US state regulators who say it has breached securities laws.

Yep, you read that right. These muppets put pension money into this garbage. They even called it a “diamond in the rough.” Guess they’ll be writing that off now.

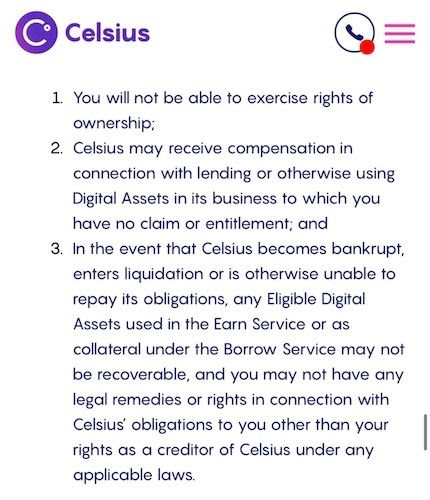

And you know what? All they needed to do was read the fine print. Here it is. Not hard to find. We found it in less than a minute with some stubby fingers and a search engine.

Perhaps we’re just getting old and more grumpy, but sheesh… it really feels like we’re surrounded by more dimwits than ever before.

…LIKE CHRISTMAS IN JULY

…LIKE CHRISTMAS IN JULY

Have a great weekend!