Here is a glass of water. You’re holding it.

How heavy is it?

The answer is: the actual weight probably doesn’t matter. It’s just a glass of water. What matters is how long you hold it.

Hold it for a minute, it’s no problem. An hour and your arm will ache. A day and your arm will feel paralysed.

The weight doesn’t change but the longer you hold it the heavier it becomes and the greater the probability you finally just have to put it down or risk dropping it altogether.

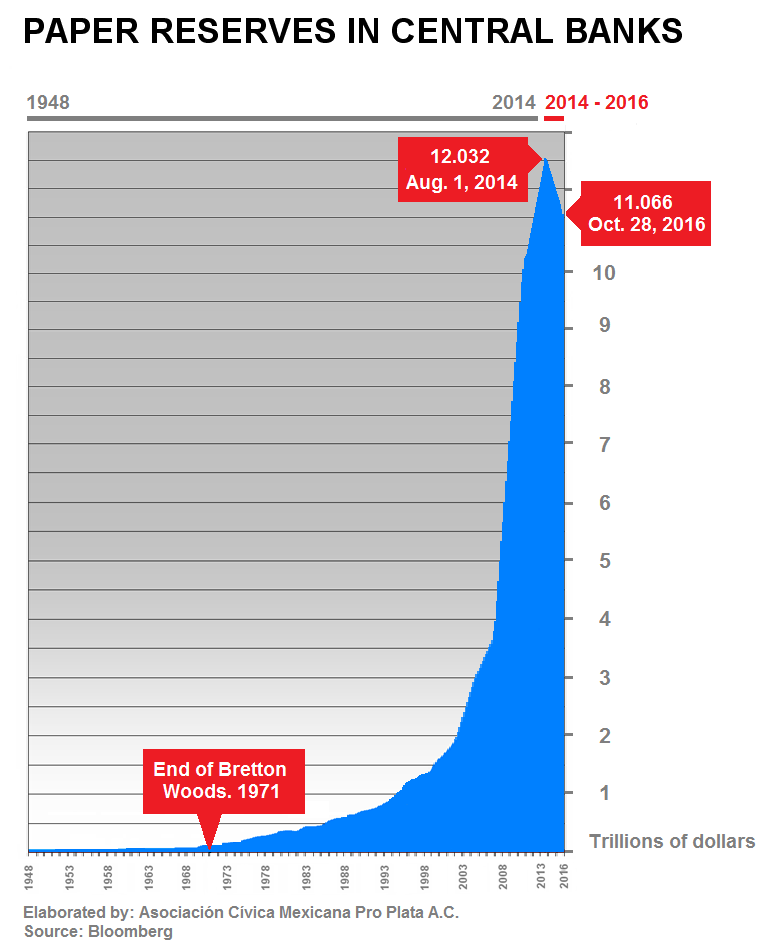

Now, take a look at this graphic which I nicked from Hugo Salinas:

Betting against the ability of governments and their central banks to keep holding the proverbial glass of water has been a losing proposition for a looooong time.

Now, simple math tells us that although this debt growth is pretty damned fantastic it needn’t be a problem if income growth has kept up with it. Income, after all, services debt.

Since income growth hasn’t kept up clearly that’s not the case. So what is it?

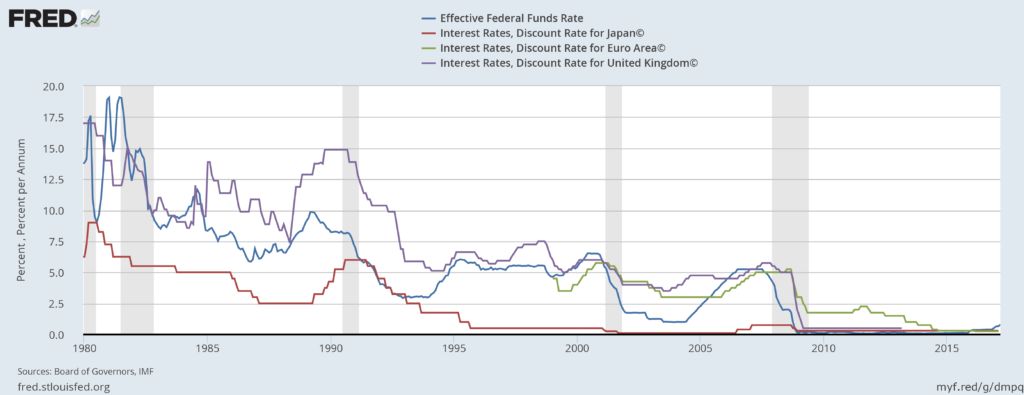

The answer lies in this chart which shows the cost of capital across the major economies of the US, the EU, the UK, and Japan.

When the cost of debt servicing is low or zero, then the size of debt really doesn’t matter much. It’s as if the glass of water has no weight at all.

Now here’s something worth pondering…

On an historical timeframe we’re at the tail end of the long term debt-cycle… a cycle that typically lasts between 50 and 75 years.

Today, bonds are more sensitive to price movements than at any other time in history and the yield achieved on them so low that it doesn’t take all that much for a positive return (just) to turn into a loss.

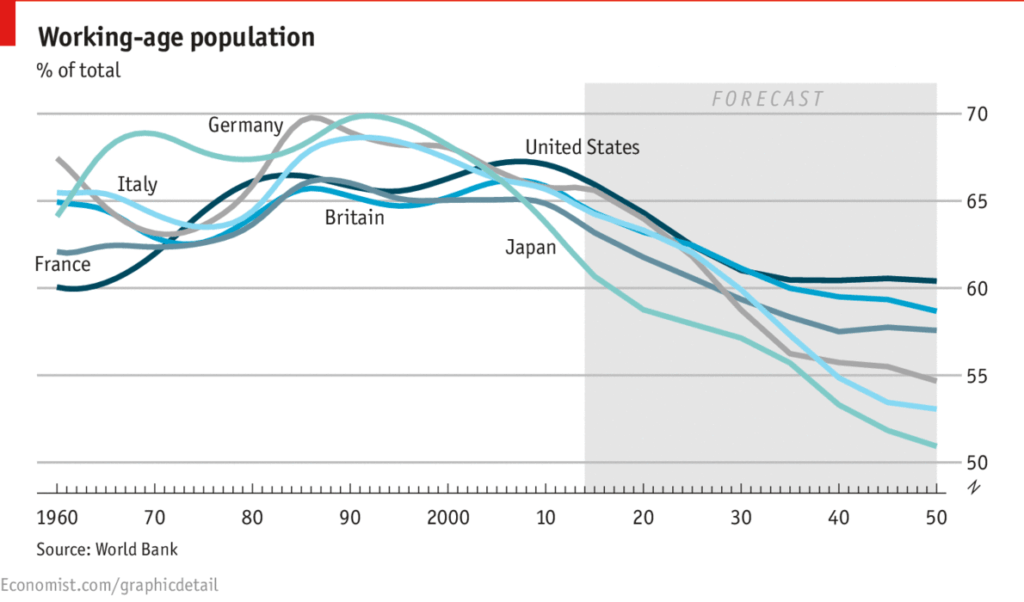

Now take a look at this:

Poor old Clyde and Maureen have been having one “heckuva” time achieving any returns at all but what they absolutely can’t afford to do is lose money as they move into their “golden years”. Bonds, especially government bonds, provide “certainty” for them.

The thing is the price of a sovereign bond ultimately is what another party is prepared to pay for it.

Sure, it’s redeemable at par but what investors forget is that issuers of bonds have been going broke ever since the City of Amsterdam issued the first bond back in 1517.

Investors, money managers, Clyde and Maureen, and Joe Schmoe are choosing to ignore this history.

The biggest issue as I see it is that we’ve approached the limit to which central banks can squeeze any additional “juice” out of additional debt creation. The proverbial “pushing on a string” has been reached.

This is for two major reasons:

- Interest rates are about as low as they can get them, and

- The effectiveness of additional debt creation on GDP growth is approaching its own limits as risk premiums and spreads compress.

While all this is happening the global coordination between these central banks which we’ve seen over the last decade is almost certainly not likely to continue. Do you really think that Chairman Trump’s administration will bail out Herr Merkel and vice versa this time around?

Nah, me neither.

As interest rates have declined and then declined further, investors’ complacency and belief that they will continue to do so far into the future has increased. This is incredibly dangerous thinking although completely understandable in terms of behavioural psychology.

As a result all asset prices, which are typically priced in terms of their present value of future cash flows, have had their durations lengthened and then lengthened some more. As the discount rate falls so the duration is extended. What this does is simply increase price sensitivity to those very interest rates.

I’m not sure anyone has done the math on what the world looks like if when the market begins repudiating bonds, pushing rates higher. Even a fairly minuscule 100 basis points higher today has the ability to create a bond market crash greater than we saw in 1981.

Central banks know this and have already begun buying up alternative assets because the last thing needed right now would be to call into question the “confidence of the market”.

This is a problem which is going to begin resolving itself… slowly at first, then all of a sudden.

I do believe we’re rapidly approaching a time when Clyde and Maureen should be looking at their “golden years” with an eye to, ahem… holding something shiny rather than paper obligations issued by “the most trustworthy” lenders.

– Chris

“History doesn’t repeat itself but it often rhymes.” — Mark Twain

Want More?

I built INSIDER in response to many investors asking for dedicated actionable investment research. This research needed to be easily understood, allowing for the ability to be implemented and applied to investors’ own portfolios. Try it risk-free for 30 days. If it’s not right for you, we’ll gladly refund your subscription.