I’ve been watching Evrim Resources for several years now. This has been particularly true since they released trenching results on April 9th from their Cuale project in Mexico that took the share price from $0.50 to $0.95.

I decided I would buy some stock on Friday afternoon at around $0.90, but before I pulled the trigger I thought better of it and reached out to CEO Paddy Nicol to set up a meeting for the following Monday.

It’s almost always best to be prudent, and, while I know a few of the board members at Evrim and trust their judgment, I wanted to hear from management firsthand what was happening at site and what the plan is going forward.

It’s almost always better to be prudent… but this time it turned out to be a mistake.

At market open on Monday morning Evrim’s share price jumped to $1.48 on the back of some even better results. I bought shortly thereafter.

Controlling the Downside

Evrim Resources is an exploration company focused primarily on Mexico. It employs what is known as the “prospect generator” model, in which the parent company (in this case Evrim) acquires one or more projects and then gets another company to pay for the work.

In exchange for funding the work the buyer earns ownership in the project, this can be a small minority stake or almost all of it depending on the deal the companies strike.

This model allows the parent to retain partial ownership (exposure to the upside of a given project) without having to shell out millions on exploration. The genius of the prospect generator lies in the fact that while exploration is extremely high risk, most projects come to nothing and cost millions of dollars to get them there, this model allows exposure to dozens of projects, while spending little out of pocket.

Is the upside constrained?

Yes.

But this is the cost of having the downside almost entirely mitigated and, in the exploration game, 99 times out of 100 that is a very good deal.

Evrim currently has 8 projects on the books which include 6 with funding partners, one project currently seeking partnership, and a 2% NSR royalty on a Mexican gold project.

They’ve been frugal, deliberate, and have built up the company and portfolio of assets over the past 7 years.

But… like many prospect generators they have a dream.

The dream is that one day they come across “the” project. The one that’s too good to give away. The one they don’t take a partner on but retain 100% of the ownership and explore themselves.

Evrim has just announced theirs.

“We look at 30 to 35 projects a year. You keep looking at enough of these things and one eventually comes out of the woodwork that you know you want to take a shot on.”

Paddy Nicol, President, CEO & Director, Evrim Resources

“The” Project: Cuale

Me: “So, how do I say it… like quail?”

Paddy: “No, no… it’s KWA-LAY. I’ve been explaining that to a lot of people this morning, haha.”

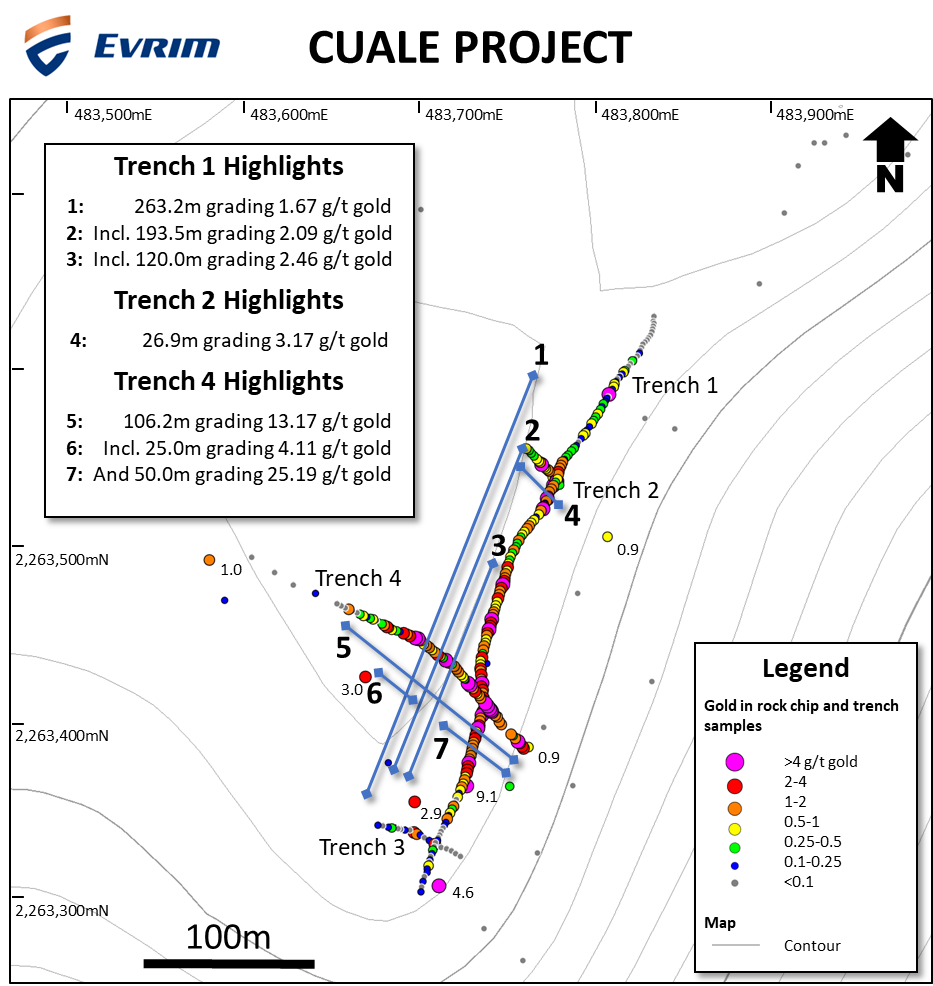

Last Monday was a busy day for Paddy. He’d been talking to investors all morning when I dropped by. Evrim had just released their second set of trenching results in a week, with grades as high as 26 g/t, resulting in their share price nearly tripling in just over a week.

Trenching is exactly what it sounds like. Geologists dig a trench in a straight line for as far as they deem necessary and assay the material that comes out. It’s quick, cheap and an excellent way to get a concept of the scope of a potential deposit. In this case, the four trenches completed at Cuale have paid off with the discovery of the aptly named “La Gloria” zone; results have been very promising.

- Trench 1 grades: 1.28 g/t gold over 351.8, including 263.2 meters at 1.67 g/t gold, 193.5 meters at 2.09 g/t gold, and 120.0 meters grading 2.46 g/t.

- Trench 2 grades: 2.94 g/t gold over 29.4 meters, including 17.9 meters grading 4.55 g/t gold.

- Trench 4 grades: 13.61 g/t gold over 106.2 meters, including 50.0 meters grading 26.13 g/t gold, and 7.5 meters grading 163.3 g/t gold.

In addition to the trenches, two IP geophysics lines were completed:

- The first indicating a 100m deep by 300m wide resistivity zone located immediately beneath the La Gloria zone with a possible 400m western extension and another feeder target at depth.

- The second line located 500m north of the first line defines a 1200m long by 50 to 120m deep highly resistive ledge associated with strong silicification and minor anomalous gold at surface and a deeper feeder target.

The scope and grade of the trench results, in conjunction with the geophysics data, indicate the potential for a substantial gold resource ranging from hundreds of thousands of ounces to over one million.

Slow Start

The Cuale property is a high sulphidation epithermal gold target 35 km south of Puerto Vallarta in the Cordillera Madre del Sur. After acquiring the property in 2013 it took Evrim 5 years to obtain the necessary permits to begin work.

There was a mix up surrounding a proposed run-of-river project located on a corner of their claims. After painstakingly identifying the issue and cutting the 108 hectares causing the confusion from their 97km2 land package, the title permit was finally granted in late 2017. Exploration began in earnest last December.

While waiting for the property title Evrim didn’t sit idle.

An Evrim geologist spent two weeks walking the property. After four-hours hiking uphill he discovered the outcropping gold which would become the La Gloria zone. Serendipitously, a small chip sampling program identified the La Gloria outcrops as an oxide grading approximately 1 g/t. That was when they knew they had something interesting on their hands.

Polymetallic veins had been identified on the southern end of the property and Caule is in an area known for volcanic massive sulphide (VMS) deposits. One of the most compelling aspects of the La Gloria zone is that it appears completely undiscovered with no indication of historic exploration. This is rare in Mexico where nearly every inch of ground has been walked by a geologist or prospectors.

What’s Next?

With $5.4M in cash, no debt, and a rising share price Evrim has options.

With an additional $250,000 in geophysics works scheduled for Cuale and 3,000 meters of drilling planned for the property it’s going to be a busy field season. Drill permit applications are currently underway and Paddy expects to see the program commence by the end of June. In total Evrim will spend $3.2M this year, $1M of which will be devoted to better understanding Caule.

When asked about potential future financing, Paddy was candid: “It’s something we’re considering, but not committed to. It comes down to a function of who it is, what the terms are, and what the price is”.

With Altius Minerals and Adrian Day each holding 17.5% of the stock Evrim already has committed top-tier backers and can afford to be picky. When asked if there were any circumstances they’d consider a JV on the project the answer was clear, “we’d consider a strategic investment into the company, but not at the asset level”.

It’s going to be an interesting year for Evrim. They’ll need to properly define La Gloria with additional trenching, geophysics, and drilling before we truly know what they have on their hands.

But, when you see a group that has patiently sorted through projects for the better part of decade decide to go all in and come out of the gate with results like this, it’s hard not to pay attention. Investors have the safety net of Evrim’s other assets and royalties, a patient team with committed financiers, and now the upside potential of one very hot exploration play.

I’ll be following their progress closely over the coming months, I suggest you do the same.

Cheers,

Jamie Keech