Over the past few months, we’ve seen some of the most extraordinary events from the anti-fossil fuel/extinction rebellion movement.

We have protestors jumping on planes:

Gluing themselves to roads

With one protestor even gluing her breasts to the road – 10 points for dedication to the cause to her.

From a BBC article about the global protests:

The protests have taken place in countries including the US, UK, Germany, Spain, Austria, France and New Zealand. Participants have glued and chained themselves to roads and vehicles, and tried to disrupt busy city centres.

“We have no choice but to rebel until our government declares a climate and ecological emergency and takes the action that is required to save us,” said Australian activist Jane Morton.

A World Without Fossil Fuel

Debates about whether fossil fuels are really behind global warming aside (Yeah we’re not going there today) I have to wonder whether these folks really understand how ingrained fossil fuels/hydrocarbons are in modern society and how if we were to actually get rid of them how much of a hit our standard of living would take?

Without fossil fuels the world as we know it starves, and the chaos that we’d experience would be unimaginable.

The irony is that without hydrocarbons there would be no road (asphalt) on which to glue themselves to, and even if there was a road they wouldn’t have any glue because that too is hydrocarbon-based. The clothing they’re wearing and those yoga mats they lay down on in the streets (one needs to be comfortable when protesting) are decidedly products of the hydrocarbon industry.

The point here is this. We are in a war against hydrocarbons.I read the IMF is proposing a $75 carbon tax:

The IMF reiterates what economists have long understood: Enacting a carbon tax is “the single most powerful and efficient tool” because pricing mechanisms “make it costlier to emit greenhouse gases and allow businesses and individuals to choose how to conserve energy or switch to greener sources through a range of opportunities.” Politicians should favor choice and flexibility over central planning. “People and firms will identify which changes in behavior reduce emissions — for example, purchasing a more efficient refrigerator versus an electric car — at the lowest cost.”

Good luck in getting individual countries to adhere to this, but that is another story. The big deal is that this is yet more evidence of a move against fossil fuels.

Then we have the attack on big oilers. Exxon is now taking the heat:

We certainly wouldn’t be surprised to see more oilers take the heat…….from the BBC:

“It’s a major milestone as a part of a growing wave of cases that Exxon and other major oil companies are facing, not only here in the United States, but in fact in jurisdictions around the world,” said Carroll Muffett, president of the Center for International Environmental Law.

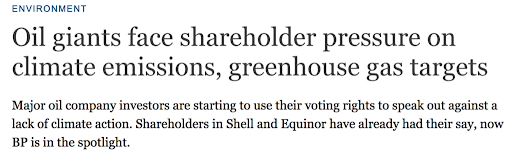

If external heat isn’t enough big oilers have to contend with shareholders

The consequences of this? Well it is fairly straightforward as in BP’s example:

Well if it’s not heat from regulators, or shareholders then it is heat from lenders:

Three of Australia’s big banks will face pressure from investors on climate change with a series of resolutions lodged ahead of annual meetings demanding ANZ, NAB and Westpac reduce loans and exposure to coal, oil and gas companies.

I think I have discussed this before but even Australian financial regulators and the Reserve Bank are getting in on the act:

The Reserve Bank of Australia last week issued a warning that banks and other lenders exposed to carbon-intensive industries such as power generation and mining would face “transition risk” from global warming as sudden regulatory changes could slash the value of assets and businesses, some of which may become economically unviable, referred to as “stranded” assets.

Granted we are talking Australia here not Nigeria, Russia, India, or China…….but the RBA wouldn’t be doing things off their own conscience – they act largely on the back of global trends.

I could go on and on………but the big thing here is that there is a growing movement against fossil fuels and this is going to have a big impact on the supply of fossil fuels in the near and far future.

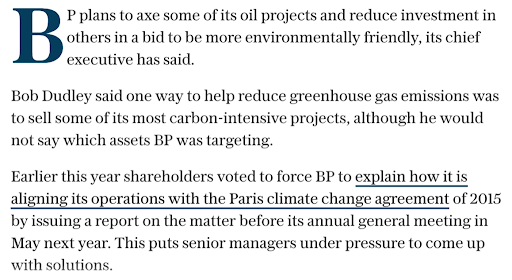

Few understand just how ingrained hydrocarbons are with everyday life:

Perhaps even fewer realise how addicted modern society is to hydrocarbons. Perhaps addiction is the wrong word rather “dependent” is perhaps more appropriate. Anyway, let’s go with addiction because it implies that it is going to be really hard to get away from its use (unless we are to all gladly run into the arms of chaos, starvation and bloodshed).

Addiction also ties in well with the cigarette industry. I wrote about this before in “The hardest thing to do”

Reliving The Tobacco Industry’s Nightmare From Yesteryears

As a recap, remember back to the late 1990s, just like everyone is having a go at big oilers now the crowd was having a good go at the cigarette industry – a massive litigation settlement:

But that wasn’t all…….it just kept on coming (in no particular order). The authorities gave it all – trying to scare the living isht out of everyone:

Banning cigarette companies from advertising………no more sexy adds like this:

But that wasn’t enough they then killed tobacco sponsorship:

They tore all brand advertising off cigarette packaging and replaced it with horror pictures

And they then proceeded to ban smoking in public places

and in cars with minors:

And they kept raising the tax on cigarettes:

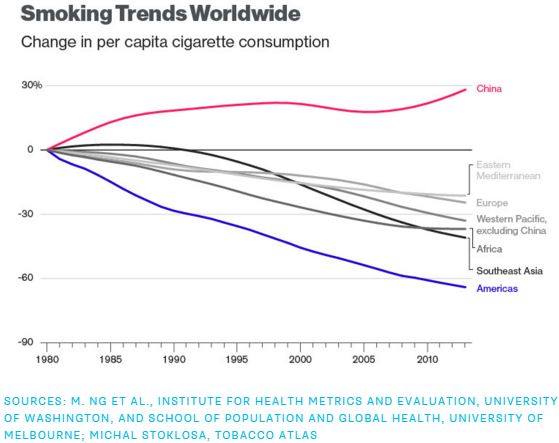

Perhaps not surprisingly global cigarette smoking rates declined (actually it wasn’t the litigation that caused this it was something else as smoking has been declining for more than a generation (except in China)

And I have probably missed out a whole bunch of things. And on top of all this: Thomson Reuters Global Tobacco Index vs S&P 500 1999 – 2015

As you can see tobacco stocks smoked the S&P 500 on a 5, 10, & 15-year time frame since the 1998 litigation dramas.

I just have this feeling that sentiment towards the energy sector is very similar to what it was towards the Tobacco sector in the late 1990s, and if history is anything to go by then we should see energy stocks outperform the broad market on a longer-term perspective. All one needs is a strong stomach and a healthy dose of patience because that’s how many fortunes are made.

– Brad