STRAIGHT OUT OF VENEZUELA’S PLAYBOOK

STRAIGHT OUT OF VENEZUELA’S PLAYBOOK

The following sounds like something you’d expect of Venezuela. Sadly, it is France (we double checked, just to be sure):

French President Emmanuel Macron said the state will need to take control of some firms in the energy sector in a plan to bolster the country’s independence.

The French leader did not name any companies and said the moves would be part of a strategy that would include delivering on his government’s campaign to overhaul energy markets to decouple electricity and gas prices.

“The state will need to take in hand several aspects of the energy sector,” Macron said on Thursday, as he laid out his manifesto just three weeks before the presidential election. “We will need to take ownership of several industrial players.”

Because central planning has such a stellar track record, right? We expect this to blow up spectacularly. Chris warned about this back in 2018 in this article:

Resource nationalism brings supply disruption (or even destruction), which is wildly bullish for the commodities involved.

In this case, this is very bullish for uranium, assuming you don’t own any uranium companies located in France (which we don’t in Insider).

NO LOVE FOR GRETA?

NO LOVE FOR GRETA?

You’ve probably heard us say that everyone is a greenie until it hurts their pocket. Case in point (from The Telegraph):

Boris Johnson has opened the door to the return of fracking in the UK, The Telegraph understands, as he stops importing Russian oil over the Ukraine war.

The Prime Minister wants his ministers to look again at whether fracking, which has been under a “moratorium” for more than two years, can help diversify the country’s energy supply.

Mr Johnson is said to see the Russian invasion of Ukraine as a “moment of great clarity” about the dangers of European countries relying on Russian oil and gas imports.

But it’s not just the UK. We also have this from the other side of the English Channel:

The European Commission on Tuesday published plans to cut EU demand for Russian gas by two-thirds and make Europe “independent from Russian fossil fuels well before 2030”.

We suggest you read that last part again. We could swear that only a few weeks ago, the same statement from the pointy shoes read something like this:

The European Commission on Tuesday published plans to cut EU demand for gas by two-thirds and make Europe “independent from fossil fuels well before 2030”.

You see, all they did was remove the word Russian. But notice the sleight of hand. They just opened the door to focusing on energy security (something Chris covered at length here). It’s almost as if they no longer care about Greta.

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

This week member Sean shared an update on a back order that has been dragging on for a few months now. As you can imagine, it’s not getting any better:

A while back I mentioned a client has 10 monitors on order since January. Today I followed up with the sales guy and get this, the supplier has 12000 orders for computer monitors but only 800 are arriving into the UK! My order has been in since early January and the new ETA is end of April.

Our hunch is it might be a while before Sean’s client sees those monitors. Make no mistake, though — all this is Putin’s fault!

“DID HE JUST SAY CHINA TECH?”

“DID HE JUST SAY CHINA TECH?”

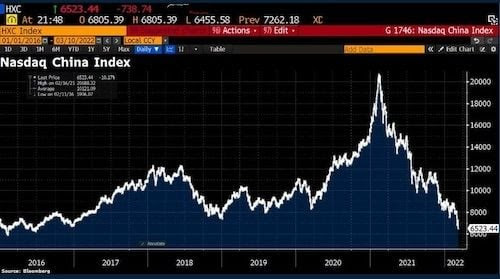

It’s not just Cathie Wood’s beloved growth stocks that have been pulverized in recent weeks.

Chinese tech stocks have sunk even deeper, to levels last seen in the immediate aftermath of Lehman meltdown. In many cases, the baby has been thrown out with the bath water as even shares of quality companies got destroyed.

What triggered this selling could have been threats that the West would sanction China since they’re trading with Russia. Then there was the Evergrande collapse causing concerns as well. And while all of these are material risks and potentially justified, what isn’t justified are the sell offs in good companies. But then that’s the way things go, isn’t it?

As the dust settles, there will be some fantastic bargains in Hong Kong-listed stocks. We’ll be keeping a close eye on them in the coming weeks and months.

WEEK’S HUMOUR

WEEK’S HUMOUR

Have a great weekend!