Not a week goes by without some suit being trotted out on CNBC, MSN, or some such propaganda outlet to most earnestly — with furrowed brow and stern expression — explain to us that yes, the end of fossil fuels is now here. Not coming, not a future inevitably, but actually here.

We are told that “we” (meaning you and I) must however act NOW, and a select bunch of jet-setting billionaires with unusual “interests” in underage girls actually have the answers. Oh yes, they do.

This speaks to the desperation resulting from a reality which refuses to bend to an ideology. You see, the problem with physics is that there are certain immutable laws upon which it is built. It must be truly infuriating for these “elites,” though if you really want to see the climate Nazis’ heads explode, you’d casually mention that not only are the laws of physics suggesting otherwise, but that Greta Thunberg can’t possibly know what she’s talking about because she never really went to school. This will immediately qualify you as not only a “climate denier” but a racist, homophobic, misogynistic toxic male. That’ll be true even if you are of the gentler sex.

I’ve always said that some cold hard facts and economic realities will eventually mean that this Hegelian dialectic approach to resetting the global economy in a dystopian technocrats’ wet dream would face opposition. I suggested that we need to watch those countries, regions, cultures, groups that diverge from this impending hellscape where relative freedoms and hence prosperity will then be most likely found.

On that note, witness the following:

Indian Oil to invest $944 mln on gas sales network in nine new areas | Reuters

Indian Oil Corp (IOC.NS), the country’s top refiner and fuel retailer, aims to invest 70 billion rupees ($944.02 million) to build gas sales network infrastructure, including pipelines, in new areas, the company said on Sunday.

The Indian political class are sociopaths along with the rest of them, so please don’t misunderstand me thinking that India will be some bastion of freedom-loving capitalist individualism.

👎 Flawed plans

“Climate change” is one of the pillars of the central planners’ agenda. This is a broad pillar and designed as such because it allows incredibly sweeping mandates that can all be brought under the already broad and increasingly widening umbrella of “climate”. Even myocarditis is now caused by — deep breath — climate change. The point is that this pillar isn’t standing in India, which has spent the last couple of decades dragging an increasing percentage of very poor people up and out of poverty. Those who’ve tasted it don’t want to go back to their old lives, and those who’ve not enjoyed it look around and realise that they too want a piece of it. Now, if this particular pillar (climate hysteria) doesn’t stand, then all subsequent nonsense doesn’t stand.

This is the flaw in the globalists’ plan. Centralisation. One pillar falls and an entire structure upon which it’s built comes tumbling down along with it.

The next few years (and maybe even the entire decade) is likely to be a series of conflicts around these pillars which have been built. They will come under pressure due to them being flawed and because nowhere, anywhere will you get to have all peoples of this earth to agree to put aside their differences and become one. It simply isn’t going to happen, and thousands of years of history teach us so.

Repercussions

In the meantime, what it means for us is that volatility is going to be high for extended periods. We’ve had decades of dampened volatility with only short periodic, although violent bursts in between as central banks have managed to keep the money spigots wide open, controlling the bond market, propping the equity markets, and kicking the debt can down the road.

What we have now is an entire breakdown in the geopolitical order that existed since World War II. As this unravels the ability for central banks to continue to do what has worked thus far is going to be put to the test. This is where we’re at now in this game. We are in the first inning, and the cracks are widening. Tech just began slipping through one such crack.

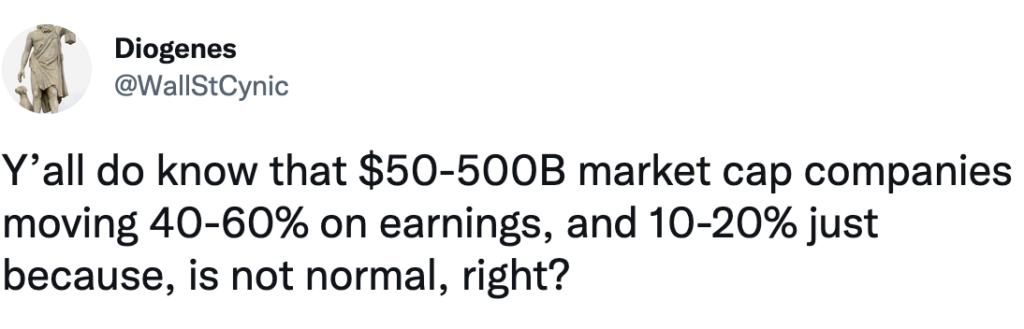

As Jim Chanos recently mentioned:

🤷Where are “we” headed?

As I am writing this I am watching Amazon swing in market cap by 13.5%, which is equal to the GDP of bloody Greece. Not normal! Expect to see more “not normal” events as markets attempt to figure out what the hell is going on and as the central banks and central planners find their tools increasingly useless.

What’s going to drive markets now is the price of stuff, in particular energy. The central planners are no longer in control.

Investors are going to be forced to fight inflation. With T-Bills well below the rate of inflation (even as measured by the “experts”) cash is a guaranteed loser. But putting more cash into “growth” stocks which are no longer growing is problematic. Investors paid multiples provided companies were growing. Even if you were selling some stupid app to help you trim the lawn nobody cared so long as users kept signing up to the thing. Revenue hardly mattered and profitability even less.

Sure, there are profitable businesses in the sector, but those are wildly overvalued. So even now they’re trading at 30x earnings (or thereabouts), and while nobody cared about this beforehand, now it is problematic. No, you want to hedge currency risk, and in a stagflationary environment the shift is going to go from “I wanna make buy a stupid ape for growth” to “I don’t wanna lose my home.” That’s quite the mind shift, but it’s already in the first innings.