Hola, RI members, and happy (belated) January. I hope that everyone had a great holiday season and is ready to get back at it in 2019.

January is a hectic month for the mining industry and heralds the beginning of “conference season”. This is the time of year where every junior mining executive wakes up from their egregiously long holiday, realizes that their company is going to be broke in 60 days, slaps together a new corporate presentation, and hits the road to beg for money.

Over the last two weeks Vancouver has hosted two such conferences, the Vancouver Resource Investors Conference (VRIC) and AME’s Roundup. These are two of the biggest mining shows on earth bringing in executives, bankers, brokers, money managers and investors from all over the world.

I’ve spent the last two weeks wading my way through a never-ending series of corporate presentations, networking events, cocktail parties, and hangovers.

The result?

We’re looking at some great opportunities, and well on our way to lining up the next RI deal.

What’s New

It’s been a busy 6 weeks. I spent the majority of the holidays prepping for the Northern Vertex deal, and I was very happy to see dozens of RI members allocate capital to NEE alongside Chris and I.

For me this is one of the most exciting opportunities that we’ve covered to date, and we produced more information for members (site visits, interviews, reports, etc.) than ever before.

As noted above, it was straight into the conferences by mid-January, and I’m only now starting to sit down and sort through the information gathered and connect with management teams. I gave a short talk on aligning incentives and choosing timing at VRIC, which you can check out HERE.

One of the most enjoyable parts for me was finally getting to sit down with Mike Alkin, of Sachem Cove, for a beer. After the better part of a year chatting on the phone and Skype it was great to finally spend some time together.

It wasn’t long before we started hatching new plans, including potentially hosting an exclusive uranium event and a site visit to a little known (for the moment) uranium asset in Latin America.

I suspect that I’ll have much more to tell you about both these things over the next two months…

The Market

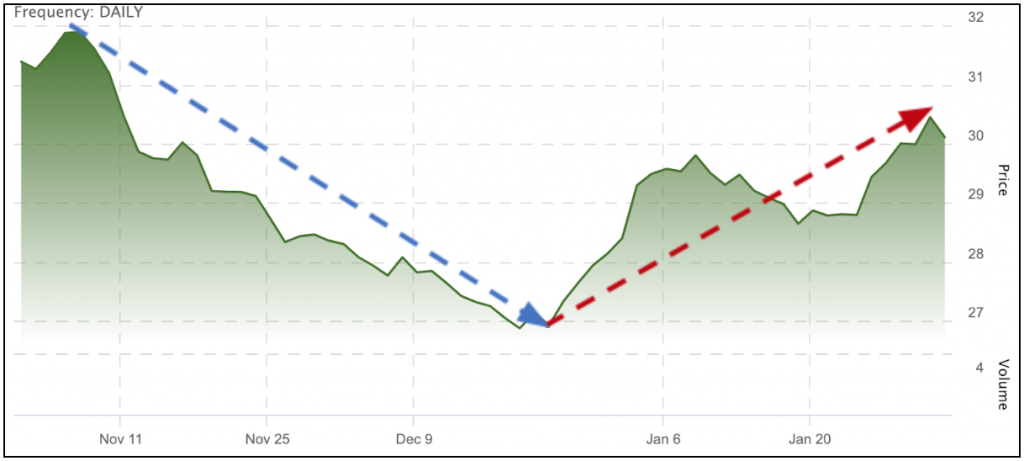

As expected, we’ve seen a mild recovery after the truly dismal fourth quarter of 2018.

The TSX Venture Metals and Mining Index is up ~13% from its low at the end of December. Much of this rebound is a consequence of the inevitable buyback of stock that was dumped during tax loss selling at the end of last year. Partially this will be due to general enthusiasm and new year optimism, but much can be attributed to a bounce in gold price.

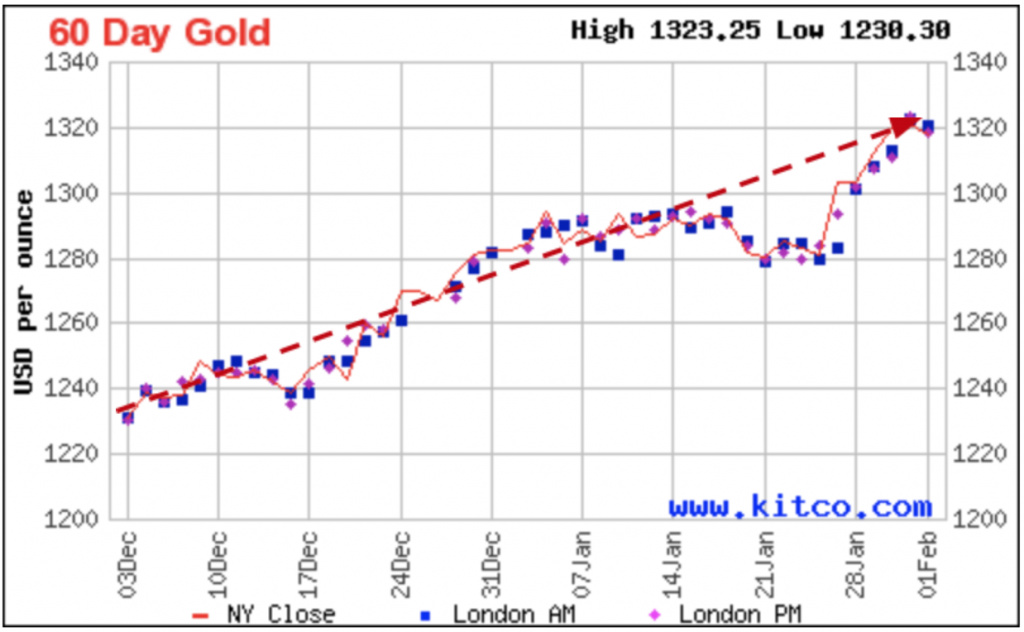

I don’t think we can quite say gold is on a tear… but it has certainly been a productive couple of months after a rough year.

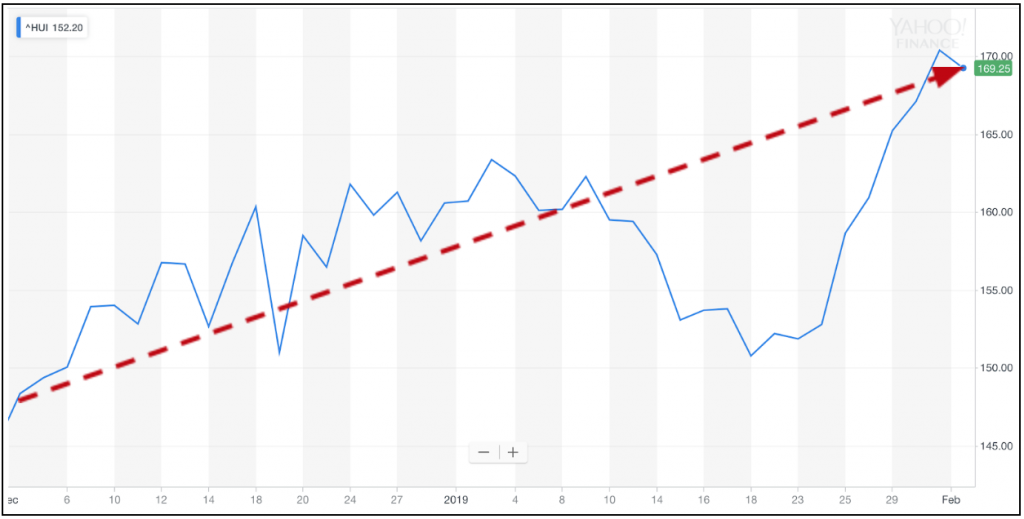

The yellow metal has seen a ~7% increase over the past 2-months, while the HUI Gold Index (a basket of gold companies) has increased by ~17%.

Those of you who are Insider members at Capitalist Exploits will have seen Chris’s recent comments on this trend:

“… my gut instinct is that we’re building for a super bullish setup in gold.

Here is gold in US dollars — a 5-year trading range. Basically going nowhere… and, in hindsight, justifying our decision to stand on the sidelines, quietly sip our drinks, watch the “gold is the only answer to all things on God’s green earth” cheerleaders prance about, rant and rave to their adoring “armageddon will come one day” fans and at the same time watch the global markets and how they’re reacting to multiple different events. Essentially, we’ve been content to just sit, watch, and wait.

The interesting thing is as we went through the December selloff, we’ve been analysing dozens of market sectors, and here is what has caught our attention in gold.

Firstly, the gold equities hardly sold off while gold itself remained unmoved in greenback terms. This tells us institutional money hardly owns the equities. Great.

Remember, it’s typically retail (owners and skin in the game retail or private equity) that own something at the very beginning of a cycle and then it’s retail (sold to you by the institutions who have packaged up neat managed funds, ETSs, ETNs, and myriad other “products” designed to “allow” retail to get involved) at the end. We know where we’re probably at in this cycle right now.

Here is the other cool thing.

Take a look at the yellow metal in all other currencies. They all “look like they want to go higher”.

Given how long gold has traded in a sideways trading range and how few people would take the notion of investing in gold miners seriously (i.e. how uncrowded the gold trade is), the upside is likely to surprise most.

We’ve always felt that gold will really move when we experience a loss of faith. Could that be in the Eurozone this year?”

This could shed some light on the recent move.

Gold is a funny metal and, as you well know, not linked to supply/demand in the way we typically see commodities behave. Anecdotally, it also seems to be one of the first movers in the metals space and can be indicative of things to come across the sector.

Why Gold?

One of the reasons for this is capital allocation. When it comes to dollars spent, more gets directed at the gold space than any other metal. Approximately 50-55% of all exploration dollars spent go into gold projects (~20% to Cu). This means there are more gold projects to choose from. It means that they see the greatest (and often earliest) inflow of capital, and thus are more likely to make a discovery or create value.

Many people have asked me why we’ve covered two gold deals in RI. This is why.

At this stage in the cycle there are simply more good opportunities in gold than anywhere else. A key part of the RI strategy is to invest alongside other highly talented professional and institutional investors. At present much of that capital is focused on gold. While we are working hard to add new metals to our portfolio (particularly Cu and Ni), great (well financed) opportunities are simply fewer and further between.

Because of this, I anticipate that the gold space will continue to make up a key component of our capital allocation in the year to come. Due to the influx of capital, this is the area of the sector that I expect will see the first signs of a bull market.

Portfolio Review

Progress Minerals

As many of you will know by now this has been an extremely difficult month for Progress Minerals. Kirk Woodman, VP Exploration was abducted from the Company’s exploration camp in Tiabongou on January 15th and was confirmed dead on January 17th.

The investigation remains ongoing and at this time the identify of his abductors has not been determined, although media outlets have speculated that Islamist extremists are responsible. What we do know is that Kirk was taken from site in the Est-region of Burkina Faso (near the Niger border) by a group of armed men, and was found dead in the northern region of Burkina Faso, within the Sahel Reserve, approximately 200 km from the site of his abduction.

I expect more information to come to light over the coming months. This article summarizes what is known.

This is clearly a very trying time for the company, and management has rightly been focused on Kirk, his family and recent funeral.

I know many of the people involved in the company well, and this has been an extremely difficult situation for everyone involved. Kirk was not only a lynchpin of the company, he was extremely well respected by both his colleagues and other professionals in the region, having spent 20+ years working in West Africa. I know that Progress, and Kirk, took project security very seriously, but it appears the situation in the region evolved quickly over the past year and they were caught off guard.

A state of emergency has been declared in the area, the Prime Minister of Burkina and his entire Cabinet resigned after the incident. Mining represents a massive portion of the Burkina economy and the first step is for the government and military to adequately secure the region and ensure miners safety.

Progress has a challenging, but in my view manageable, road ahead of them over the next 6-12 months. Clearly, they will need to work closely with government and likely security contractors to determine if and when it is appropriate to re-enter the Burkina properties. Given the current state of emergency I won’t speculate how long that might be, but I do expect Progress to suspend exploration activities in Burkina Faso for some period of time.

In the meantime, this should not overly affect the Côte d’Ivoire projects and I expect the company will continue to add value there.

From the perspective of an investor this is a difficult setback, Kirk was the backbone of the technical team and the person at Progress most familiar with the region and the geology. However, the company has fantastic assets, is well financed, and a has deep network in the region. I believe in time Progress will recover from this loss and move forward successfully.

From a personal perspective it is far more difficult. I did not know Kirk well, but I have seen the effect of his death on many people that did. He was clearly a respected and well-loved member of the mining community. His death is devastating to those that knew him, bad for the region and bad for the mining industry. It’s easy to forget the risks that people working on the front lines of this industry often take to create great companies – they deserve a tremendous amount of respect and admiration.

I trust the management at Progress to do the right things going forward and I plan on being patient in allowing them to do that.

Resource Insider Uranium Fund SPV

The RI Uranium Fund is progressing well. We have completed two deals over the last 8 weeks alongside Mike.

We allocated 2.2% of the fund to Radio Fuels Corp. in an early financing at a good price. And 1.5% of the fund into Appia Energy Corp. in a deal that included a warrant. Both deals were selected by Mike, and we allocated capital proportionally to Sachem. Mike and I will be discussing a 3rd deal early this week.

All told, things are progressing according to plan. Mike and I are working to coordinate a site visit to a very interesting project in Latin America in March that has the potential to be another investment for the fund. If this turns out to be the case, I am considering opening this deal up to all RI members. More to come on this soon.

Members can expect a video discussion between Mike and I updating them on Sachem and the Uranium space in the coming few weeks.

On another note, assure has told investors in the fund to expect confirmation of their holding and all necessary documentation associated with the transaction shortly. This has taken longer than I would have liked, I intend to harass them regularly until everyone gets what they need.

Northern Vertex

The Northern Vertex financing has turned out to be a great success. NEE extended the financing to allow several of their existing shareholders time to increase their investments and when they close shortly, I expect they will have raised ~US$10M in equity. This is a massive success in the current market and should be sufficient to ensure the Moss Mine is running smoothly.

Even more interestingly, Maverix Metals Chairman Geoff Burns has joined NEE as a member of the board. A board member of this calibre significantly extends the reach of the company and between Geoff and Greenstone I expect we’re going to be seeing big things happen at Northern Vertex over the next 18 months.

I’m meeting with CEO Ken Berry next week to discuss what’s next for NEE and the progress at the Moss Mine. All and all I’m very happy with this deal and impressed with the direction NEE is moving.

What We Are Looking At

This is what I’m looking at right now. In all likelihood many of these will not stand up to our due diligence process or we be unable to get the price I want. But all hold significant promise.

Warrior Gold (TSXV: WARGF): Very interesting land package next to one of the most prolific gold camps of all time: Kirkland Lake. Located in northern Ontario Canada, hosted in a greenstone belt (similar geology to Progress). Lead be a very experienced geologist who managed to cobble together numerous claims over several years into what is now a respectable land package. Project is very early stage. Almost no drilling to speak of, which is risky, but therein lies the opportunity as it happens to be one of the largest unexplored areas in a region that has churned out untold oz of gold… that is exciting. Working to wrap my head around the opportunity, and risk/reward now.

Plateau Energy Metals (TSXV: PLU): Same as last month. Interesting lithium and uranium assets in Peru. Very good management team whom I know well. I’ve been talking extensively with management and like the project more and more, plus it is cheap right now. With the right deal (ie. warrants!) this could be a very good buy. Working to better understand how the lithium is hosted, the extraction process and permitting risk in Peru.

Talon Metals (TSX: TLO): Still on the fence on this one. I’ve had considerable back and forth with management the last month. It appears that they will be completing a financing at a minor discount with no warrant. They will also likely need to complete another financing in the near-ish future. I still like the project (a lot) but this is leading me to think the best thing to do is wait for the next financing. I’m not convinced we won’t be able to get a better deal then, and I don’t want to be diluted. Besides that, RI members interested in this deal now able to buy on the market for what is essentially the same price. Unless something changes Talon is on the back burner.

Solaris Copper (Unlisted): Massive copper project in Ecuador. I love this project and believe it has the potentially to be a massive discovery. Solaris is currently a private company controlled by Equinox Gold (where I used to work). Solaris is expected to IPO and will likely need to complete a financing, but a date has yet to be set. At the right price this undoubtedly one of the most interesting copper stories on the planet right now, one I’m watching very closely and angling to get us involved in.

Sun Peak Metals (Unlisted): I am already a tiny (~$2,500) shareholder in this Ethiopian exploration company and would very happily increase my allocation. East Africa is truly one of the last great frontiers for exploration. Massively under explored, when compared to West Africa, it holds tremendous discovery potential. Sun Peak is lead by a team I respect, explorers who know the area extremely well having cut their teeth for years next door in Eritrea, and making two discoveries at Sunridge and Nevsun. Exciting project lead by guys that know their stuff.

Pucara Resources (Unlisted): Gold. Peru. Potential for a massive discovery. I’ve just started to look at this one, but I’m interested in two reasons 1) Marcel de Groot is one of the major investors 2) My friend Keith Laskowski is on the board. Keith is one of the best geologists I’ve ever met. He’s highly critical and a born skeptic. For him to put his name on something makes me sit up and take it very seriously.

Until next time!

PS: Don’t forget to send in your best bar photos.

Unauthorized Disclosure Prohibited

The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Capitalist Exploits and Resource Insider reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion of the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Capitalist Exploits. Capitalist Exploits reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact admin@capitalistexploits.at.

Disclaimers

Capitalist Exploits website, World Out Of Whack, Insider, Resource Insider and any content published by Capitalist Exploits is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

Capitalist Exploits and other entities in which it has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in publications or the website. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest should they arise, in a timely fashion.

© Copyright 2019 by Capitalist Exploits