I haven’t been sick in over three years. Nothing, not a sniffle, not a cough – nada. Strong as an ox I tell my wife. And so, naturally, I am immune from anything dodgy. The terminator of sickness if you will.

Except I wasn’t two weeks ago. God only knows where this bastard came from but it was the Jeremy Corbyn of stomach bugs. Born and bred to create nightmarish things to mankind. If it lingered longer, I’m sure it would have killed me, though my wife tells me to stop being such a man about it. It was just a stomach bug she says. I know better. This thing let loose on the wider population would have surely been like a plague. The weak, frail, aged and vegans would likely have succumbed and have been laid to rest or begged to have been put out of their misery. And if they could summon the strength, which is unlikely, they’d have moved to Belgium where Euthanasia is legal. Just to make it go away.

What about me? Well as mentioned, I’m strong (no really I am) but for a time there I became a human firehose. Every hour, as consistent as Big Ben, I would hobble into the bathroom, position myself for what I knew was both inevitable, and unavoidable, and then clutching the sides of the bowl as if my life depended on it. I’d heave. Not just once but a few times. Apparently, I’m “not very quiet”. It’s a man thing. Might as well let everyone know when you’re having a rough time. The thing with repeated vomiting like this is that even though you’ve already chucked everything up that you have inside, it doesn’t stop, and so on the subsequent go-rounds, you’re left throwing up what can only surely be your intestinal walls…and maybe a teensy bit of gravy from a month ago that got stuck somewhere. Perhaps that explains the particularly rancid smell.

11 hours!! That’s how long it took. It felt like an eternity and during those 11 long hours while pleading to nobody, in particular, to please make it stop, I did think to myself…will this ever end?

And this is where our investment strategy of buying deep value often cyclical industries mirrors the pain of uncontrollable vomiting.

Let me show you.

In the late 90s and early 2000s, the FTSE seemed pretty crazy to me. Overvalued and pricing in the very best of outcomes no matter. I had been burnt a few times on the short side and been learning that no, Chris, you’re actually shit at shorting and that yes, Chris, it often makes more sense to wait for a market to puke first, leaving deep value and play things from the long side. Time is on your side and your risk-reward is far better.

And then, along came the Y2K hysteria. Remember it? And so I thought to myself, well this could be the catalyst to bring things back to earth. Yippee. I waited in gleeful anticipation and then along came 2000 and guess what happened to the market? Nada. It was only after the fateful year of 2000 was ushered in…and the zombie apocalypse failed to materialize that the market finally did puke.

The slide began in earnest in August of 2000. Two full years later, it began looking juicy. Actually, there is a lesson in that. How many investors will sit and patiently watch a market for two years picking their nose and twiddling their thumbs?

Warren Buffett said it best.

“You do things when the opportunities come along. I’ve had periods in my life when I’ve had a bundle of ideas come along, and I’ve had long dry spells. If I get an idea next week, I’ll do something. If not, I won’t do a damn thing.”

I never caught the absolute bottom. Those who tell you they regularly do are full of BS. I bought both the index and a bunch of companies I had on my buy list in July 2002 only to see my positions move against me…materially. Two years later in March 2004, I had that feeling of having spent the last two years clutching the toilet bowl waiting…begging for the pain to end.

But, as the market made progressive higher highs and higher lows I loaded up and pressed the pedal to the metal increasing position sizing and buying a range of LEAPS. And then I got to sit on my skinny arse for another two full years pretty much ignoring the gyrations of the market. I never got the top. I got too afraid and bailed in 06. The risk-reward was gone. Why continue playing?

Now to be clear. Far be it for me to say “hey I got it right”. In many respects, I didn’t. Certainly, I could have made more money timing it better. But a good investor knows that it’s a matter of probabilities and the trade to make was clear. Fade the nonsense and invest in the probability that represents skewed risk-reward that’s in your favor.

All in all, I had to clutch the toilet bowl for two years of pain and then experienced two years of pleasure. The thing is none of us want the pain but only the pleasure. I get it. But really, that’s unrealistic. If you want to enjoy asymmetric returns you have to buy what’s on sale even and especially when nobody else will. That’s the actual prerequisite for the asymmetry to exist. When I explain this to folks they’ll nod their head and agree wholeheartedly. It’s obvious.

And it’ll be painful. Very painful. Clutching the sides of a toilet bowl painful, but you know what? Even though you don’t believe it at the time (pain remember…overwhelms the senses) that’s the right thing to do. Realize it’ll end and just harden up.

You’ll want to put a bullet in the head of the pain (sell that bastard). That’s a reasonable response. It’s what most do. It is why markets exhibiting asymmetry exists.

Some current examples

Asymmetry would not exist without the entire market pricing the US 10-year at 132 (yup that was it in September of last year)

Or the SPDR S&P Oil & Gas Exploration & Production ETF at 20 just a few months ago (yeah really)

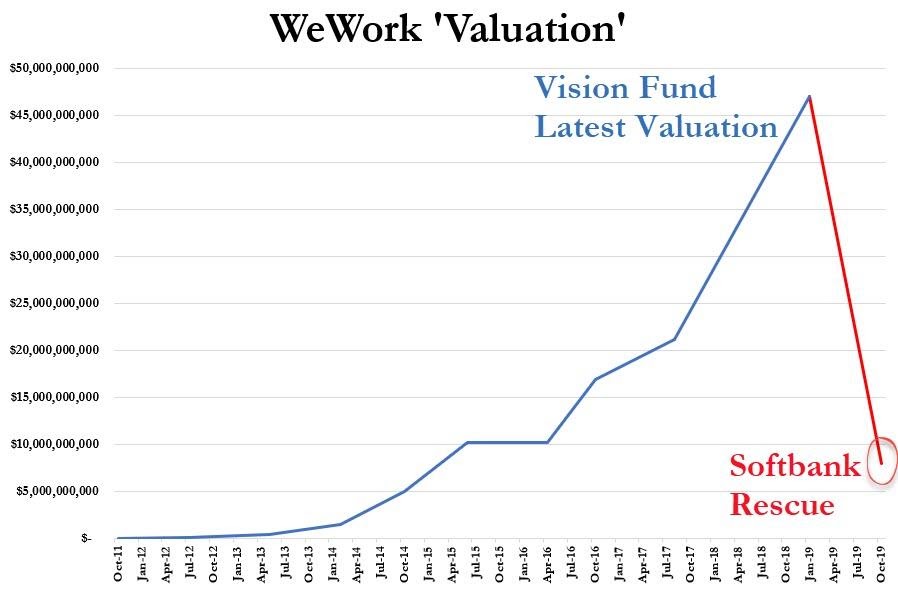

Or even the value of WeWreck at $65 Billion mid last year while it was for anyone who cared to look always just an office leasing company taking on massive long term liabilities at a loss and incurring obscene duration risk.

All of these things are going on and if like us you’ve been on the painful side of them, like us you have been left clutching the toilet bowl begging for it to end. But as we saw with Adam “he’s really a genius, cut from the messiah’s cloth” Newman and his ball of wax, these things do always…always come to an end. They must and so they do.

Right now we’ve been told a number of things. I’ll let you decide whether they’re correct or not and where opportunity may lie as a consequence.

- “Renewables” will replace all fossil fuels at a speed that will blow you away.

- Government deficits don’t matter and their borrowing ability will be untethered to reality. The quants say it is so. Here they are at work.

- We’re told that inflation doesn’t exist and yet financial assets have gone through the roof…and because the post GFC “stimulus” all hit at the tail end of the commodities boom (when supply was in excess) many people actually believe that the next 10 years will look exactly like the last. They won’t.

I could give you a dozen examples. They form the portfolio of sectors we cover in Insider. Anyway, without this pain, we just wouldn’t be where we are.

Like vomiting from a stomach bug it WILL end. We know it will.

So what to do?

The answer is simple but not easy.

– Chris