We investors, speculators and traders may easily be considered a crazy lot. Our heroes are determined by their intellectual capacity and actions. We look up to entrepreneurs and those that think for a living. We don’t care if they are one-legged dwarfs with chronic halitosis, or stunning supermodel types. Tabloids annoy us, and we could care less if Kim Kardashian is now hosting an orgy with goats on Oprah’s show.

I for one am blissfully happy to be counted as one such “nut.” We here at capitalistexploits are particularly thirsty for knowledge and intellectual stimulation. We believe it’s impossible to ever have too much knowledge, and while we may not grasp everything immediately we believe in the power of osmosis.

With the above as a precursor, below I list a small sampling of somewhat recent investment ideas/moves taken from a few of the folks we look up to (or at least respect for their savvy).

- Shorting the US housing bubble by short selling subprime mortgages. There were a few market participants who correctly forecast this, with the most publicized being John Paulson.

- David Einhorn shorting Lehman Brothers.

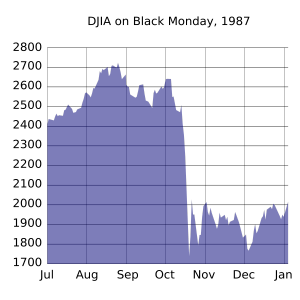

- Paul Tudor Jones tripling his money on black Monday of 1987 when he accurately predicted, and more importantly acted, on shorting the market.

- Stepping a little further back in time we have George Soros and his legendary shorting of Sterling in 1992. He used enormous leverage, taking a $10 Billion short position.

- Jesse Livermore shorted the market in both 1907 as it crashed, and then again in the 1929 crash, making an estimated $100 Million on Black Thursday.

My question to you, our readers is this:

What in your opinion, is going to be the best trade of 2012?

Some thoughts from my perch…

- I’ve mentioned the idea recently of shorting the Yen. Will 2012 be the year that reality bites?

- Long Euro debt. Specifically Italian, Portuguese and French. There exists the potential for a vicious short covering rally here. The boat is so heavily weighted towards the short side that anything at this point that brings some form of hope to the Euro debt crisis in the short term could result in some frantic short covering. Longer term it doesn’t matter, what can’t be repaid, won’t be. There is a big difference between a trade and an investment. For now I’m long.

- Buying long-dated calls on the major mining companies who are trading as if gold was below $1,000 an ounce. Think we’ve probably got 12 months to make some money here before we will need to get out.

- Short Volatility. Sorry but it’s just too overpriced right now. Shorting the VIX directly in the futures market. I guess you could buy the Proshares short VIX ETF if you like.

- Long oil. When (not if) does the house of Saud fall? Will the psychopaths in the Pentagon poke the Iranian hornets nest? Or, will we see an escalation of the Syrian crisis develop into a regional war? In the long term energy problems will be solved by the free market, and we’ll likely look back on the use of fossil fuels in the same way as we look back on the horse and buggy cart today. Between now and then though I remain bullish on oil.

- Shorting Chinese real estate. You could look at shorting the Guggenheim China real estate ETF (TAO). There are many ways to participate in this trade.

Since we’re probably more proficient as investors and speculators rather than traders, I’ll talk about some further ideas for investing.

- As Jim Rogers has stated on numerous occasions “In 1807, if you had moved to the U.K., you and your heirs would have been much, much better off for the next 100 years. If in 1907 you had moved to the U.S., you and your heirs would have been much better off for the next 100 years.”

I’ve personally focused my attention both physically, as well as with my hard earned shekels, on Asia, so I guess I agree with Mr. Rogers sentiments here. I’ve mentioned before my belief in certain Asian nations and I intend to continue to seek out opportunities in this region with Myanmar or Burma (depending on your political inclinations), being just one that I’ll be spending more time investigating.

Moving right along, we’ve talked before about some of these as well:

- The aged care sector is an investment we believe in, as is biotech (for the same reasons).

- Mongolia. If you’re not involved don’t come crying to us in 10 years time.

- Major trends such as precious metals, in which we continue to be over-weight.

- We’ve been accused of giving up on the West. This is not true. It’s not a West vs East issue, but rather a creditor/debtor, freedom/tyranny issue. We believe that technological innovation still largely resides in the West, and we have committed capital to projects in this arena. We are presently working on a particularly exciting deal right now that will give us exposure to some incredibly talented entrepreneurs in this sector, while significantly reducing our risks. This is something that we will discuss in future posts, so stay tuned.

While not an all encompassing view of our investments or trading hypothesis, the above is simply a sampling that we’d be interested to discuss with our readers and begin an open dialog. Together maybe we can find the next big investment theme for 2012.

– Chris

“I believe that the public wants to be led, to be instructed, to be told what to do. They want reassurance. They will always move en masse, a mob, a herd, a group, because people want the safety of human company. They are afraid to stand alone because they want to be safely included within the herd, not to be the lone calf standing on the desolate, dangerous, wolf-patrolled prairie of contrary opinion”. – Jesse Livermore