Our friend Harris Kupperman recently wrote an interesting article asking the question, “Does Real Estate Equal A Bond Short?” If you haven’t read his occasional musings you should. He’s sharper than the hairpins at Monaco.

To summarize Harris’ article: You’re not buying Real estate per se, what you’re buying is long-dated fixed-rate debt while betting on an inflationary outcome.

It’s a valid idea, and it got me thinking and re-analyzing a number of real estate markets around the world, both past and present.

There appear to be a number of them which correlate with this theory, although not all for the same reasons. Then there are others that do not. Digging deeper into the specifics for each of the markets I looked at, I’m fairly comfortable in saying that generically speaking, using real estate as a bond short will work when either of two sets of circumstances are in place.

- Long dated fixed interest debt is obtainable; and/or,

- Capital is trapped and cannot flee (this is typical where capital controls are put in place and a currency is devalued)

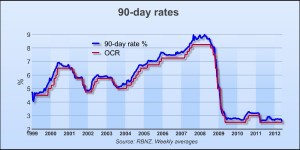

Harris was referring to real estate in the United States, Florida in particular, in his article. If we jump across the pond to Australia and New Zealand we see that housing prices are again on the rise. Effective May 2nd, the RBA slashed interest rates by 50 basis points, the first time since the ’08 crisis. Over in NZ the Reserve bank recently left the OCR at 2.5% and lowered interest rate projections.

Joe Sixpack is eagerly getting back into the fray. Remember, Australia and New Zealand came out relatively unscathed in the ’08 crisis. Question now is: Are Bruce and Sheila as smart as those large institutional money managers buying up top end real estate in Florida?

I tackled the question of Australian and New Zealand Real Estate – Where to? some months back. I took some heat by suggesting a few reasons Why Not to Buy Your Own Home, not the least of which for Joe Sixpack, means rooting himself to a fixed locale like a common garden vegetable.

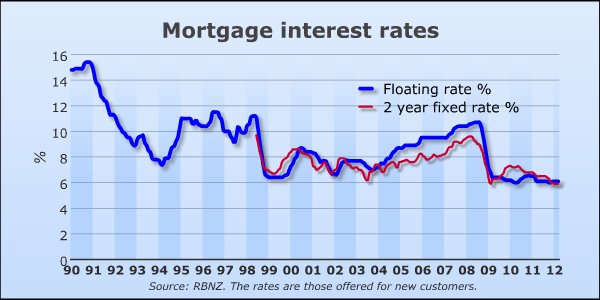

Borrowing money in either of these countries on a fixed-term basis amounts to 5 years max. Anything beyond that and you’re talking about interest rates that would make Greek politicians blush. So, with income to asset ratios in the + 6 range, what are these folk seeing into the future?

I think what they’re “seeing” is complacency with rates. Rates have been so low for so long that it’s becoming difficult for Joe to envisage an environment where this is not the case.

This brings up the question of what allows for a low interest rate environment in a free market..? In a free market, low interest rates are a by-product of low risk, which itself is a by-product of underlying political stability, fiscal stability, low debt to income ratios and strong collateral.

With this in mind let’s take a look at Australia and New Zealand.

Australia

- Government Debt to GDP – 22.3%

OK, nothing too ominous to fear here, right?

Wrong!!

Mortgage debt to GDP actually exceeds that which the US experienced at the peak of their housing boom. With banks having lent roughly $1.2 trillion in way of mortgages, they’re sitting at about 90% of GDP. This does not include personal debt, which if we include it totals over 100% of GDP. New Zealand

New Zealand

- Government debt to GDP – 31.6%

Government debt to GDP isn’t a problem here, but private sector debt certainly is.

Private sector debt in NZ is about 150% of GDP!!

How has this happened?

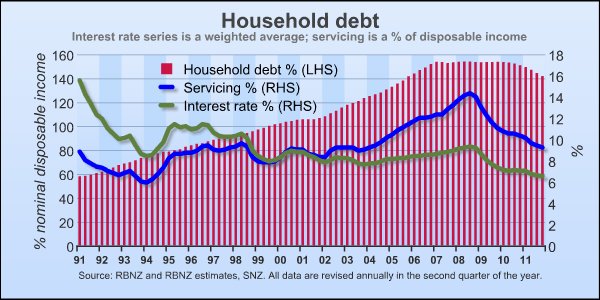

The answer lies in the graph below…

Monthly debt servicing costs have been driven lower due to interest rates. Those decreasing monthly mortgage payments increasingly service greater levels of debt. Ooh the wonders of leverage.

How is it that mortgage rates, which are set by the private sector, but heavily influenced by central banks, have reduced the compensation required for loans even while the total debt of consumers has been rising? Clearly this is arse backwards.

Once again, the answer lies in the graph below…

Ok, Back to the original idea of using RE as a bond short. To do so effectively we need the ability to buy debt at current rates now and fix it there.

Neither Australia nor New Zealand offer investors the ability to buy long-dated fixed-rate mortgages in the same way they are available in the U.S. Capital controls are not on the horizon for either of these countries, so I don’t think you’re going to get any protection on that side (if you could call it protection…).

In short, I think investors and home buyers in the lands down under, who are leveraging themselves into these markets right now, are plain loopy.

I mentioned the crazy income to asset value ratio’s that exist in both these countries (over 6:1) in my previous articles (linked above). Without perpetually low interest rates the majority of homeowners in these countries are playing with fire.

Leverage cuts both ways, and when (not if) rates begin rising around the world, beginning possibly with an almighty shock out of Japan, Australian and New Zealand rates will reset – UPWARDS. I don’t want to be in the way of that, and neither do you!

Instead, I will be waiting with my very own humanitarian “disaster relief” package, provided the government doesn’t intervene in order to “help.” No guarantees here though… remember, we’re dealing with highly-educated bureaucrats with PhD’s in “bozo” and Masters in “moron,” so I fully expect them to “do something.”

One of my guiding methodologies that has served me so well is to find markets which are undervalued, and first and foremost, pose little downside risk to my capital. Secondly, they provide me with a potential to make multiples on my money as they head out of a crisis.

In real estate it makes sense to mitigate risks by buying markets where credit has, for whatever reason, been decimated. Argentina provided investors with this opportunity post-2001, as the credit in the system was wiped from the playing field.

Today, Fiji offers us a similar opportunity.

I discussed Fiji when detailing the virtues of bankruptcy and a dictator, but probably didn’t tell you quite how fantastic I think the place is. I say that for a whole number of reasons, both investment as well as lifestyle, which we recently touched on when interviewing John Robb and discussing Rural Resiliency.

After nagging Mark incessantly to go and take a look for himself, he finally went and spent a month and a half there just recently. He’ll update us on his own thoughts in the coming weeks. Suffice it to say that Fiji may have a new resident capitalist soon!

In full disclosure, Mark and I have substantial current and future commitments in Fiji, and we don’t invest our money on whims… nuff said!

– Chris

Dear Optimist, Pessimist and Realist… While you guys were busy arguing about the glass of water, I drank it! – The Opportunist.

This Post Has 5 Comments

I too was very intrigued by Kuppy’s RE as a bond short article. Sounds like smart money is doing just that in the U.S. with 15-30 year refi’s at today’s low rates. It seems the U.S. will prevent capital flight if/when a devaluation is necessary.

So any ideas how one would structure this on a CA beachfront property that could be 100% controlled using borrowed money at a SUBSTANTIAL discount (perhaps 75%) to the current market price? The large discount is due to illiquidity……The property is in an irrevocable trust and has a zero income lease in place until death of the current 82 year old tenant. The note would have to be serviced from other income of the buyer, who would also end up being the sole trustee/beneficiary. In effect it is a reverse mortgage-type arrangement but the very low LTV loan needed would also allow a significant cash out (that could be off-shored and reinvested) at closing.

Any ideas how this transaction should be analyzed to provide a RE bond short?

Thanks!

offer full value with a 25% vendor finance. Use the vendor finance to carry the loan. If you’re financing at say 3.5% and simply servicing interest not principal you’ve got 7 years roughly. Will the tenant make it past 89 years of age??

A risky strategy really. The key with the strategy is to be able to ride the servicing for a looong time. You get paid because you have the ability to wait. With a 30 year fix you don’t need to be too sharp about picking bottoms. If you can’t service you’re screwed no matter.

If I living in the US I’d consider buying rental properties with decent yields, then financing the borrowing in Yen. I have a friend doing this right now. I suspect he’s going to make a fortune.

Chris,

Thank you for your insight. We will likely be able to borrow at around 4.375% for 30 years and my broker is investigating doing that in Yen on this L.A. property. Servicing should not be a problem for the first 5-7 years and then it will likely eat into savings unless:

1. The current tenant dies and we sign a cash positive new lease.

2. The cash-out from this refi provides sufficient global income to service.

#2 is the strategy behind this “USD/JPY/bond short” equity extraction. My fear with a Yen loan is that SOMEHOW Japan gets spared and the markets focus on the USA after Europe. Perhaps a re-alignment in Asia? China bails them out because they join the Chinese sphere of influence (and new monetary regime) and abandon the U.S.? It is not unthinkable given the locations, proximity to markets of the future and geopolitical upheavals coming.

Thanks again,

Pete

Pete

China won’t bail out the Japanese. They hate each other and have long standing animosity. Japan are too big to bail out anyway.

Regarding your strategy…just make sure you can service cash flows. If it was me I’d be inclined to just go and do the same thing with higher yielding RE so you know you can weather any cash flow losses waiting for your ship to come in. You don’t want to be right about it and be forced out of the market due to cash flow issues. Ensure you’ve got “staying power”.

Or maybe not……

http://www.zerohedge.com/news/presenting-kyle-bass-harvard-business-school-case-study