It was 1998 and the Ruskies were having a bad time….

Not a “bad hair day, dog shat on the carpet sort of bad time. No! A really f’ing bad time.

For the previous decade they’d been running a fixed exchange rate that was tenuous at best. Though they where running a fiscal deficit that could only be described as batsh!t crazy it kept trucking on thanks to a strong oil price and bullish ferrous metals markets.

Then the Asian crisis hit in 97 and the demand for the resources that Russia produced took a bat to the head. Now if it hadn’t been for those fiscal deficits this would have simply coughed up a recession in Russia, Olga and Ivan would have eaten more turnips, less beef, and life would have gone on. That never happened due to the aforementioned deficits as foreign exchange reserves collapsed.

We can see how it played out in the chart of oil.

The simple truth was they were screwed, Asian crisis or not. Even if you couldn’t or didn’t predict the Asian crisis it was evident that the risk reward behind the Ruble was hovering somewhere between isht and complete isht. You didn’t need to know what any catalyst could or would ultimately be. The inflection point when it came was always going to be sudden, dramatic and painful for those unprepared. Successful investing is all about probabilities and the pricing of such probabilities. The Ruble was mispriced. The end. Being long was silly.

Anyone paying even a modicum of attention could have seen what was coming, even if the timing of any event was uncertain (hint…it always is). And then it happened.

The government enacted currency controls and devalued the Ruble.

With foreign currency banned, Olga and Ivan were trapped. In fact if you wanted to bribe any official in Russia they wouldn’t even accept Rubles.

Why the story?

Todays topic isn’t so much about identifying mispriced risks in the global economy but rather looking at what the “solution” was back in 98 and then looking at what’s changed since then.

So back to the Ruble crisis. What did Olga and Ivan do?

They bought dollars.

Why dollars? Well you wanted something liquid, with stable value, and widely accepted.

Easy, so buy dollars in order to hedge against any EM crisis Chris?

Well not exactly. You see we’re not in 98 anymore. Dollars aren’t what they used to be. Don’t get me wrong I’m not bearish the dollar. In a world where things are relative the dollar looks pretty darn good, but let’s address the equation that Olga and Ivan were trying to solve here.

They’d just been handed a painful lesson in trusting central banks and government with their life’s work and savings. Immediately choosing yet some other central bank and government was done ONLY because no other solution existed.

But back to the dollar. Why may Olga and Ivan no longer look to the dollar in the same way?

Remember what’s happened since 2008?

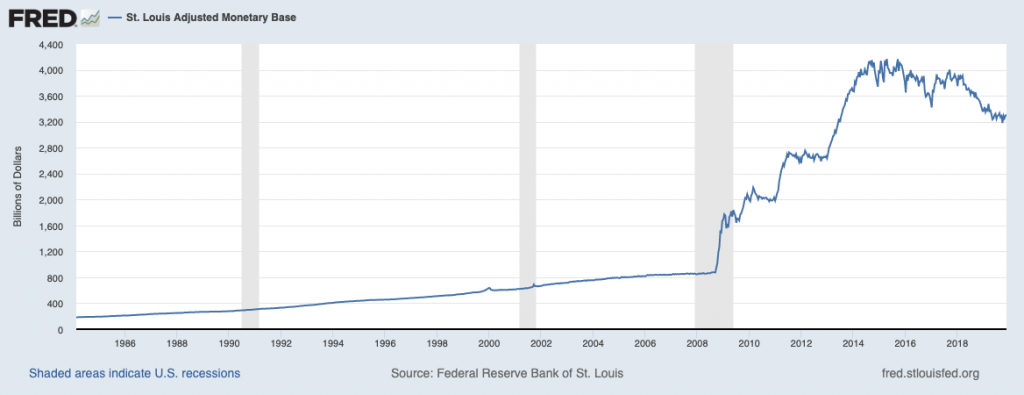

Here’s the US monetary base. Look at that monstrous increase since 08. THAT is not normal. Nor is it sustainable.

The reason I tell you this story it because it gets repeated over and over again. Sure there are different industries involved, different currencies, different governments and a host of dynamics which we can all point to and say…oh well that was different. But at the end of the day the underlying structure is always the same. A market, manipulated by pointy shoes attempting to get something for nothing reaches a breaking point. And unsurprisingly does just that. Breaks.

Surprisingly folks get caught unawares and are shocked, and outraged. This is then followed by howling, protests, “emergency measures”, presidential decrees and all such like. Then the pointy shoes are often replaced with a new set of pointy shoes who promise to “fix things”.

Tell me it aint so.

What to do?

The question for intelligent investors isn’t what will break an unsustainable market structure. It is simply understanding the probability of this happening, looking at what the pricing of such probability is and then finding the most attractive risk/reward means of executing on this.

Which brings me to Bitcoin.

Now I’ve been a long standing proponent of this strange technological breakthrough, once the exclusive domain of sunlight deprived kids in hoodies, but increasingly brought into the global financial arena. I could crow at the fact that I was early in bringing it to my clients attention while still in the hundreds of dollars so I will. There see I just did, but the reality is that by understanding probability, risk/reward and the dynamics of global finance and the geopolitical world as it is…this wasn’t as tough a call to make as you may think.

I’d go so far as saying that being bullish today is a way easier call to make. Sure that investment has returned roughly 300% annualised returns for a decade and is the single best performing currency (bar none) for this time period but it’s actually much less risky today than it was when I first began rabbiting on about it.

Bullish factors

Today hacking Bitcoin is impossible. Quantum computers can’t do it. Heck a stack of quantum computers can’t do it. Does that mean it will forever be un-hackable? Of course not. I’m not here saying it’s the holy grail I’m simply looking at this as a professional money manager assessing the risks (there are many and growing) and the reward. That’s it.

It is already being used by multi nationals in countries with isht banking systems (African countries I’m looking at you) moving over $150m/day. It is going mainstream and quickly. Custodial solutions (asset managers can’t invest without this) now exist.

It’s already been banned in many countries only to see its usage in those same countries rise.

And please don’t send me in your emails saying that governments will just ban it. I’ve heard the argument. It’s not a bad one and it will probably take place sporadically in various countries but I think that:

- the risks of this are much lower than they were when I first began pounding the table on Bitcoin and

- the geopolitical situation today is vastly different to that of 10 years ago. There is less and less coordination, and cooperation. Sure they’ll fight it then some will break ranks and see that adoption makes much more sense. (This is why the banks are already going that way). This will only accelerate.

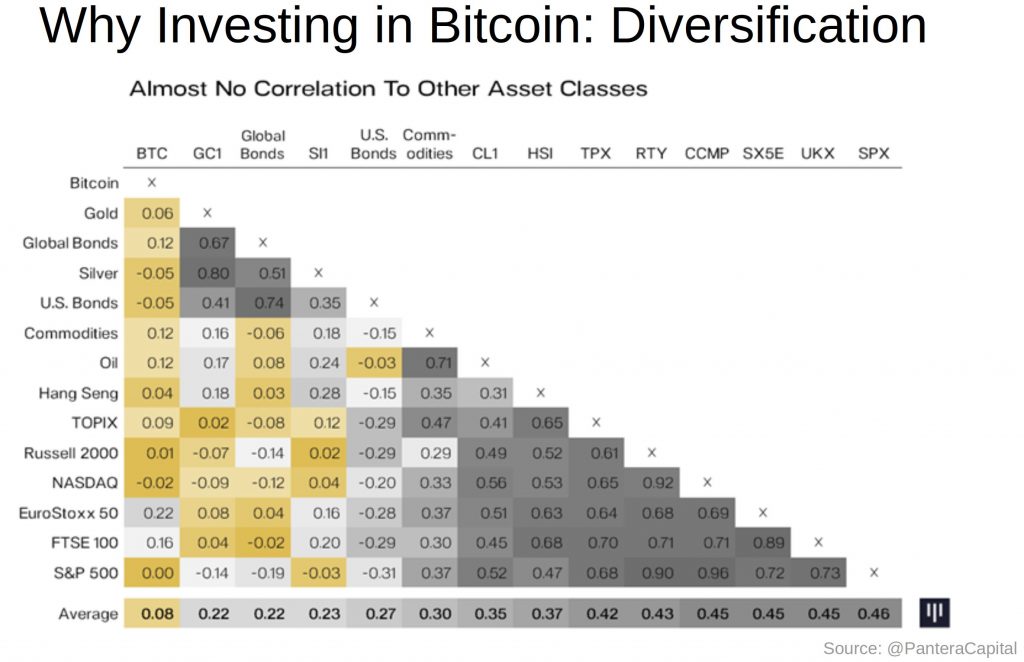

Diversification. Pantera capital provide an excellent chart below showing how uncorrelated Bitcoin is to other asset classes. It’s actually quite incredible.

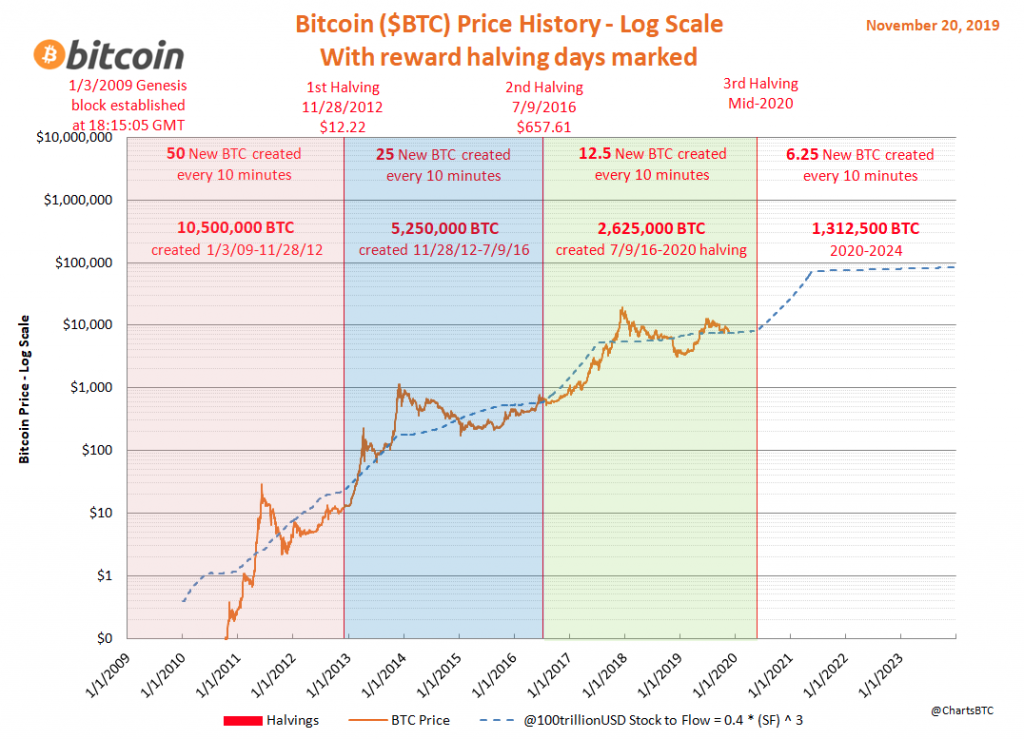

The halving is coming. If you don’t know what this is google will puke up more than enough to satiate your curiosity. In short bitcoin is a deflationary asset and as of early next year it becomes ever more so. In a world which is on the brink of an inflationary impulse (long term readers will know what I’m on about here and those of you who are sadly not can always sign up for more information) this is a spectacularly good risk reward asset to own. The asymmetry is phenomenal.

The cats out of the bag.

There will be competitors. But I ask you this. What would you rather buy when you’ve that sneaky suspicion you’re about to be treated to what Olga and Ivan were treated to? A tokenised money market fund run by Facebook (that’s essentially all Libra is) or a tokenised version of some ishty government issued currency (Mark Carney I’m looking at you, and yes you too Xi…your Chinese crypto currency is as interesting to me as a vegan steak)….or a decentralised currency that has been around for over a decade, produced stunning returns and proven un-hackable?

Owning an asset such as Bitcoin which is uncorrelated, geographically and politically agnostic, technologically superior and carries no duration risk might be something you’d want to consider.

-Chris