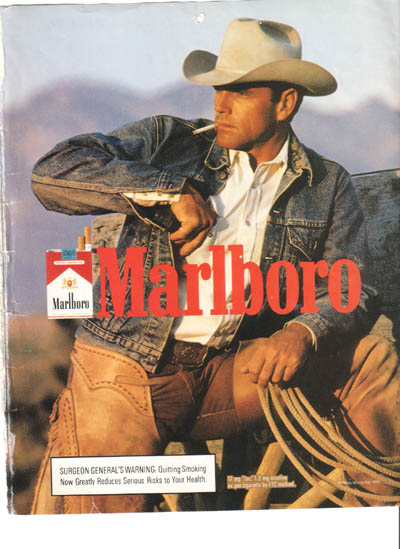

From 1954 to 1999 this guy was on the cover of every magazine. He was also regularly featured in those ads you’d see just before a film kicked off at the cinema.

And just in case you never read magazines or watched movies, he was on giant billboards, distracting you from looking at pretty girls on sidewalks.

We could say that at least until the late ’70s, it was good times for tobacco stocks.

But we all remember how the zeitgeist changed.

The Start of the Tobacco Industry’s Bear Market

I’m going to pick 1997 as peak bearishness for tobacco stocks. Why 1997?

This was when the tobacco companies were in the news for killing people.

It was a time when the anti-tobacco crowd was adding followers to their religion faster than Catholic rabbits on Viagra and lawyers were elbowing each other out of the way to file lawsuits against those murdering, cancer-causing bastards.

And to top it off, cigarette companies in the US were slammed with a $360 billion fine.

It was the last place investors wanted to be… and so they weren’t. They all left.

How Smart Investors React

And you know what smart investors did?

They held their nose and bought the snot out of tobacco stocks.

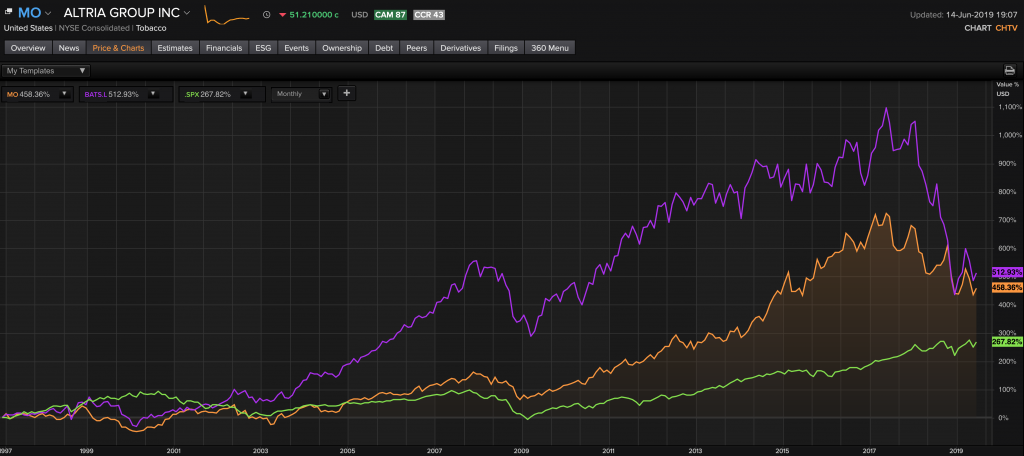

Here’s 1991 through till today for Altria Group and British American Tobacco.

They’ve had a pullback in the last two years but beat the S&P 500 by a wide margin.

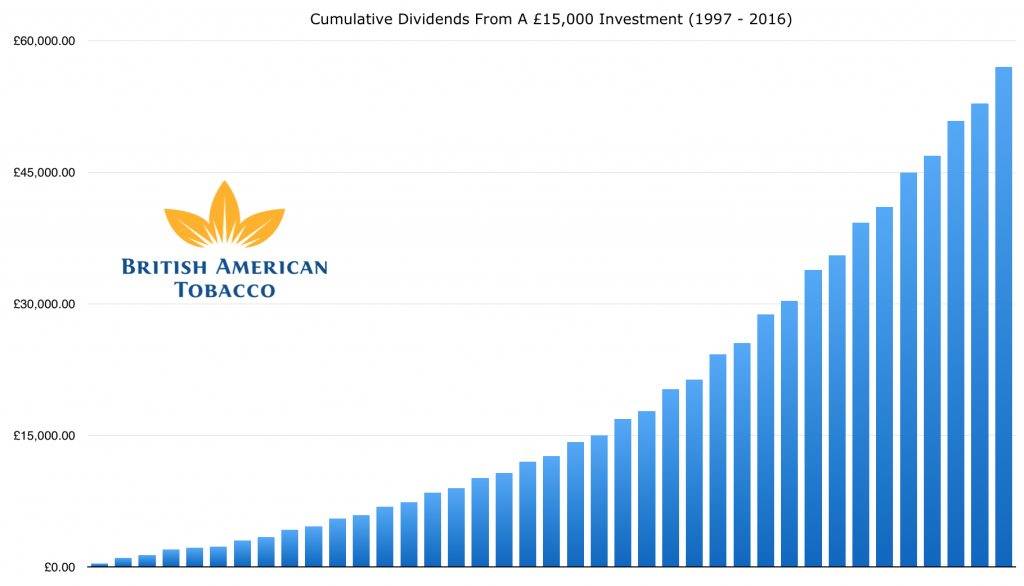

And this is simply looking at the equity prices. Take a look at the dividends:

Hated? Disgraced? Sounds Good!

Tobacco was feared, hated, and disgraced. And yet tobacco stocks have been one of the greatest investments over the last 20 years.

Let’s list all the things that these guys had going against them:

- An industry in decline

- Widely considered to be murderous thugs

- Banned from advertising via many traditional media channels

- Fined by regulators

- Enjoying a blizzard of litigation

- No innovation in the industry

Take another look at those charts.

Not only did big tobacco have all of the above going for it. This all took place while folks were living through a century of some of the greatest technological innovation, scientific advancement, and “exciting” and “new” industries ever to have graced this ball of dirt.

And yet no industry did better than cigarettes. Crazy, heh?

Here’s the thing with tobacco. It’s not about innovation. You grow the stuff, package it into those little cancer sticks, and then flog it.

Sure, the logistics have gotten better, maybe Joey in the tech department on-boarded some inventory management software that improved efficiencies by 4.3% across supply chains. And Suzy in HR (who’s got a thing for Joey) figured out how to better deal with hiring policies, and now they’re no longer hiring so many brain-dead dolts, thus shaving half a point from the entire operating expenses across the organisation.

Maybe some of that happened, but if we’re being honest, not a lot has changed.

What they are is boring and sustainable. And THAT is what makes them spectacular investments. Well, that and the compounding of the dividends over time.

Today’s Equivalent

Tell me, what’s more hated today than the industries that are ostensibly behind global warming climate change?

Of course, it’s not just the halfwits like that Cortez woman who wants to bring America to its knees by reversing the progress of the last century.

Because the flip side to this is that there’s no shortage of parasites “entrepreneurs” who’ve used the narrative to get filthy rich save humanity.

Still, we shouldn’t pick on Elon. He’s only following a path well worn before him.

Enter: Energy

Energy is the anti-Christ.

Take a look at oil stocks. We’ll use the oil services index as a broad proxy.

Now, let’s do some back of the napkin math.

The world currently gobbles about 100 million barrels of oil a day. And due to decline rates, if no new oil is found to add to reserves, then the world will only be able to pump 20 million barrels per day by 2050.

So we ask ourselves the question, what will the demand be by 2050?

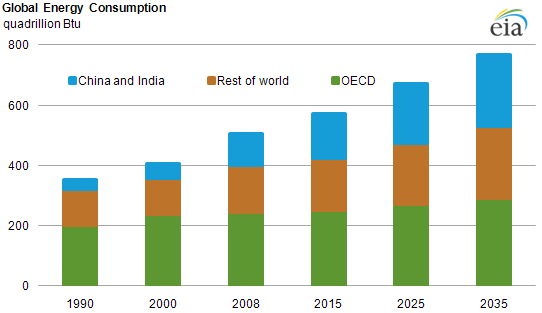

Well, here’s the EIA’s best guess as to global energy consumption through 2035.

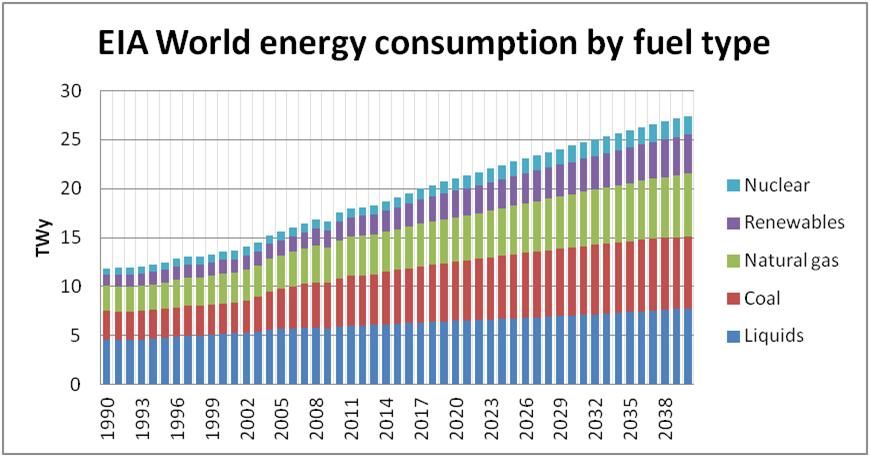

And it’s not all coming from rainbow farts.

Even in the most “optimistic” analysis, I’ve researched, the demand curve goes only one way.

What we do know is that even though we’ve had renewables take up an increasing share of the global energy pie, this is a pie that’s been getting bigger with net oil demand itself growing.

But let’s pretend it wasn’t.

Let’s pretend that we only consume 100 million barrels per day by 2050, which is where we’re at today. Optimistic and almost certainly unrealistic. But hey, let’s play the game.

Playing Catch Up

The Saudis currently produce about 12 million barrels per day. The Permian produces about 4.2 million barrels per day, and Russia produces about 11 million barrels per day. That’s the bulk of it.

So the world is going to have to find about 80 million barrels per day just to maintain current reserve levels by 2050. That, my friends, is “humassive.”

We’re talking fields big enough to produce 6x Saudi, 9x Russia, or 20x the Permian.

And capital investment into the industry?

Pffft! Let me put it this way. For every barrel of oil found today, we’re consuming 4.

So we’ve an industry that survives by replacing reserves, having thrown in the towel on doing so. And at the same time, the market sitting back, saying, “It’s ok, we’re going to power the world with renewables.”

Except the numbers don’t stack no matter how you look at it.

Burning through inventory without replacing it isn’t very different than burning through capital without replacing it. And that looks awfully like the business model used by Tesla, Uber, WeWork, or Softbank… with two exceptions.

- None of those companies will be around come 2050, and I’m willing to bet that we’ll still be gobbling through the oil in 2050.

- Investors are about as interested in oil stocks as they were in cigarette stocks in the late ’90s.

- Look carefully, and you’ll find that many oil stocks pay a healthy dividend just like the cigarette stocks mentioned above.

Sticking with energy, here’s the uranium sector…

I’m sorry, my bad. Let me try again.

And if you looked at how the executives at energy companies are acting, you’d be inclined to think that yes, we’re going to get rid of fossil fuels and so there’s no need for capital investment into the sector.

And really, I don’t blame them.

They’ve a wife, two and a half kids, and a dog called Rover, all of whom need feeding. If they jumped up and down and began investing shareholder capital into, say, some offshore rigs, you know what would happen? The board would promptly have them removed, their wife would leave with the pool boy, and they’ll be seeing their kids under a weird schedule called “visitation rights.”

And so here we are.

You know what else the energy sector has “going for it”?

Market participants today are overwhelmingly bullish on deflation and bearish on inflation. Just look at the sovereign bond market yields.

This is a gig where you make money by paying to invest your money with bankrupt governments in the hope that someone further down the track will be happy to be charged even more than you did for the privilege to invest even more money in that same government.

See, perfectly reasonable?

The flip side to having markets anticipating deflation until the cows come home is that we have inflation protection at the absolute cheapest levels we’ve ever seen.

And here’s a little something that I know I’ll get hate mail from the gold bugs for, but run the numbers and you’ll see that it’s as true as the night is dark.

Energy is THE best performing sector in any inflationary period.

It’s strange.

Investors universally accept it when someone at a cocktail party says “buy low, sell high.”

They nod their heads in agreement when reading Rockefeller’s statement “buy when blood is running in the streets.”

And then, like a bloody moth to a flame, they ignore all that and steer themselves directly into the flame ignoring the blood welling in pools on the street.

-Chris

“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” — John D Rockefeller