While scenes of frowning people wearing face masks continue to capture and maintain the limelight there have been some very important shifts gaining momentum in the global political landscape. Wuhan Zombie flu I mean COVID-19 and the economic knock on effects of the virus will likely only exacerbate and accelerate them.

Let me explain.

The post world war 2 era is changing

After the second world war it was the Americans who were left standing tall, while their allies (Brits in particular who importantly had ruled the globe prior) were hobbled, and upon their return home found mostly a lot of rubble, and so they set about rebuilding their respective countries from shrapnel and duct tape. Which left the global playing field wide open. Something the Americans took full advantage of. What’s more the Americans also had a formidable navy. The largest, and one they’d grow aggressively over the coming decades.

With a large navy on the one hand and those bloody commies posing a threat on the other, they set about crafting a new world order.

The deal they negotiated with much of the rest of the world was by and large this: Stand with us against those Russian commies and their filthy ilk, and we’ll use this badass navy of ours to ensure your safety. The allies, what with their severely rubbished militaries gladly agreed. Economically it laid the groundwork for trade agreements between these allies and the United States, and equally as importantly between the allies themselves. NATO was the most obvious agreement of this sort, which it can be argued laid the groundwork for the European Union. I touched on this topic in part 1 of an article I wrote on Nato last year where I stated:

The important takeaway is that after the second world war this US led alliance expanded, and then expanded some more eventually including most of what we know of as Europe today, East Asia and even China itself. It is one very good reason that globalisation spread like gonorrhea at a 60’s love festival. The ability to trade with fewer risks (Pirates found the US Navy to be a formidable force) and the ability to use and leverage foreign goods, services and capital was very important in three major ways:

- It kept the peace. There have been good reasons for countries that have been tied into this globalised system NOT to go to war with each other, even where deep long lasting resentments may otherwise have led to confrontation. Japan and South Korea are just one example.

- It helped create economic growth for those involved. And no it wasn’t perfect so please don’t send me your stories about US corporates raping the third world. I get it. That doesn’t take away from the overall setup created and wealth generated across the board which is undeniable.

- It created deflation in goods and services as hundreds of millions were brought into the global economy.

Like it or not the US led global order created a period of stability that even the British Empire before it never managed to do.

All of the above contributed to a broadly deflationary environment for both goods and many services, it’s why your “local” ISP call centre sits in Manila or Mumbai, and it’s why your T-shirt is made in Bangladesh, your jeans in Indonesia, your shoes in Vietnam, and your iPhone in China. Couple that with technological advancements and the fact that those technological advancements, could and did move across borders meant that deflation of manufactured goods and services accelerated. As millions of people from emerging markets joined this global system they were dragged out of poverty with the increase in trade creating one of the most prosperous periods in history.

The pullout

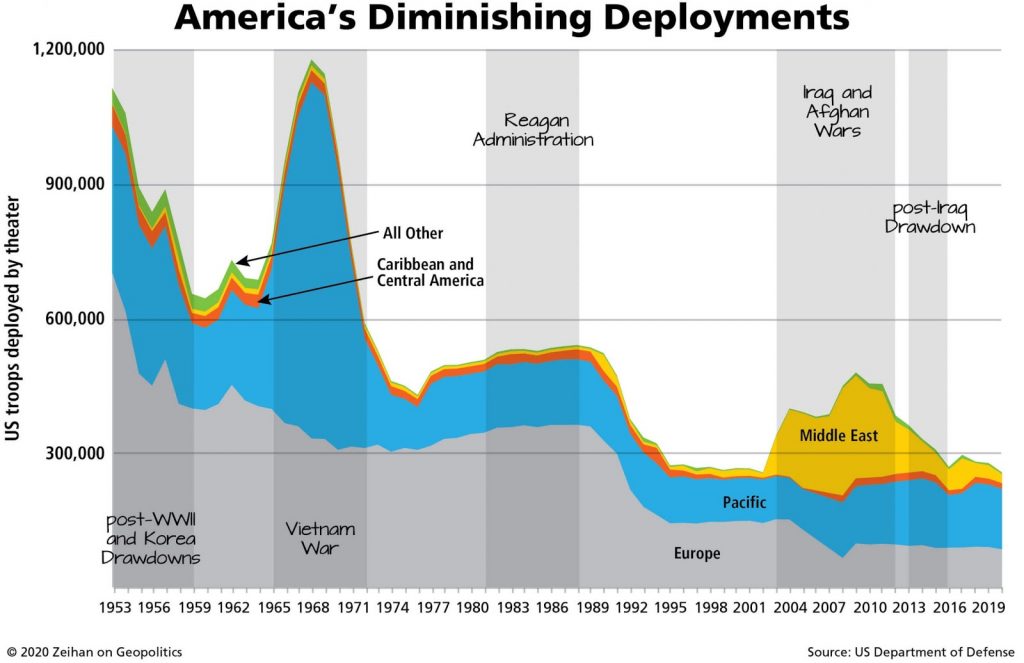

Fast forward to today and if you’ve been paying attention you’ll know by now that the US has been pulling out of this global watchdog role.

Why pay for a monstrous military to police the world’s oceans providing safe passage to “allies” who were originally there to “combat Ivan and his sickle” when Ivan no longer poses the threat he once did?

This pull back has been taking place for decades now. Trump was the first US president to openly acknowledge and put a name to it. And please don’t send me your pro-Trump or anti-Trump objections. I don’t care. Remember I’m not American. I care about politics ONLY insofar as it affects investment markets. That’s it. And the US pulling out of the global watchdog role has been going on at scale ever since the late 80’s. What’s more it’s not about to reverse. Geopolitical analyst Peter Zeihan produced this excellent chart of this.

More reasons to leave

Before we look at reasons to leave let’s look at one reason the US has stayed.

Oil. US oil dependence meant that hanging out in the sand to make sure that oil got to where it needed to (the US) was a pretty darn good reason to have troops on the ground and battleships at the ready.

That was until shale came along.

And as I stated in “Fed Policy, Chaos Theory, Shale and Dangerous Miscalculations in the Middle-East” earlier this year

‘Without the energy independence the US believes it has, they would never have pulled forces out of the Middle East…at least not to the extent it has. No country has national security without energy security. And now the US believes it has that.”

And as is typical with the man. Trump tweeted US foreign policy objectives.

Except we believe this to be like that time when I was 21 and after half a dozen Heinekins attempted a handstand. In other words a giant mistake (hint. Shale is a pushup bra. Read more here)

Ok..onward…

Inflation vs deflation

So we know that globalization contributed greatly towards a deflationary environment for goods and services but for folks in my industry…they tend to think almost exclusively in terms of …well finance. Let’s look at how they define deflation

“Deflation is an decrease in money supply and credit, with credit marked to market“.

Which is sorta true..or can be true but like so many things that are interrelated can also lead one astray. A story to illustrate:

When the Asian bird flu hit in 2017 folks acted accordingly by shunning chicken. The demand for chicken collapsed throughout Asia. But it wasn’t a one-sided affair. Supply collapsed right along with it as chicken farmers went about killing all their livestock for fear of either getting infected by the virus or from passing it on. Demand collapsed faster than supply…it literally went to zero and so we had massive deflation in chicken prices.

While all that was going on the price of pork rocketed. Why? Simple all those chicken eaters chose pork instead, except farmers couldn’t increase the supply of pork fast enough to keep up with demand. So we had “inflation” in pork prices and deflation in chicken prices. Most importantly none of this had very much to do with monetary policy. Indeed we’d have had the same environment in a broadly inflationary macro environment just as much as we’d have had in a broadly deflationary macro environment. The same thing just happened with swine flu. As reported by Reuters

BEIJING (Reuters) – An outbreak of African swine fever in China is proving to be a windfall for chicken farmers, helping drive up prices of the country’s second-most popular meat to two-and-a-half year highs.

Side note: I reckon you could sit in Asia with your nose to the ground and simply trade chicken and pork futures against one another and regularly make a fortune.

This is I believe one risk that finance experts have. They’ve enjoyed a period of time which has broadly been deflationary as a consequence of globalisation. And attributing that pricing environment to many things, some of which may be correct but not allowing for ALL of the picture to be seen. And it’s that “other” part that I’d argue is actually the very foundation upon which a globalised and broadly deflationary world has been built. And it is that “other” part that is coming apart at the seams. The risks posed to investors portfolio’s is potentially huge.

It has been one of the key geopolitical topics I’ve been writing about for the last 2 years.

Here’s the risk

As the US military retraces from policing the world’s supply chains (basically shipping) the risks and thus costs will increase. We’ll see what are already dangerous trade routes become more lawless. This will increase the costs of goods moved about the world. Who for example takes charge of the straits of Malacca, and the Suez?

What we’re heading for is an increase in insurance costs, and increase in transportation costs and all of this will have the effect of decreasing supply…at least until prices adjust upwards to compensate businesses for the increased costs. That my friends is stagflation. You know what else?

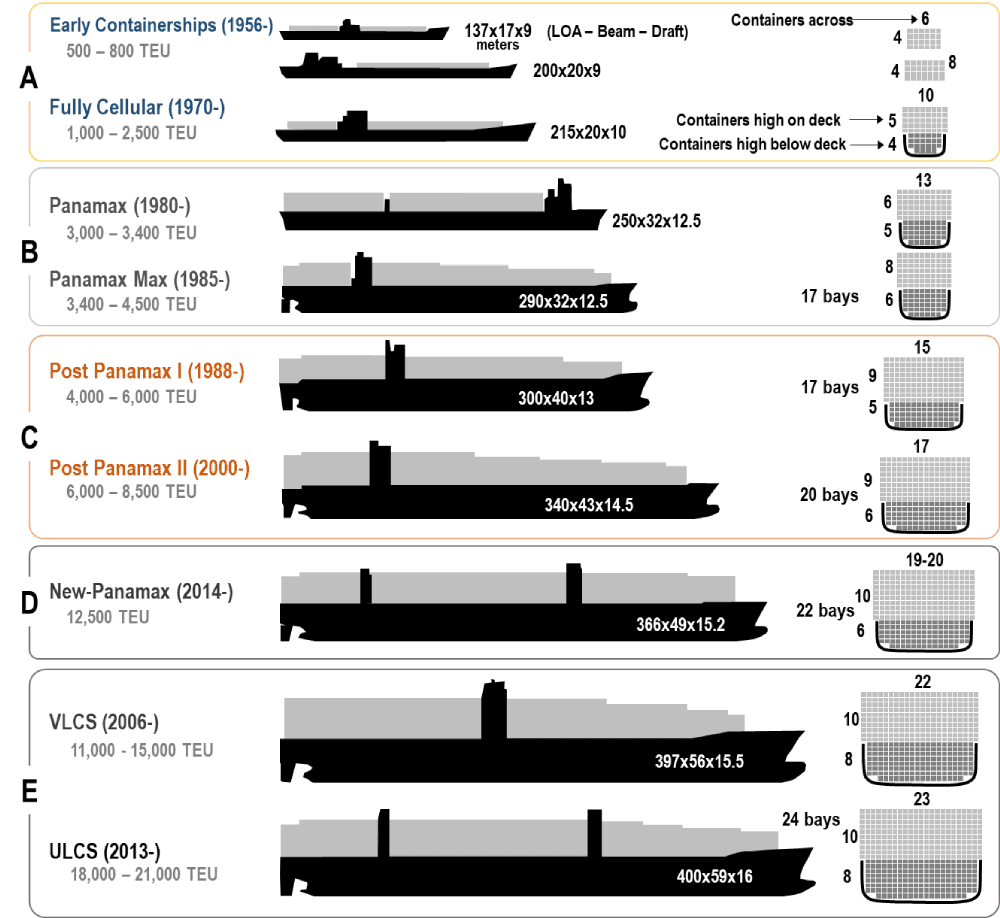

Take a look at this beast.

Nimble it is not. Which was fine when the world’s largest and most powerful navy ever made sure that it could trundle its way across the oceans unimpeded. That too was deflationary. The scale of economies presented by going from a 500 TEU ship to a 21,000 TEU ship is hummasive.

The ever increasing size of ships was a direct result of a global supply chain underpinned by the security of the US navy.

Today as we stare down the nose of a world that’s increasingly more tenuous globally, a world where supply chains are coming under pressure, and a world where financing something such as shipping is “so yesterday”. Which is hilarious. Shipping is a cyclical market like most. There’s nothing “unique to it. No magic. And it’s been through one of the most devastating bear markets, which it rightfully deserved (too much supply brought on in last cycle top) and here we sit.

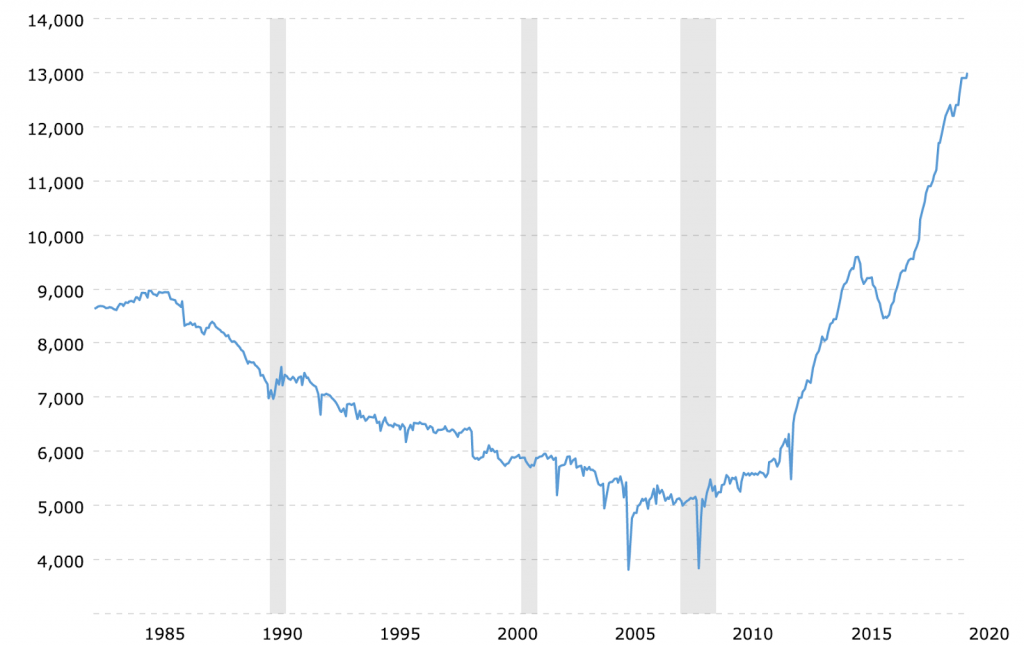

Nobody gives an isht about shipping. Take a look

Here’s Scorpio tankers

And lest you think I’m cherry picking…

Here’s Valaris

Think of it like this. Take away that security of the US navy and things change. And you know what? It’s likely not a deflationary outcome.

And don’t get me started, I’ve not even touched on the political outcome of this new world. It will involve new alliances being made, old alliances being dissolved in the formaldehyde of necessity and almost certainly a reversal of the seemingly never ending,unstoppable force of globalisation. That my friends is a bet worth making. A bet on de-globalisation which I dare say is NOT a bet on deflation up the wahzoo…which is EXACTLY what markets are pricing right now.

Enter Coronavirus

In my previous article “When Trust Evaporates” I compared what the world looked like when SARS came visiting with today:

If you don’t think that supply chains are going to be rethought by industries then you’ve not been paying attention. It will and with it will come increased costs and likely reduced supply.

And then of course we have central banks who are about to go full retard with fiscal stimulus (watch)…which is NOT going to have the same consequences as monetary.

Oy vey

This de-globalisation will reveal weaknesses in many countries and they’ll scramble to patch those weaknesses. Some countries rely more heavily on those shipping routes being protected and patrolled (Singapore for eg) than others. Some rely heavily on others for their energy needs (Japan for eg) and some rely heavily on others to feed their people (China). In a globally interconnected world that for the last few decades has known nothing but increased globalisation, increased “just-in-time” supply chains, what’s coming is setting up for absolutely THE most asymmetric investments I’ve ever seen in my professional career.

It’s not easy but I am attempting to control my excitement.

-Chris