Let me explain…

It was late 90’s and I, wet behind the ears, had subscribed to a financial newsletter. It was kinda a big deal for me as I was just a kid, but more importantly broke, figuring out how to feed and house myself and pay for my uni fees.

It doesn’t matter whose newsletter it was as it’s unimportant. The key was that if I’d had money to invest at the time, I’d have invested it. But I didn’t so I was merely a bystander. Curious, broke, and learning.

The newsletter was pumping promoting resources, and gold, in particular. I built a mock portfolio and tracked it like a 5-year old tracks days till Santa comes.

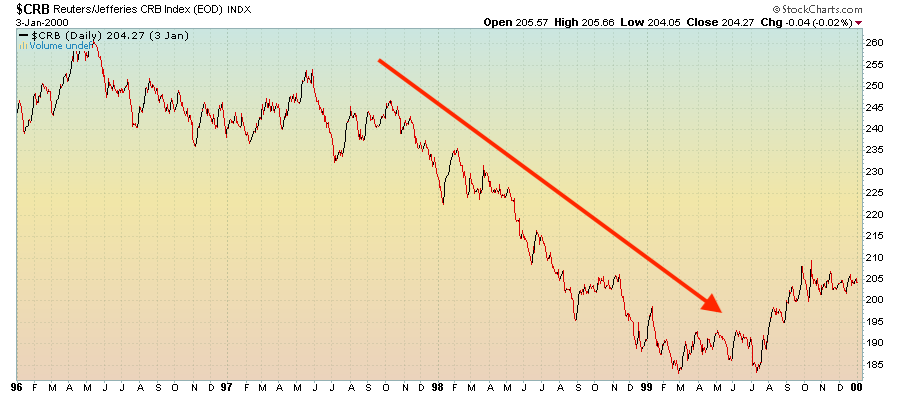

Over the course of the next few years I’d read this monthly letter, often late at night, build my pretend portfolio, and watch it like a newborn baby. Over about 3 years my newborn did nothing but isht and vomit on me, which is to say, lose money. Quite a lot, actually. Gladly it was just numbers on a spreadsheet. Lucky!

And while I ploughed pretend money into the commodity sector, only to see it whittle away, the story never changed.

We were always on the cusp of something HUMMASSIVE.

God himself was going to come down and make it happen. And if not him, Pope Francis would come lend a hand.

In fact, I figured (and still do) that for some it’s a bit like going to church. On any given day something ishty happens to us and the men of the cloth will tell us it’s God’s will. And then on the other hand, when your gorgeous sexy wife wakes you in the middle of the night for a bit of… oh never mind… let’s just say good things happen. Well, then you’re blessed… which is to say that investing in an idea becomes a religion. And investing shouldn’t be a religious activity.

I knew this because I was having a lot of “God’s will” and it sucked. The red ink on my paper portfolio said so.

If I’d had actual money on the line, no doubt I’d have been more than miffed. But instead I was simply intrigued. What were these guys missing?

Macro. I just didn’t yet know it.

And it was around this time that I got a job in the City at Lehman which, aside from introducing me a treasure trove of institutional research, actually paid me pretty well.

As for the research… Well, I had everything from the fixed income guys to equities, derivatives, and a means to learn about emerging markets, capital flows, and much more all right there in front of me.

Curiously, nobody seemed to take advantage of it. You know what they say about how we bipeds value free? We don’t!

I was odd that way because I did.

Later I moved to a couple of other firms ending up at JPM but access to institutional research was always there, and I guzzled it up like Charlie Sheen would cocaine while on a weekend bender in Vegas.

The original newsletter now became interesting to me, not for the recommendations but purely as a tool for me to analyse what narratives existed in the marketplace. And so I began reading a helluva lot of psychology books. Jung, Dostoevsky, Nietzsche, and dozens you’ll find on any study list of psych grads.

That helped me explain to myself how it is we bipeds can so easily delude ourselves… and keep doing so, which in large part explains what Keynes was getting at.

Piecing together the multiple research reports completely changed the way I viewed everything. Markets, politics, war, peace.

They’re all the manifestations of billions of humans pushing and pulling against one another, and those humans push or pull, dependent on their collective psychology. And as Soros points out in The Alchemy of Finance, this can take the form of a reflexive process which feeds on itself and at times can alter the underlying fundamentals. So we need to watch out for such things.

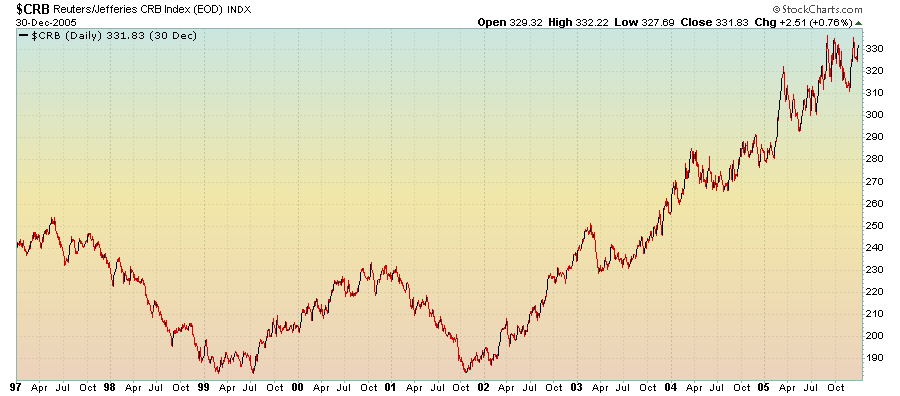

And so, not unsurprisingly, that newsletter kept up the same narrative (and still does to this day). But between 1999 and 2002, the commodity markets hammered out a bottom and then took off.

Here’s the CRB from 1998 through to late 2005:

And here’s gold over the same period.

Now, as you can imagine, the recommendations of this newsletter did well over this time.

I, on the other hand, had snagged myself some super useful contacts directly in the mining and resource industry and looked at the world from a macro view where commodities either fell into favour… or out of favour. THAT began to drive decision-making, not the other way around.

I began to realise that the best fund managers, some of whom I had the pleasure of working with, had the foresight to seek out experts in any given sector when it was needed… and only when it was needed. As I mentioned the other day, we need experts:

Experts are very useful. But we need to be careful WHEN to use them and rely on them only for what we need. Because, let’s face it, without their knowledge we’re worse off.

That was a good few years ago now. And here we sit over a decade later and signs are there for us once again. Much of what we discuss in these little missives.

In conclusion, here are 4 of heuristics I think worthwhile… at least with respect to any sector. Doesn’t have to apply just to commodities.

- Is sentiment euphoric, pessimistic, or somewhere in between?

- If commodities: facts, supply, demand. Econ 101, which you’d think would be obvious. But one look at history tells you that just ain’t so.

- What, if any, major shifts are taking place? This can be technology driven, political in nature, though often they affect one another. What knock on effects will there be? Think it through. Diligence the affected sectors. Then go back and be a devil’s advocate. Find people who disagree with you. Why? Reassess. Re-analyse. Never stop.

- Bankruptcies. The more the better. Sector wide, not company specific. That doesn’t count. Either the industry or sector is going away (like the horse and buggy) or something else is happening. Gold lives here.

And when you’re going through the process, you’ll sometimes find something that’s really great only to dig deeper and realise that executing on the idea diminishes favourable risk/return dynamics. Bugger! Major bugger. What then? Ok, well if X happens, what else happens to related sectors/components?

Sometimes the best way to short a sector is simply to go long something else.

[clickToTweet tweet=”Sometimes the best way to short a sector is simply to go long something else.” quote=”Sometimes the best way to short a sector is simply to go long something else.”]

Oh, and lastly… when you’ve found your “gold”, one thing to look out for nearing the top is when our friends, the bankers, begin offering “structured products”, making it super easy for us all to get invested in the hottest sector over the last half decade. For the love of Zeus, don’t be one of them!

Good luck, and thanks for reading.

– Chris

“Predicting rain doesn’t count. Building arks does.” — Warren Buffet