I’ve never been trapped in a fire before and trust me, I have had plenty of opportunity. Yes, I was THAT kid, the one who played with fire. The trick was, and still is to steer clear of the flames, to anticipate what and where. Fire is however notorious for doing what it wants and once its out of control even the best firefighters don’t stand a chance.

Each day that passes we come closer to the arrival of a monetary fire that threatens to dwarf anything in our collective living memories. Watching the Australian bush fires in New South Wales recently made me think of our monetary system. Funny that.

The Australian bush has been burning long before the Brits began exporting their best and brightest to the “lucky country.” Right now the fires are raging. It was inevitable. Like the business cycle nature too abhors excess and steps in to correct it, clear the dead wood and prepare for rebirth.

What is often forgotten is that nature has evolved to rely on bush-fires as a means of reproduction and new “birth.” Fires are an integral part of the ecology of the planet’s surface. Humans can try and prevent these inevitable fires by “controlled burnings”, clearing out much of the dead underbrush, but it’s not foolproof.

The fires now raging in New South Whales are in part due to an extensive build up of dry brush which is likely overdue a good burning. The longer the dry bush remains unburned, and the more that accumulates the greater the risk of an inevitable fire. The result will be much greater than that which would have preceded it should a fire have taken place sooner. This is a basic, easy to understand law of nature.

Financial markets are NO different. The dry brush of excessive credit, monetary stimulus, rampant fraud, and government interference, which has caused the largest sovereign bond bubble the world has ever seen, has not been cleared or burned to allow for regeneration. In contrast we’ve actually been ADDING to it, doing the exact opposite of the “controlled burn.”

The market, like nature, has attempted to correct these excesses many times, only to be met with central bankers fire hoses spraying liquidity at ever increasing volumes and velocity. As the outbreaks of financial fires increase so too do the tools and technologies used by the central bankers. This postponement of the inevitable leads to massive mis-allocation of capital.

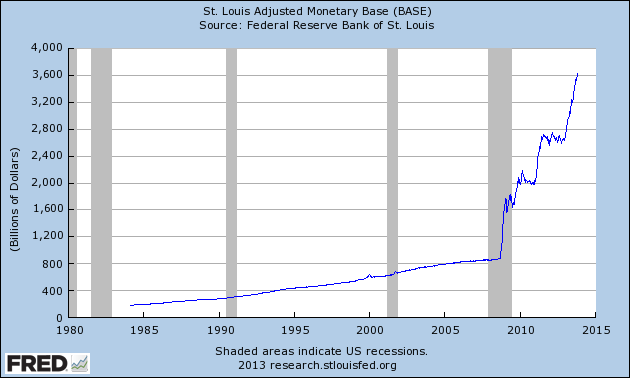

The above graph shows all the dead wood build-up. Quite a bonfire awaits us.

It is possible that the fires will continue to be contained, central bankers promise that this is indeed the case. We DO know however that it is not possible to contain it forever. This time is not different…or is it?

Let’s compare what’s different this time around in Australia and the world’s monetary system?

- The bush fires have invaded the suburbs. So too have the monetary bush fires directly impacted most western “suburbs”.

- The “tools” available to the firefighters are more advanced than at any time in human history. The tools that are at the disposal of central bankers are more “advanced” than at any time in human history.

What’s happening in New South Wales right now provides us with an instruction manual for how to proceed forward in a world of monetary madness. We need to BURN THE UNDERBRUSH. Simply hoping that the fires will fail to erupt simply defies history and mathematics. “Hope and Change” be damned.

The likely outcome is that we’re heading deep into asset confiscation mode. Government meddling will fail, it always has and it always will. The playbook from throughout history tells us that governments will steal anything and everything from the most productive before they default.

This happens either overtly (taxation, fines, penalties, asset seizure) or covertly via destruction of currencies (quantitative easing). Everything not nailed down is up for grabs. Don’t say you weren’t warned! If you need an example look at what’s happening in France. Hollande is insane, but he’s not unique.

As such, aside from structuring myself in order to protect what I have, which I hope I’ve done, ensuring that what I invest in going forward is structured properly is just as important. It makes no sense to invest intelligently only to have some thug steal the proceeds because I failed to set myself up to deal with the inevitability just mentioned.

So, how are Mark and I choosing to allocate our capital:

- Investing in private equity. We like businesses where we can get to know and deal directly with CEO’s and management, and where we are not at the whim of black box trading systems, plunge protection teams and assorted other “firefighters”. This is by far our most overweighted asset class. If you want to know more about how we do this, drop us a line.

- Trading the volatility created by these madmen. Our friend and colleague Brad Thomas, the new editor of our Trade Alert service, “The Capex Options Alert” is our guru in this area. You can get to know Brad a bit and sign up for this complimentary service for a limited time HERE.

- Continuing to buy and store physical precious metals. This just seems a long-term no-brainer.

- Investing in agriculture. A guy’s gotta eat, right!

- Select real estate. Maybe some premium scorched earth in New South Wales, Australia. After all, the risk of a devastating fire is now significantly reduced! But seriously, a nice piece of land where you can escape the madness and “grow your own” if need be.

The above is neither a recommendation nor an endorsement of any particular asset class or strategy. Obviously everyone’s situation is different, and we don’t know yours. Some could probably do just fine with a couple hunting rifles, some ammo and a nice piece of land to grow food and run a few livestock. Albeit that’s not going to work for urban dwellers.

The bottom line is that we are just encouraging you to consider how to prepare for a monetary firestorm. Do it your own way, use common sense, but just don’t be the dupe who ignores the obvious.

– Chris

“So just as I want pilots on the planes that I fly, when it comes to monetary policy, I want to think that there is someone with sound judgement at the controls.” – Martin Feldstein