EXXON… OR ZOOM?

EXXON… OR ZOOM?

Back in November 2020 we published an issue of Insider Weekly where we made our case for Exxon Mobil:

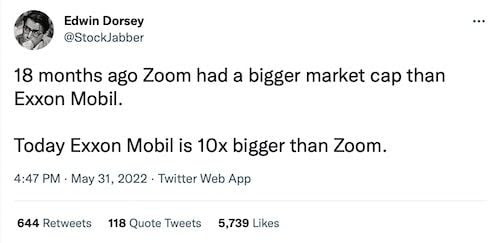

It’s trading at the same level it was some 22 years ago, booted from the Dow, seemingly uninvestable (try to convince a pension fund board of trustees to buy Exxon), and sitting on the same market cap as Zoom. Absolutely “nucking futs!”

Our head trader, Brad McFadden, chimed in with a story to illustrate the point:

When I was a lot younger, actually it was back in 1998 when I was 28-year old, I was a portfolio manager at a private bank in South Africa. I overheard one of my colleagues (who was 50 years at the time) buying a stock called Richemont for his children’s trust fund. I was curious. Why buy Richemont when you could buy a company like Dimension Data — a high flying IT company that everyone in South Africa was raving about, where virtually no one would question its fantastic long-term growth prospects, and its management had reached “rock star” status?

His reply? 20 years from now Richemont will still be around but Dimension Data probably won’t be.

Well, he was right. Richemont is still around. And Dimension Data? Well, in early 1998 I recall it getting close to ZAR70. By the time I left South Africa in 2007 it was trading for less than ZAR1.00 and eventually it was bought out by NTT at ZAR 10 but I think that was after a 20:1 stock consolidation (not even a shadow of its former self). He foresaw everything, except the 3000% growth in Richemont. I wonder if his children still own it?

Well, here I am 22 years later in the same situation as my former colleague (50 years old) and looking at investing money into a trust fund for my kids where they will only be able to access it in 20 years from now. Do I buy Exxon or Zoom? For me it’s a no brainer. But I am curious, how much of that previous experience is influencing my decisions? I guess we are the product of our past experiences.

You can probably guess where we’re going with this…

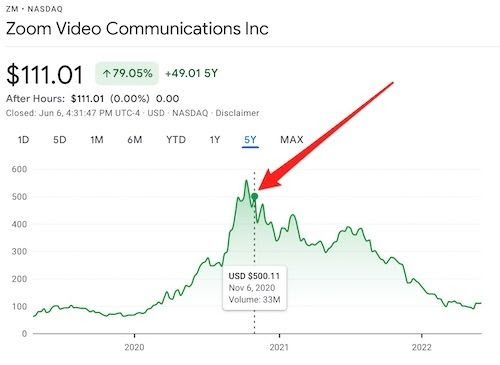

Zoom is down 78% since we made that comparison…

And Exxon? That crusty old bugger is up 200%.

It’s exactly why we choose to focus on what’s expensive (and popular) here at Capitalist Exploits HQ and instead gravitate towards what’s cheap (and hated). If you have a bit of patience, it tends to work spectacularly well.

ARKK: TIME TO GET GREEDY?

ARKK: TIME TO GET GREEDY?

Moving on to the things that don’t work as well (not as they used to, anyway)…

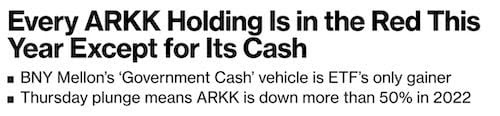

A number of clients asked for our thoughts on the stocks that make up Cathie Wood’s ETF portfolios. They are down significantly, so would it make sense to look there for new opportunities?

Just like Zoom, many of them are down about 70% from the top. Actually, considering that Tesla has made up some 15% of her portfolio and it is “only” down 40% from its 2021 high, the average stock held by ARKK is probably down about 80% from its highs.

On the surface, it seems like a fertile hunting ground. But once you look under the hood (or bonnet for our English readers), not so much.

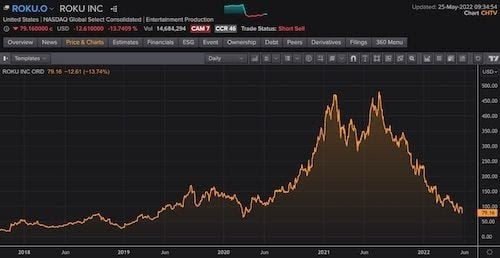

Let’s take Roku as an example. It’s one of ARKK’s bigger holdings.

Roku is still sitting on a P/E of 80x and ROE of 5%. This valuation implies stunningly huge growth over the next 10 years and a very high ROE to justify paying this valuation. Ditto with many other holdings like Block (formerly Square).

We think ARKK has to fall another 50% at a minimum before we start sniffing through the wreckage (and when we say “sniffing,” that is all). No doubt Cathie Wood has invested in some great companies, but the valuations being placed on them were (and still are) outrageous.

RIGHT ON CUE

RIGHT ON CUE

And it’s not just Cathie Wood’s ARKK. Last week we highlighted something our buddy Harris “Kuppy” Kupperman pointed out recently.

Namely, how most hedge funds can’t afford to screw up for three quarters in a row without having investors pull out their money. And when that happens, hedge funds will have to sell. That selling then begets more selling. And on and on… until everyone is exhausted.

Earlier today, an interesting story in the Wall Street Journal caught our eye:

Tiger Global Management rode the tech boom like no other investment firm. It was funding more startups than any other U.S. investor when the market peaked last year, and had tens of billions of dollars from pensions, endowments and rich clients riding on some of Silicon Valley’s hottest stocks.

It worked spectacularly well for many years… until now:

Tiger said in a note to investors last week that its hedge fund, which managed $23 billion at the end of 2021, was down 52% this year. That is one of the largest-ever losses by a hedge fund. Its other large stock fund—a long-only fund that managed $11 billion at the end of 2021 and doesn’t short stocks—has lost 61.7%.

And right on cue…

The article goes on to explain:

Hedge funds globally are bracing for nearly $20 billion of investor redemptions for the rest of 2022, even after seeing a net inflow in the first quarter, according to a report from Citco Group Ltd.

And also this:

Only 40% of hedge funds globally made money in the first quarter, compared with 61% in the previous three months, Citco said.

Given how things are moving in the broader market, we don’t think the selling is over. Rather, our hunch is we’re in the “return to normal” phase, which is likely a bull trap.

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

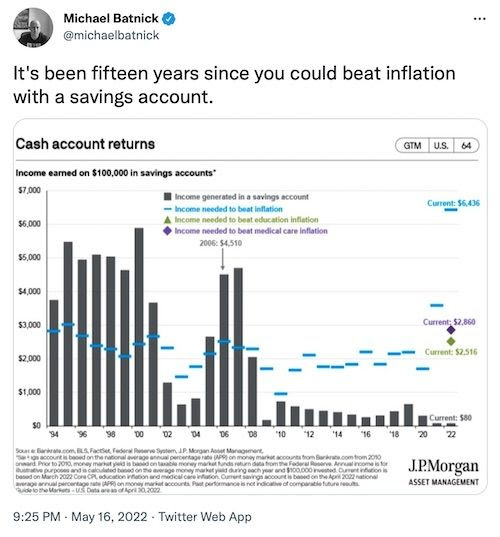

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

This week, here’s Insider member Rhud with a fascinating inflationary vignette:

A relative of mine is the lead superintendent for 8 & 9 figure construction projects. I was talking to him about work at a family gathering. Commodity prices are so volatile right now that bids for “red steel” are only good for 24 hours. Wow. I can’t imagine trying to build anything 8 figures and only have 24 hours to accept a bid to lock in pricing.

And Elliot shared this sobering reminder:

Ah, those good old days!

DON’T WORRY, OUR MERCH HAS GOT YOU COVERED

DON’T WORRY, OUR MERCH HAS GOT YOU COVERED

…with a 100-trillion-dollar-bill shirt.

Have a great week!