Oh, boy! Crypto is (once again) moving with the volatility of the British pound.

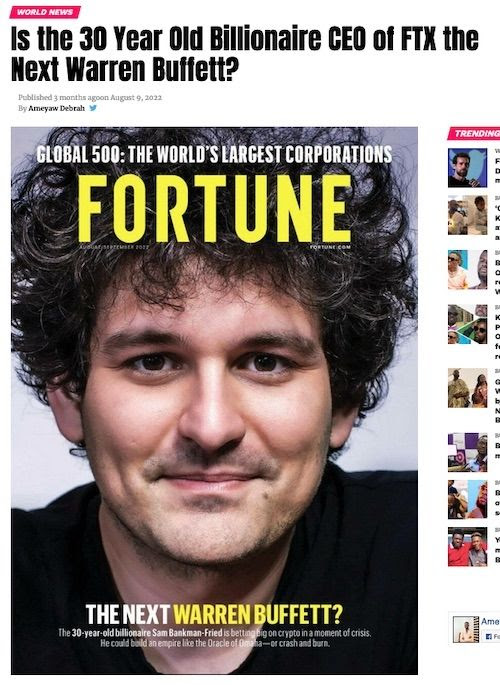

By now, you have probably heard of the wipeout of FTX and their founder Sam Bankman-Fried.

In case the guy’s name wasn’t enough reason to give you pause (bankman fried?), Fortune tried to warn you back in August.

And guess who else got fried as FTX collapsed? The Ontario Teachers Pension Plan. Yes, really! Turns out they invested in FTX earlier this year at a — get this — $32 billion valuation.

Oops, sorry Grandma! Call us old fashioned, but we thought pension funds were meant to be conservative.

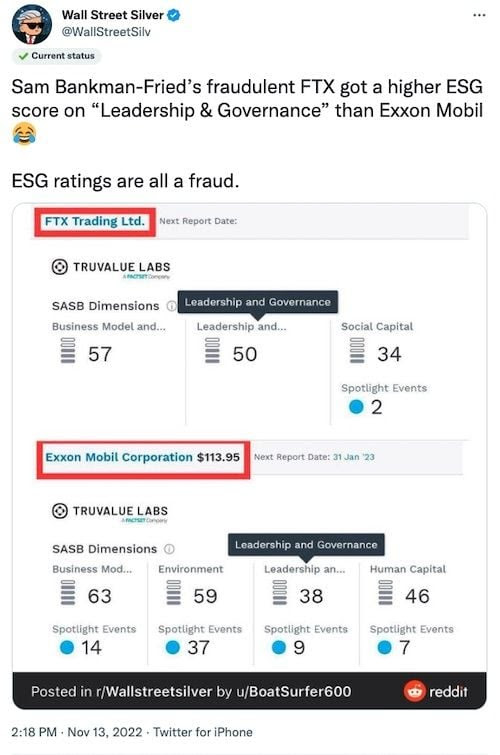

We live in a clown world where the empty suits that run these things are more concerned with ensuring they don’t get cancelled for buying something that’s deemed “ESG unfriendly.” For example, these muppets are deathly afraid of coal or oil and gas companies (more on that in a second). Meanwhile, crypto Ponzis clearly must be ESG compliant. And we’re not even exaggerating…

Truly breathtaking!

WHAT $32 BILLION GETS YOU…

WHAT $32 BILLION GETS YOU…

Staying on the topic of FTX and their former $32 billion valuation…

We were chatting about this at Capitalist Exploits HQ, our head trader, Brad, made an interesting comment. It highlights things perfectly:

$32bn could have bought you all the listed offshore oil drillers and OSV [offshore supply vessels] operators — every single one plus a shit load of change! what farken morons!

Yeah, we’ll stick with buying “toxic” energy stocks over here.

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

First up this week, an inflation report from Moldovan member Vitalie that makes CPI numbers in the West look pedestrian:

Official inflation numbers for October in Moldova: year-on-year inflation of 34.62%. Monthly inflation of 2.62%. Year-on-year increases by category:

Food prices increased by 36.23%. Most of all, fruits went up in price – by 68.32%, vegetables – 63.98%, eggs – 63.88% and sugar – 55.91%. Services have risen in price by 52.65%. In particular, utilities increased by 125.86%, transport services by 65.77%, and catering by 27.1%. Non-food products rose in price by 21.78%. Medicines went up the least — by 10.2%, and fuel — by 42.08%.

And some further context from Vitalie:

As far as I know, some prices are frozen by government decrees in Ukraine. Ukraine and Russia were important exporters of food in Moldova, now there’s a lot less of that (hauling anything from Russia by truckloads costs 5x as much now). So yes, the war is having a direct impact on Moldova (we’re probably the second most-affected country after Ukraine in this regard).

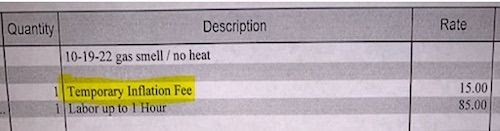

And Insider member 13th Gen shared a curious notice:

Recent invoice I received from a residential HVAC service company (Southeastern US) … the “inflation fee” is about 17% of the total service charge, but the good news is it’s temporary

We can’t help but wonder how permanent that “temporary inflation fee” will be.

UH OH! BAD NEWS FOR OIL & GAS INVESTORS?

UH OH! BAD NEWS FOR OIL & GAS INVESTORS?

Circling back to magazine covers…

The following Barron’s cover got us worried the other day… until we read the article.

Rather than focus on why oil companies are making healthy profits — you know, things such as the collapse in capex, the war on fossil fuels, and the destruction of supply chains, etc. — the geniuses at Barron’s decided to go the other way and shill for the ESG scam.

They’ve taken the view that the big oilers are going hard at the “renewables” angle, building out wind and solar. And not only that — they even have their R&D departments hard at work on converting cow baffs into energy.

In other words, they’re doubling down on the propaganda. Whew! And we got worried for a moment that Barron’s was bullish oil!

In our view, energy — and by extension, energy stocks — remains a coiled spring.

WEEK’S HUMOUR

WEEK’S HUMOUR

Hat tip to @KenEcoComic for this gem!

Wishing you a great week ahead!