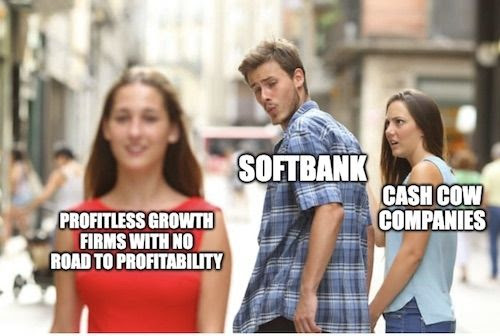

Back in 2019, Chris wrote a lengthy article warning about the house of cards that is Masayoshi San’s Softbank.

You can read Chris’ entire piece here, but here’s an excerpt:

The entire “growth” story, which is to say companies that can continuously grow market share (preferably at a loss) looks to be rolling over.

It’s the classic Ponzi scheme. You always need fresh new capital to pay off the old capital in order for the scheme to continue. When there is no fresh new money, everything reverses and folks quickly realise the value of positive cash flow.

[…]

I think SoftBank is potentially the “Lehman of venture capital”. Not in the “too big to fail” bracket, but in the “bring down the house” bracket.

That has ramifications for many asset classes that we are invested in, so I think it’s worth watching.

It appears we’re now approaching that moment.

This Financial Times article on the state of affairs over at Softbank caught our collective eye a few days ago:

The value of Son’s 17.25 per cent stake in SoftBank’s $56bn second Vision Fund was also wiped out entirely by the end of September, having been valued at $682mn during the previous quarter. His stake in the investment vehicle climbed as high as $2.8bn at the end of 2021, when heady valuations for start-ups enabled SoftBank to sell shares in public listings of portfolio companies such as WeWork and AutoStore.

SoftBank has not yet collected $2.8bn that Son owes in relation to his stake in the fund. Previously, SoftBank netted off the value of his equity from the amount he owed the group, meaning at the end of 2021 this stood at just $4mn.

Son also owes SoftBank $669mn under a similar arrangement on its Latin American fund, which has backed start-ups across the continent, although this is reduced to $252mn when his equity value in the fund is taken into account.

The total amount the Japanese executive owes his company is now at $4.7bn, when losses in the group’s shortlived internal hedge fund SB Northstar are also taken into account, SoftBank confirmed to the FT.

The reason this is worth keeping an eye on is because Softbank IS venture capital. Masayoshi Son’s child represents the industry more than any other single company embodies any industry. And it now appears to be coming unglued.

Now, can “Masa Son” get out of this alive?

Sure, but it’s like making love with a crocodile. It’d be a heck of a story to tell but only because the odds of coming out alive are so slim.

CHECKING IN ON SPACS…

CHECKING IN ON SPACS…

Staying with profitless companies…

It’s been a while since we checked in on what’s left of the SPAC boom. As a refresher, here’s how it all started…

As we told Insider Newsletter readers at the time:

Wild speculation? Euphoria? Too much money floating around? All of the above? When there is too much money, it tends to find itself doing daft things.

Participate, if you will, but be very careful. For us we just gotta make sure we aren’t doing daft things — you know our gig here.

Which brings us to today, as per Dealbook:

The aggregate value of SPAC offerings is down from what it was in 2021. IPOs in the first three quarters of 2022 raised a combined $12.78 billion, compared with $127.27 billion in the same period a year ago, according to Market Intelligence data.

You probably won’t be surprised to learn that the most revolutionary/world-changing/paradigm-shifting SPAC stocks have crashed down hard over the past year or so:

As it happens so many times, when you hear the word boom, it is either close to the top or the top is already in. And SPACs were no different.

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

Insider member Ram shares an insight into the state of Europe’s healthcare industry:

My Health insurance monthly cost in the Netherlands is going up 29.65% from January 2023 (from €90 to €116.69).

If you’re wondering what might be the reason for this steep increase, here’s what the insurance company says:

This is due to rising healthcare costs. This is due to the aging population, but the treatments have also become more expensive. The salaries of healthcare workers have also increased.

And an update from member Sam — just in time for Thanksgiving (for our American readers):

Turkey cold meat at M&S here in Jersey has increased from £2.10 to £3.30 (140 grams) this week! Nothing like a 57% increase in my sandwich bill

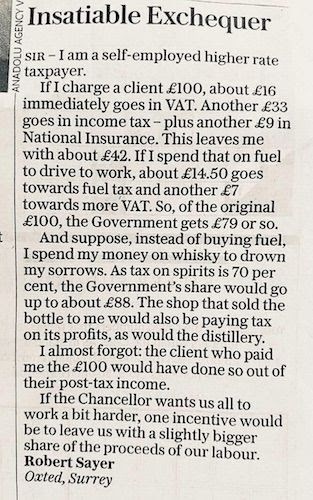

And lastly, member Stefan shared this letter to the editor:

And yet, the pointy shoes try to convince us this man isn’t paying his fair share — whatever that is.

ARE RISING RATES REALLY THE CURE FOR HIGH INFLATION?

ARE RISING RATES REALLY THE CURE FOR HIGH INFLATION?

We are led to believe that raising interest rates will head off inflation.

However, it may not be that simple. Energy (albeit, the cost of it) is life as we know it.

Rising energy prices (oil, coal, natural gas) mean higher electricity prices, food, transportation, and stuff in general (think of plastics and petrochemicals).

It requires huge capital investments to explore, develop, produce oil, coal, and natural gas. Oil and gas projects tend to become less attractive as rates rise. The general negativity towards oil and gas exploration and development certainly doesn’t help matters. The long and short of it is that rising interest rates may well spur inflation higher.

Seems to us that the only realistic way out of this inflationary storm is for a whole lot of cheap energy to appear… and the only way for that to happen is for a significant amount of oil and gas exploration and development capex to occur. And that will only happen if we see oil at levels that encourages capex for an extended period of time.

Hence our long-term bullishness on oil and gas and energy in general.

MERCH HOLIDAY DEADLINES

MERCH HOLIDAY DEADLINES

Christmas is coming, which means time to gift some of our snazzy merch! Last reminder about our holiday deadlines — order by these dates to get it on time:

- United States: December 11

- Europe: December 14

- Everywhere else: November 29

Wishing you a fantastic week ahead!