Unless you’ve been hiding under a rock or meditating in a Buddhist Nepalese mountain retreat nourishing yourself with nothing but water, lettuce (which is just chewy water) and positive thoughts for the last few years, you’ll no doubt have been made aware, whether you like it or not, of the dire problems we all face.

What are these?

If we are to believe the MSM they are:

- Covid Pandemic

- Climate change

- Gender equality

- Stakeholder rights

- Racial equality

Setting aside the first topic, which is at this point now plainly evident to anyone that cares to do some simple math or look at actual mortality rates, a colossal hoax, we can safely categorise the balance into what the corporate world calls “ESG”.

Environmental, Social & Governance.

This idea, like so many ill thought manias of our present day, was first led by over-indebted social sciences majors who derive inner joy from controlling other people.

But it’s not these fanatics that you should worry about.

It is the folks in positions of power… the politicians, CEOs, management boards and trustees, who are too afraid to suggest that the king indeed is stark-bollock-naked.

Leaders these days are like the parents you see that cave to every fleeting whim of their child, terrified of disappointing their little angel (who is in mid-tantrum) and being seen to be a bad parent.

Instead of steering clear of social justice issues, or refraining from providing views on the impossibly complex system of our environment, and focussing instead on… I don’t know, maybe providing goods and services to the world… they go “all in” on any, and every virtue signalling opportunity they come across.

Not because they believe it, but because of what happens if they don’t.

The problem for most, who recognise the inherent cognitive dissonance, is that in even questioning it, they risk facing the wrath of their colleagues, partners, friends, and needing to explain to their husbands or wives why it is they lost their jobs… and so instead of speaking their minds, they mutter and nod their heads passively in agreement.

I get it, their incomes depend on it – at least in the short term.

A bigger problem is that – like any parent who allows their child to become a miniature tyrant – their position depends on more extreme concessions in the long run.

And a bigger problem still – i.e. where all this leads – is dooming themselves and the next generation to the sort of shortages and hardships that previously only existed for them on the History Channel doco’s about the former USSR.

By the time they finally realise this, the loss of their jobs will likely be the least of their worries, because shutting up and continuing down this path is put quite simply… communism.

Wait… Communism?

Yes. Communism.

For many of my fellow colleagues who manage money, this has become a now frequent exercise in appeasing the intolerant minority.

Like paying off the local mob boss for not burning down your shop.

The asymmetry in diverging from the ESG pack – the peer pressure and the ramifications of telling someone espousing this horse shit that it is indeed a load of horse shit – is too powerful a disincentive.

Most don’t care about ESG… trust me… but what are they to do when their institutional LPs come to them with a new “ESG mandate”, drafted up by Janice the red headed she-bitch in compliance, who landed her new role as “diversity officer” after bouncing onto the scene fresh out Berkley with a shiny new social science degree, a complete ticking time bomb in the company that everyone has to placate or get sued by?

(real example there, I’m not just stereotyping)

And so everyone goes along with it, no matter how far the facts diverge from the reality, no matter how compromised their integrity becomes.

Galbraith understood this.

My buddy “the macro tourist” Kevin Muir (worth a follow at https://twitter.com/kevinmuir) reckons we’re in for a monster bubble in this entire ESG shulbit, and I think he’s right.

And he’s sure as hell is no dummy.

Let’s break it down, and then we’ll see why this is setting up for a bull market where few see it, and a geopolitical shift that promises to change the world for the rest of our and our children’s lifetimes.

Heady stuff I know.

ESG is a measure of the environment and social impact of companies.

It began as a “movement” with a haphazard bunch of intolerant folk who, not content to only do with their money as they pleased, began forcing others to do as they say.

It has now reached the stage where in a mad bid to “out-woke” their counterparts, they’re now outlawing any investments into companies that don’t fit some loosely defined criteria.

This is largely by design – loose criteria that is.

It is much easier to simply take down, threaten, and destroy companies that are “bad” by some new vague criteria, than it is to have a clearly defined criteria where everyone knows the rules.

Don’t have a bigender two-spirit half Navajo eighth black blind pansexual woman in a wheelchair on your board? Damn… you’re racist, sexist, sightist and homophobic… a nazi by all accounts… and most definitely don’t meet the ESG requirements.

What on earth were you thinking?

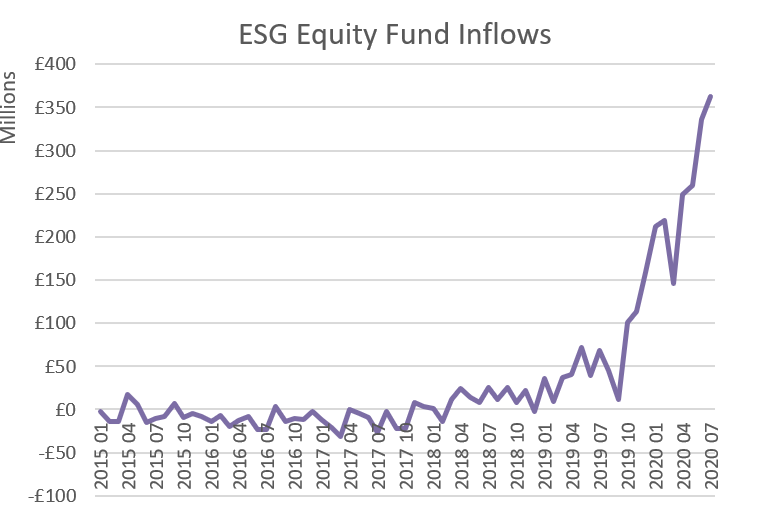

But as absurd as this is, capital has been pouring into anything “woke”.

Now if I was in charge I’d call a meeting and, while brandishing an AK47, I’d explain with spittle flying that nobody is going to be allowed to tell others what they’re allowed to do with their money.

But I’m not in charge. Morons are.

The good news is that Communism is coming and the shortages are going to be following close behind.

But really Chris… Communism?

Yes.

Remember, when capital is allocated based on its highest marginal return, individuals… you and I… will invest where there is legitimate value, where we believe our highest risk-adjusted returns will be.

On the other hand, when capital is allocated based on some other set of metrics, such as which company is the most “socially responsible”, this is simply a thinly and poorly masked form of communism.

“The key to understanding the appeal of communism, despite the grim reality on the ground, lay in the fact that it allowed so many followers to believe that they were participants in an historic process of transformation, contributing to something much bigger than themselves, or anything that had come before.”

― Frank Dikötter, The Tragedy of Liberation: A History of the Chinese Revolution 1945-1957

Yes, THAT communism.

You might remember it from Moa’s China, or Pol Pot’s Cambodia or the former USSR. It is phenomenally stupid and wholly destructive.

Always has been, always will be.

Plugging in cuddly buzzwords doesn’t make it any less so.

A key punching bag in the current ESG fraud is, of course, the fossil fuel industry.

Our beloved leaders have gotten it in their heads that it is their job to ensure that the brown spotted tree frog enjoys a happy life… that it’s our job to read it bedtime stories and tuck it into bed every night safe in the knowledge that no man will come along and dig up his home, and replace it with a nuclear power plant so that our teenagers can stream Netflix.

The thing is, energy has to come from somewhere, and we’re told that it can no longer come from fossil fuels?

This has led to a flood of capital into alt energy and an absolutely devastating divestment of capital (by westerners… pretty much only westerners) from the fossil fuel industry.

“JPMorgan, by saying what they said, will be able to borrow billions of dollars from the ECB at negative rates … it doesn’t have to work, they don’t need to do anything, they are now getting free money from Europe for basically being able to say this,”

As Chamath Palihapitiya recently pointed out when critiquing the ESG movement and the absurd hypocrisy taking place – specifically when JPMorgan announced them putting the kibosh on investing in any fossil fuel projects.

And the herd is stampeding. Take a look. This is, I promise you some of the most unproductive investments ever made. JPM and Goldman don’t care -they’ll sell you this bucket of sick all day long.

They make money no matter what.

I’ve written extensively about the problem with “green” energy (in “The greenwashing bubble”, for example) which has dutifully been banned on social media, as no doubt will this article.

What I didn’t mention however is how retail investors will find it increasingly difficult to invest in fossil fuels themselves. Assuming you’re prepared for the ridicule and treatment befitting a baby seal clubbing thug, you will find it increasingly difficult to do so.

Take a gander down to your local mutual fund shop and you’ll find that all these folks are too terrified to tell the mob to go get knotted… and so there isn’t any product for you.

Sorry it doesn’t fit in our “ESG” policy.

It is now to be found in every western country.

The European Union is to stop funding oil, gas and coal projects at the end of 2021, cutting €2bn (£1.7bn) of yearly investments.

The European Investment Bank (EIB), the EU’s financing department, will bar funding for most fossil fuel projects.

https://www.bbc.com/news/business-50427873

Commerce Minister Kris Faafoi said banning investment in fossil fuel companies would help combat climate change and carbon emissions.

“It also makes sense for the funds themselves given that there is a risk of investing in stranded assets as the world moves to reduce emissions.”

https://www.rnz.co.nz/news/business/410692/new-kiwisaver-rules-to-ban-investing-in-fossil-fuels-and-illegal-weapons

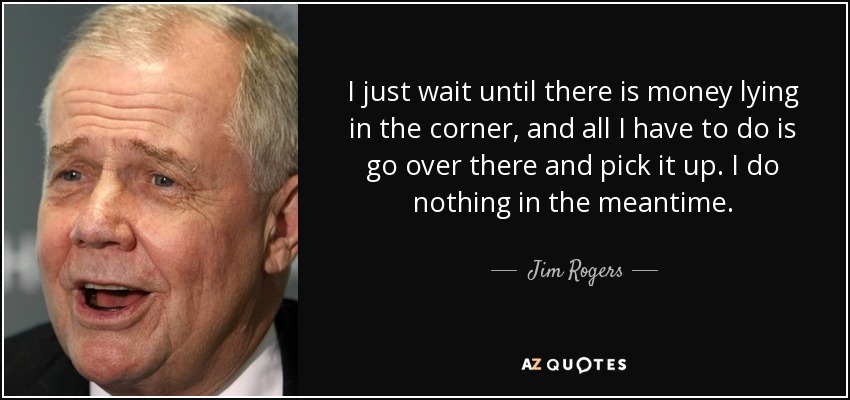

“At risk of investing in stranded assets”??

There’s another name for stranded assets you absolute dolt. It’s called “a fire sale”, and reminds me of Jim Rogers famous quote.

The greatest opportunity of our lifetimes sits in front of us, and the Marxist gatekeepers will increasingly be taking measures to ensure that you will NOT be allowed to be participating. Watch.

Fossil fuel investments into your IRA? How dare you… Sorry, not accessible.

Fossil fuel investments if you’re a UK citizen? Your government has determined that you are a horrible person and so no, and don’t expect to be able to access foreign exchanges in your brokerage account either.

Fossil fuel investments into your pension scheme?

Not on our watch big guy.

Trust us, it’s for your own good, and society’s.

So who will be able to access this phenomenal bull market?

Asians for one, who look at us round-eyes and think to themselves:

Muppets.

The Chinese have a name now coined for this. “Baizuo” is a Chinese term meaning “white left” and it refers to Western leftist ideologies primarily espoused by white people. The term baizuo is related to the term shèngmǔ, a sarcastic and derogatory reference to those whose political opinions are perceived as being guided by emotions or a hypocritical show of selflessness and empathy.

Zhang Chenchen, a PhD in political theory and science explains it.

Baizuo refers to people who “only care about topics such as immigration, minorities, LGBT and the environment,” who “have no sense of real problems in the real world,” who only advocate for peace and equality to “satisfy their own feelings of moral superiority” and who are “obsessed with political correctness” that they “tolerate backward Islamic values for the sake of multiculturalism,”

“”who advocate inclusiveness and anti-discrimination but cannot tolerate different opinions.”

Sound familiar?

I wrote a whole report about the effects of this movement here that you should definitely read if you haven’t already.

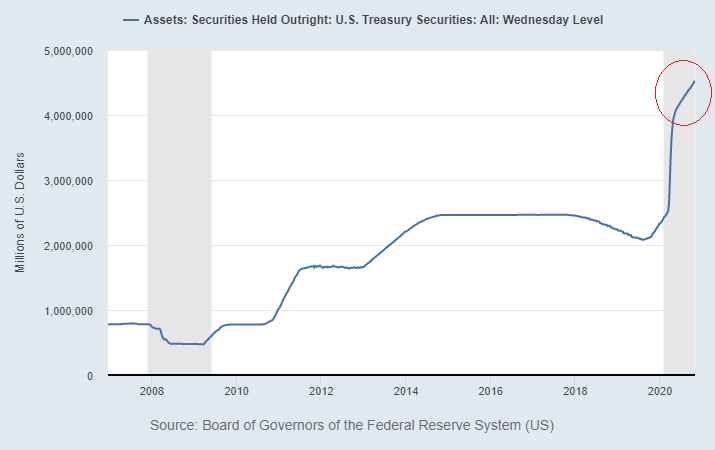

So we have a catastrophic dearth of investment going into the very nuts and bolts of what powers our world and while this is happening we have central banks accelerating money supply.

I can’t think of a more bullish setup.

Now, if you’re into things like gender equality, candles, bicycles and veganism etc. all the more power to you, but most people I know just want to hop in their car every now and then and take a driving holiday, and when they come home from work each night they want to flick on the power and not think to themselves, “by golly I don’t think we can use the radiator tonight honey” because the cost of power has tripled.

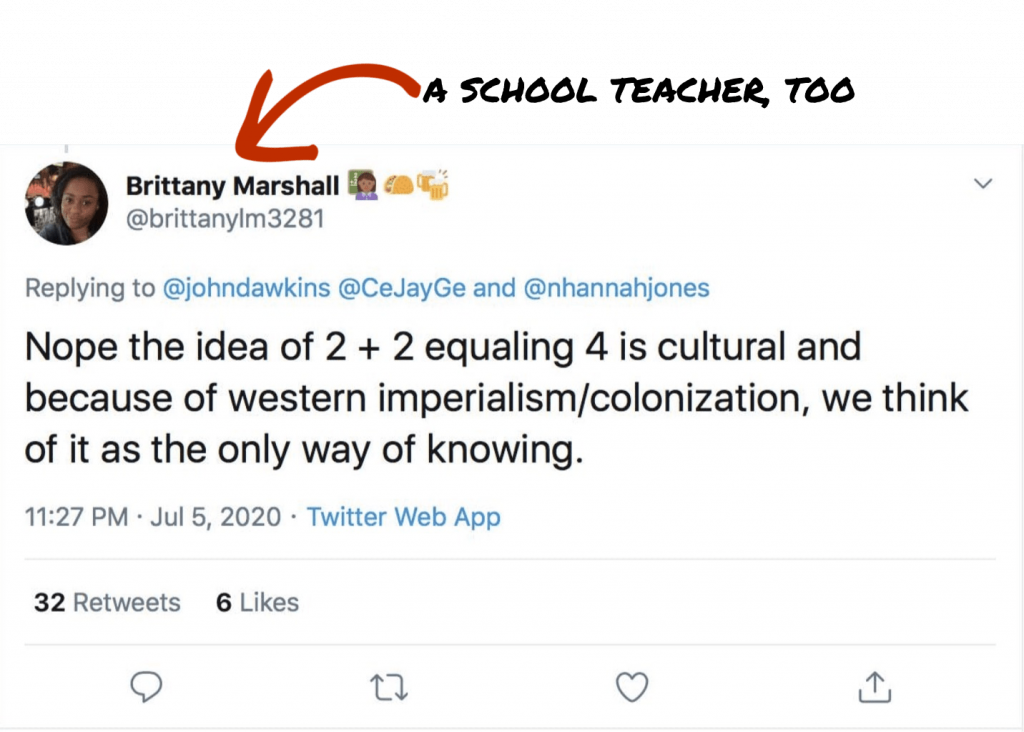

Though it’s evidently a tell tale sign of white supremacy to say that 2+2 equals 4, it really does, and it will continue to do so forever and ever.

By the time the western world wakes from the current self inflicted delusion, the geopolitical makeup of the world we live in will be firmly in the hands of those who are not participating in this ridiculous Marxist agenda, and who take advantage of what is easily the most spectacularly asymmetric setup I’ve ever seen.

By the time the decade is out, ESG will be seen as one more pivotal factor which accelerated the shift of wealth from the Western democracies to the East.

And at that point it’ll simply be a chapter in books written about how the West was lost and how China became the global power.

-Chris

“Complete fraud,” “joke,” “jargon,” “so ridiculous,”

Chamath Palihapitiya Venture capitalist, engineer and the founder and CEO of Social Capital

This Post Has 26 Comments

Nice writup. So, in what to invest though?

I’m with you on that. Just struggling to know how to invest accordingly.

Be like the Chinese

Thank you Chris,

This is an excellent and telling article.

a loyal reader

Hi Chris,

“Fossil fuel investments if you’re a UK citizen? Your government has determined that you are a horrible person and so no, and don’t expect to be able to access foreign exchanges in your brokerage account either.

Fossil fuel investments into your pension scheme?

Not on our watch big guy.”

Absolutely right, I just tried to buy some Lukoil in my UK SIPP account and was refused. Computer says NO.

Long on rhetoric. Short on facts.

Actually speaking from experience as a fund manager and if you spoke to any in the industry I think you’ll find the facts speak for themselves.

No, sorry Joe … when you’ve lived through similar cycles that Chis is talking about you’ll learn “the trend is NOT your friend.” Go back to 1964 and include all of 2020. 2021 is going to be rough. Europe is looking at the ground and seeing the cracks of EU, a non-recovery, countries that want their independence back (Hungary, Poland), and a Brexit revolution STILL in the making.

When our leaders tells us “bigger is better” … and we “need” more government … and we “need” more stimulus and money printing, how has that worked out in the past? How did that housing/financial crisis work out in 2007-08, and how did that government-created (Obama) college student loan crisis

($1.7 trillion) make lives better? There’s a couple of examples worth contemplating.

Fantastic article. What is the workaround to being shut out of this asymmetric opportunity?

Different for everyone depending on circumstances. Changing brokerage accounts if needs be, setting up corporate domiciles offshore and subsequent brokerage accounts under them.

Not sure if it’s still possible for US and citizens from other Western “democracies” but when I last checked, there are brokerages in Hong Kong that will accept foreign clients. Such an offshore broker enables access to exchanges in Asia for shares that are not listed on major US or Euro exchanges. The noose has been tightening, though, due to regulations like FATCA, so not sure if this is an option.

With the latest move to delist Chinese companies in the US, it seems like the writing is on the wall for Western investors.

Nice to find a blog that is comfortable telling uncomfortable truths. If you’re not worried you’re not paying close attention!

So are you saying to put our money in Gas and Oil?

You might have missed the first train on that. Look at what good energy & ETF funds have done in the last 2 weeks. Up 15-26%. There’s a second train coming soon … most likely early in December. Get ready.

Hi Chris, the challenge I have with grasping this article is that there is no beginning and no end… just a mishmash of ideas without any conclusions drawn… nothing is the past has ever been repeated it may appear similar but never the same… new technologies are a certainty, holding onto the old will prove costly, never mind the fact that the new tech is just so f#cken cool and makes oil and gas soooo inefficient in comparison on so many different levels… there is no doubt the planet has been f$cked up by dirty energy disputing that is idiotic and worse than any communist… perhaps splitting your posts up into investment ideas and political ideas would help? onward and upward

well, without this so called dirt i.e. CO2 we’d be all dead in no time. Plants need CO2 like we need oxygen. Thus if no CO2 —> no plant life. Without plant life no oxygen. It’s that simple And by the way, take away oil and we are right back in the medieval ages. Go try to run an electric device without insulation! yeah , thats made from oil. Come back and reply, if you can find something in your household, that’s not based on oil-based products.

Hey Kenny, the free blog is just documenting of thoughts. We run the fund and Insider, which you’re familiar with I believe… that documents the execution / application of the ideas on the blog. The article is highlighting one of the ways capital is going to shift from West to East in the future, in this case because of political ideology that is not based in reality. We are positioned for both the clean energy revolution AND its abject failure given the lofty targets set by governments which are, in our opinion, unachievable. I would encourage you to read https://capitalistexploits.at/investing-for-the-greenwash-bubble/ in relation to your comments around how efficient and green clean energy is.

Honestly, as layman I can’t quite understand your argument. From my point of view, the west is headed towards stone age –> no more need for oil &gas for the next ten or even twenty years(as per ideological requirement); the eastern powerhouses like India and China , Indonesia etc are getting their demand more or less satisfied at current prices. Africa still is a marxist mess.

So , who is going to drive the prices considerably higher over the medium term?

The West having “no more need for oil & gas for the next ten or twenty years” is where we’d disagree. Aside from oil’s application in tens of thousands of products, it’s also going to be required to enable the “green” future to happen, and apparently maintain it: https://stopthesethings.com/2017/03/22/back-to-the-future-wind-powered-south-australia-to-run-on-diesel-generators/. Demand has been crushed this year, but so has supply, and it is being strategically concentrated into fewer hands. Important also to remember “The West” isn’t the whole world, who will continue to use these economically superior forms of energy, increasing demand. Coal, for example, has seen consistent increased demand (until this year), despite having oil around. Point is we don’t replace one energy form with another that quickly. So the scenario where we go back to the stone age is (hopefully!) longer than 20 years…

Great article. Loved it and loved your one on greenwashing. I’m new to your newsletters but really enjoying them so far. Thanks Chris!

Still plenty of institutional ownership of big oil and tobacco and they are a key constituent of many indices so still lots of passive inflows too. It will be a long time before they are at risk of being cut off from capital markets.

Even if institutions exited and they were removed from indices o long as they have cash flows they will find easy financing. We are in a zero rate world after all.

My main concern would be the sustainability of the cash flows once politicians see how easy a target they are.

Sorry to be so ignorant but can you please point me in the direction of where I can read reliable information about covid being a hoax. that brought you to the conclusion to say “Setting aside the first topic, which is at this point now plainly evident to anyone that cares to do some simple math or look at actual mortality rates, a colossal hoax”

They haven’t even properly isolated, and purified the ‘virus’, let alone prove that it is ‘disease causing’. The CDC themselves have admitted this. From this arises two questions – 1. how do you want someone to believe there’s such a virus going around causing the disease they call ‘Covid-19’ and 2. If it’s not been properly isolated and identified, what is the test ‘testing’ for? Turns out it’s so flawed that it doesn’t even exist. There’s so many things wrong with this that labelling it sketchy would be an understatement. First of all, they haven’t even isolated and identified the virus for it to be deemed as a disease causing virus. Second, the RT-PCR testing is therefore completely incorrect and useless (if they haven’t isolated the virus, what is the test testing for?). Third, the inventor of this RT-PCR test, Kary Mullis, said this shouldn’t be used for viral infection identification diagnostic purposes (for testing negative or positive), yet that’s exactly what they’re using it for.

Every aspect of virology and infectious disease has been ignored, Koch’s postulates (the gold standard criteria for discovering and establishing a disease causing virus – taking the virus out of a sick person; inserting it into a live host, which has to get the disease they say the virus is causing; taking the virus out of the live host and putting it into another live host which also has to get the disease they say the virus is causing) has been ignored. It’s like every scientist has turned a blind eye to the fundamentals of the science here.

questioningcovid.com

Detailed study and explanation on why the Covid-19 doesn’t exist:

Easiest one to read for someone without a scientific background: https://fort-russ.com/2020/06/covid19-pcr-tests-are-scientifically-meaningless/

https://www.greenmedinfo.com/blog/does-2019-coronavirus-exist

https://off-guardian.org/2020/06/09/scientists-have-utterly-failed-to-prove-that-the-coronavirus-fulfills-kochs-postulates/#note

Long story short: There’s no new virus.

https://www.stopworldcontrol.com/planned/#

Australian lawyers filing law suits against the government for Covid-19 hoax: http://davidicke.com/wp-content/uploads/2020/11/6.11.20-CLN-TO-GOVTS-LETTER-covid-legal.pdf

https://drtomcowan.com/only-poisoned-monkey-kidney-cells-grew-the-virus/

Derived from: https://wwwnc.cdc.gov/eid/article/26/6/20-0516_article

Dr Stefano Scoglio study: ‘Sars-Cov 2 virus has never been isolated and Covid-19 swabs produce up to 95% of false positives’:

http://davidicke.com/wp-content/uploads/2020/10/Covid-19-tests-English.pdf

Lawsuits on Covid-19 swab tests:

http://davidicke.com/wp-content/uploads/2020/10/COVID-19-SWAB-TESTS-LAWSUITS.pdf

The PCR test, was not designed to be a test that picks up on infections within the body, it cannot be used for viral infection identification diagnostic purposes.

A word from its creator:

PCR is not a test; it’s a process. The frauds and medical board are misusing this process as a test. “PCR is just a process that’s used to make a whole lot of something out of something. It cannot tell you that you’re sick and it cannot tell you that the thing you ended up with was going to cause you ‘dis-ease’ or anything like that.” – *Kary Mullis, Nobel Prize Winner in Chemistry* for inventing the tool that carries out polymerase chain reaction process–PCR.

A few other credible voices on the PCR test for Covid-19:

Dr. Christina Northrup, September 11th, 2020, “Covid 19 tests were never meant to be used as a diagnostic test, it was designed to be a research tool for RNA and DNA, NOT for detecting infections.”

Dr. Thomas Cowan, 10/3/20, “The PCR test was developed by Dr. Kary Ellis , and he said specifically, you cannot use this test to prove infectious etiology or to diagnose an infectious disease.”

*Dr. Kary Mullis , inventor of PCR test* stated, “PCR test doesn’t tell you that you’re sick and it doesn’t tell you that the thing you ended up with was going to hurt you.”

Attorney Tom Renz, Ohio, September 23rd, 2020, “The Covid 19 test is made by numerous companies and is not standardized , CDC Center for Disease Control has no standard and what it means to have covid-19. Having covid-19 has not been defined by the CDC. Over a hundred companies make the covid test and each one sets the standard for what it means to be sick. The covid test is not FDA-approved.”

Dr. Pamela Popper, September 24th 2020, “The covid tests are inaccurate and are being marketed by incompetent companies.” “In Florida, in one day, 18 labs reported that all Covid tests were positive, which is statistically impossible.”

Dr. Robert Young, August 25th, 2020, “The covid tests are worthless.”

Dr. Mike Eden, September 27th, 2020, Chief Science Officer for Pfizer Pharmaceutical, “Covid tests are being used to manufacture a second wave based on new cases. Half or even almost all of the tests for Covid-19 are (incorrect) false positives.”

As of August 2020 (even with their lies):

– The CDC’s latest fatality data showed that COVID-19 was listed as the sole cause of death for *just 6%* of those killed by the virus

– That 94% of fatalities were in people who also suffered at least one chronic health condition, such as high blood pressure, diabetes, obesity or heart disease

– And that on average, people who died of coronavirus had 2.6 additional underlying health conditions

Hi Rui,

Wow, thank you very much for your detailed reply, it was exactly the information that I was looking for, greatly appreciated.

This is a really good post here. Thanks for taking the time to post such valuable information.

Quality content is what always gets the visitors coming.

Here you’ve got a fair argument! I agree completely with what you said!! Thank you for sharing your thoughts.

We hope that more people can read this post!!!