Market dislocations occur when financial markets, operating under stressful conditions, experience large widespread asset mispricing.

Welcome to this week’s edition of “World Out Of Whack” where every Wednesday we take time out of our day to laugh, poke fun at and present to you absurdity in global financial markets in all its glorious insanity.

While we enjoy a good laugh, the truth is that the first step to protecting ourselves from losses is to protect ourselves from ignorance. Think of the “World Out Of Whack” as your double thick armour plated side impact protection system in a financial world littered with drunk drivers.

Selfishly we also know that the biggest (and often the fastest) returns come from asymmetric market moves. But, in order to identify these moves we must first identify where they live.

Occasionally we find opportunities where we can buy (or sell) assets for mere cents on the dollar – because, after all, we are capitalists.

In this week’s edition of the WOW we’re covering the US withdrawal from TPP and the repercussions

There’s always something new.

Take US presidents. Americans have had old codgers, young bucks, white men, a black man, dark haired, light haired, even red-haired, and now there’s one with a fox’s hair. Nobody is surprised by this and yet they’re surprised by what “the Donald” has done in his first few days in that ugly looking office that is clearly decorated by an avid fan of the antiques road show.

He promised to be a wrecking ball and now that he’s in that ugly-as-sin chair (who decorates that place, really?) he’s actually doing what he promised and people’s jaws are grazing the floor.

This is the consequence of decades of politics.

Recall the story of the boy that cried wolf?

The podium donuts get up there promise warm milk and cookies, bunnies and rainbows, and chickens in every pot; the largely illiterate electorate play their part, liking what they hear, hoping and praying that it won’t be them that has to pay for it all, and deep down not fully expecting all that is promised.

They can’t pin the feeling down so I’ll do it for them. It’s called experience. Recall Trump’s long line of predecessors and the promises they made on the campaign trails? Point proven.

Now, along comes the ginger ninja who promises all manner of things, many outrageous, and in his first few days of office sets to work delivering them. WHOAH!

Today we’ll cover just one: the Trans-Pacific Partnership (TPP), which is now toast.

To be clear, even though I repeatedly stated that Trump would win and pointed out why (here, here, here, and here) this doesn’t make me a Trump supporter. You can play the probabilities of a horse race without having any “favourite horse”. Heck, I carry 3 passports and none are blue.

My job isn’t to opine on what should or shouldn’t happen. Markets don’t give a rat’s furry behind about my opinion (or yours for that matter). My job is to allocate capital according to the best probabilities and continue to profit regardless.

So who benefits and who loses – short-term and long-term?

Firstly, let’s be clear: This is a big deal.

Consider that even though congress never ratified former President Obama’s deal, the signatories to the TPP together represent 40% of world GDP and about a third of world trade. Not insignificant.

Short-Term: The Losers

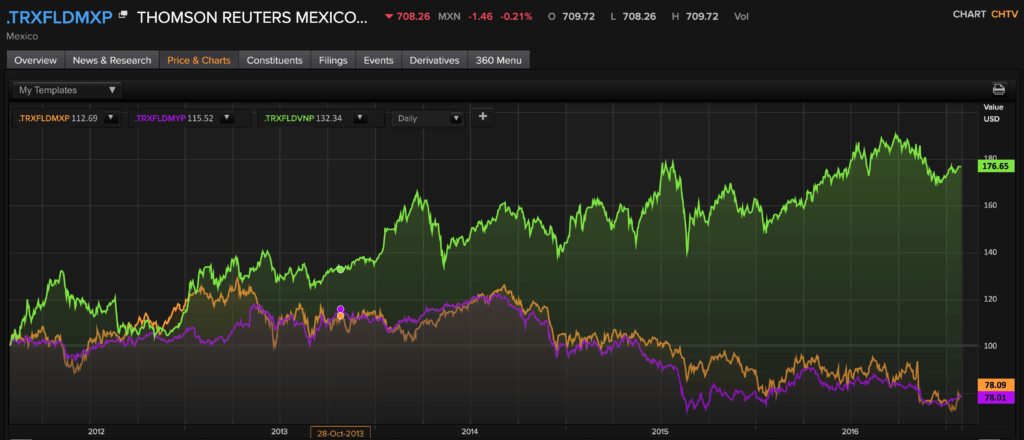

Vietnam, Mexico, and Malaysia have been beneficiaries as low cost manufacturing hubs. The market has long ago woken up to the stresses the Trump administration puts on Mexico and it’s gotten a lot cheaper as a result. I spoke just last week about Mexico and previously featured Mexico in an edition of World Out of Whack.

As you can see both Malaysia and Mexico have been punished by the markets. Strangely elevated and sticking out like a leg in a cast sits Vietnam. Considering that Vietnam’s largest export partner is in fact the United States ($29.9b) I think the market has yet to fully digest this information. When it does I’d rather not be long.

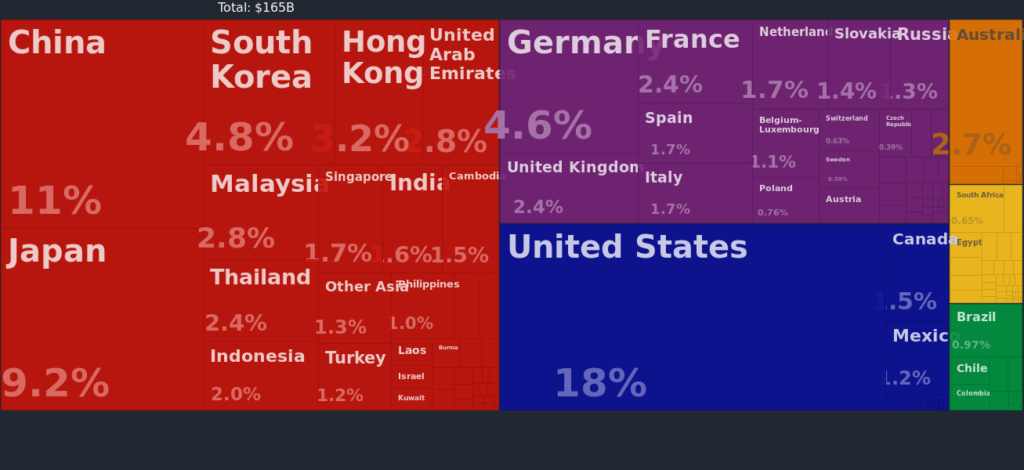

Here’s Vietnam’s breakdown of export destinations:

You’ll notice that China ($17.5b) sits in second place in terms of exports. Also, let me remind you that China is grappling with a ginormous credit problem and the most appropriate release valve is its currency. And right now China is enjoying rising liquidity problems but this is a topic for another day.

Suffice to say the odds of a nasty surprise coming from China are elevated and there will be secondary trades to be made as they attempt to deal with the confluence of exploding NPLs (non-performing loans) and continued credit expansion. Bullish Vietnam? Not that I can see.

The US?

Bullish. Capital moves like water and Trump’s likely to torch a lot of really idiotic bureaucratic red tape as well as lowering corporate tax rates. Capital will continue to move to the US.

So that’s the quick and nasty on the short term.

The Long Game: Winners and Losers

It was interesting to see Chinese President Xi Jinping denouncing Trumps populism, protectionism, and de-globalization, likening it to “locking oneself in a dark room.”

Is Trump planning on starting a trade war with China? I don’t know what’s on the man’s mind and annoyingly he’s failed to brief me.

What we do know is that even though China has some serious problems in the immediate future, its long-term prospects are undeniably attractive.

At the end of the day, America has nowhere to go. It’s a fully developed economy that will struggle to grow and it is suffering from a decaying education system, falling living standards, and a crippling military budget. And I’ve not even mentioned the debt…

China, on the other hand, has a billion hungry, and increasingly educated workforce with high rates of growth. Much of Asia is like this. Despite my reservations in the shorter term you can’t ignore this.

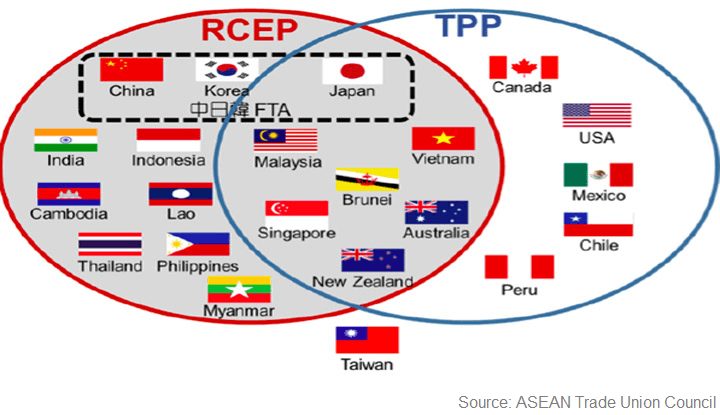

So while the west turns inward RCEP is taking shape.

RCEP?

The Regional Comprehensive Partnership will simply get a further boost from partners. Now that TPP is off the table expect the “disenfranchised” to do what humans do in such situations. React. I just got of the phone with a friend whose firm provides economic advisory to governments in Asia and this is definitely happening. Now!

Economic, political, and military ties will be strengthened as a result. Russia, Iran, and China are already moving closer together. This is a force to be reckoned with.

The Consqeuences

So America closes its doors. Now, what if China does the opposite?

When one ally shuts their doors to you, isn’t it in your interests to strengthen ties with those who aren’t?

China, the forerunner for the establishment of the 16-country Regional Comprehensive Economic Partnership, is punching forward. The RCEP would be the 10 ASEAN nations and their six FTA partners: Australia, China, India, Japan, New Zealand, and South Korea.

Interestingly, Australia, Brunei, Japan, Malaysia, New Zealand, Singapore, and Vietnam would all see trade ties weaken with the U.S. due to America’s withdrawal from the TPP. Human nature will be kicking in and RCEP will likely gain greater support and participation.

Once RCEP goes through, American manufacturers are likely to find that breaking through supply chains between these regions, especially as China strengthens its trade ties with low-cost havens such as Philippines and Malaysia, is not going to be easy. Regional deals offering more favorable terms of trade via RCEP could well help these emerging markets grab additional market share from US’s exports to Japan. Slow at first, but watch.

Losing Control

America can’t afford to lose control of Europe’s governments, which is bound to happen as European trade with China increases and decreases with America. This is a natural thing.

Last week something happened which went largely unreported in the tabloids MSM.

The first direct freight train from China to London arrived.

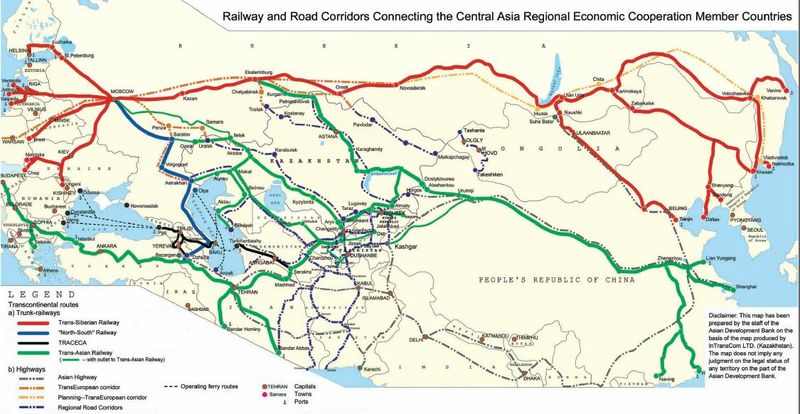

This isn’t completely new but it is a significant sign. Take a look at what China’s access directly into Europe looks like:

Students of history (of which I stand accused) understand that as goods flow and as trade increases so follows influence. China understands this.

This is bad news for Washington. Their influence in Europe will decline and China’s will increase. Watch for it.

The West has routinely underestimated China. Why, I can’t fathom. We’ve had 30 years to witness one of the greatest economic miracles the world’s ever seen as scrawny little brown people clinging to their rice bowls clawed their way out of poverty, amassing increasing wealth – to the extent that they’ve now almost single handedly fuelled bubbles in Vancouver, Sydney, and Hong Kong real estate.

“Illiterate peasants producing plastic garbage” is what a friend, a patriotic American, suggested to me. I suggested a stiffer drink and some education.

Consider the following:

Medicine:

Tu wins China’s first Nobel Prize for medicine

“Chinese scientist Tu Youyou, 84, was awarded the 2015 Nobel Prize in Physiology or Medicine for her contribution in fighting malaria. She won the prize for her work using artemisinin to treat malaria based on a traditional Chinese herb treatment, making her China’s first medicine Nobel laureate.”

Technology:

Beidou system extends its reach to global users

“A new-generation satellite of China’s Beidou Navigation Satellite System was launched in March, enabling the Beidou system to expand its coverage out of the Asia-Pacific area.”

“The Beidou system, named after the Chinese term for the Big Dipper constellation, is a domestic alternative to the United States-operated GPS. The first Beidou satellite was launched in 2000. By 2012, a regional network of the Beidou system had been formed, providing positioning, navigation, timing and messaging services in China and several other Asian countries.”

China launches its first dark-matter satellite

“China successfully launched its first dark-matter satellite at a launch centre in Gansu province on 17 December. The satellite, nicknamed “Wukong”, is named after the heroic Monkey King in the Chinese classic novel Journey to the West. Designed in a one-cubic-metre box weighing two tons and with four probes aboard, in the next three years Wukong will search for dark matter, which is believed to make up a large part of the cosmos.”

Already the leader in supercomputers, China plans to introduce the first exascale supercomputer by 2018.

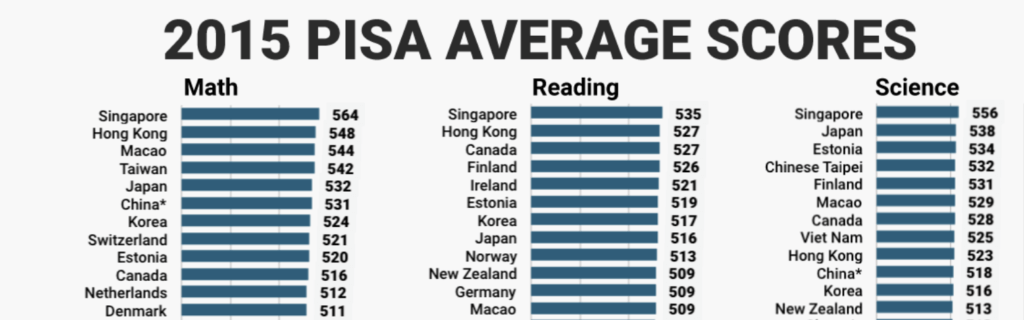

Recent PISA scores paint a pretty clear picture. This is an OECD ranking of students’ performance in math, science, and reading. The top countries:

You’ll notice China isn’t all thicko in math and science. USA, on the other hand, doesn’t even feature and is in fact below average.

It’s University professors suggest that “algebra is too hard and schools should drop it.” (no, really!)

You can’t make this stuff up. America increasingly leads the world in gender studies, safe spaces, and trigger warnings. Snowflakes rejoice. Watch out Beijing.

Trump, a bully with the manners of an ill-tempered and badly trained shitzu, tells Americans that China needs America much more than America needs China. Apart from being ridiculous, you may recall the same thing being said of Iran, Cuba, Russia, and a host of others. How’d that work out?

The taco eating neighbours to the south make for an easy punchbag. China is not that.

Empires typically last for roughly 100 years. Check your calendars.

A Question

2016 was a year of the “unthinkable”, Brexit and Trump to name just two. Why should 2017 be any different?

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” — Benjamin Graham