Revisiting Bitcoin

GOLD: QUIETLY ON THE MOVE Gold has decisively broken $2,000 in dollar terms and is now solidly above $2,300. That’s not the news, though. The news is that — despite

Capitalist Exploits is the blog and creative outlet of money managers responsible for hundreds of millions in client capital. The mission is simple; to provide readers with an unfiltered version of reality that is sadly missing from mainstream financial discourse. If you are easily offended, this is not the blog for you. If your identity is tied to a political party, this is not the blog for you. If you believe “the experts” are never wrong, this is not the blog for you.

If you wish to profit from the insane trajectory the world is on, this is the blog for you. Jump on our free email list above, trial our investment newsletter for just $1, or join our follow along investing service.

We don’t engage in the typical online marketing crap that we all hate, so if you see anything you like around here, please share where you can to spread the word ✌️

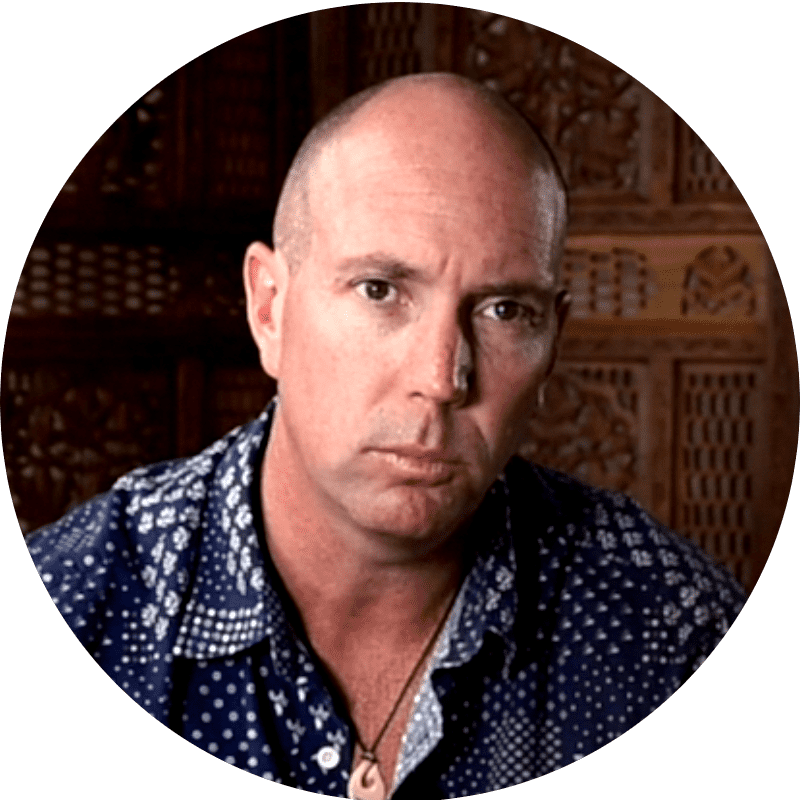

Raised in Southern Africa, Chris has since lived & invested from 7 different countries. After a career at top tier investment banks such as JPM, Lehman, Robert Flemmings and Invesco, Chris became tired of corporate life, and has since built and sold multiple million dollar companies, overseen $35m into venture capital, all the while investing full time, and managing his own and private client wealth.

GOLD: QUIETLY ON THE MOVE Gold has decisively broken $2,000 in dollar terms and is now solidly above $2,300. That’s not the news, though. The news is that — despite

The pushback against the “Net Zero” scheme is growing bigger and bigger. Leading the trend are our beer-drinking, bratwurst-eating friends — some of the best designers and manufacturers of cars

Ruh-roh! More bad news in the US banking sector (in regional banks to be more specific)… Actually, “plummet” doesn’t even properly describe the tragedy that is New York Community Bancorp.

We seem to be a lone minority here at Capitalist Exploits when it comes to (stubborn) bullishness on energy. Here’s Barron’s: Energy stocks are out of favor. Fund managers had less

CHRIS ON INVESTING IN 2024 Chris joined Brian Leni from the Mining Stock Education podcast recently to discuss what’s happening in the markets right now as well as what he sees

NEW PODCAST WITH CHRIS MACINTOSH New OWTW issue, new podcast with Chris. This time, he sat down with Jason Burack of Wall St for Main St to discuss, among other things: You

NEW PODCAST WITH CHRIS MACINTOSH Chris joined Patrick Ceresna and Harris “Kuppy” Kupperman for an anniversary episode of The Market Huddle to discuss the macro landscape right now and how to navigate

After the turmoil we’ve seen in the bond markets in recent months, the popular press is now starting to wake up to the fact that maybe, just maybe the era

CHRIS MACINTOSH ON THE ART OF CRITICAL THINKING Today’s podcast is slightly different from Chris’ podcasts we’ve shared with you in the past. But it might be the most important

Lyn Alden shared an article that caught our attention. One might say the diamond market got a kick in the stones. From the article: Lab grown diamonds — physically identical

You may have seen the press of popular opinion talking about this year’s rally in tech stocks. Here’s what it looks like on the chart: But when you take a

And just when we thought we’ve seen it all… From the article: One of Vietnam’s biggest automakers has made a big splash on its entry to Wall Street, pushing its

Capitalist Exploits is dedicated to finding asymmetric risk/reward investment opportunities.

Read Reviews About Us (Trust Pilot)

Reviews/testimonials on Trustpilot by current customers may not be representative of the experience of all others. Capitalist Exploits does not provide compensation for reviews/testimonials and is not involved with nor responsible for content posted.

Capex Internet Content LLC

Al Kazim Building 3

Hor al Anz East

Dubai

UAE