… and all at the same time.

Last week was a humdinger. Three things happened:

One

Firstly, our pasta-eating friends, after having experienced firsthand a blizzard of accelerating violent crime… and watching their previously gentrified neighbourhoods reconfigured into ghettos resembling the Maghreb, decided enough was enough and said “non piu”.

Italy turns away two more boats loaded with ‘human cargo’ https://t.co/ZplI1SIUmy via @SCMP_News

— Capitalist Exploits (@capitalistexp) June 19, 2018

And who could blame them?

A clash of cultures. One that will one day be studied by scholars sipping their coffee, scratching their heads, frowning and scorning the insanity of it all.

The below video of migrants unhappy with the accommodations provided by the Italian state is nothing unusual. It is rather a daily occurrence, not only in Italy, but across various parts of Europe, Britain, and Scandinavia.

https://www.facebook.com/VofEurope/videos/621444001570423/

A strange way one would say to show gratitude to the Italians who rescued them from the ocean, fed them, clothed them, and provided them shelter.

That these daily events aren’t publicised by the MSM is a topic for another day, but increasingly it’s hard to hide this sort of thing from your own people. Italy, as we all know, is predominantly Catholic, certainly Christian. And so when Luigi strolls outside for an espresso at his local cafe and finds this in the streets:

… he wonders what the hell the politicians are thinking.

When future generations look back at the reasons why the European Union and one currency system collapsed, there will be many factors to consider. But arguably the catalyst may well be seen as the decision by Brussels (and when I say Brussels, I really mean Germany… and when I say Germany, I really mean Merkel) to invite into Europe what can only be described as a tsunami of largely uneducated, often violent, and almost entirely anti-western, pro-Islamic peoples.

This isn’t a racist comment. I’m simply observing and stating the facts as they are.

Facts, which are not debatable, no matter how politically incorrect they may be. They are what they are. Let’s not ignore them.

I’m interested in what this means, because, quite frankly, at this point who cares whether it was smart or stupid. It IS, and that’s what matters.

Now, you may well ask yourself, why would member states sign up to this?

Maybe they didn’t see it coming, which is possible, even probable. But why hang in there in the face of obvious catastrophe? Especially those mediterranean members, which, due to their geographic locations, bare the brunt of the migrant wave.

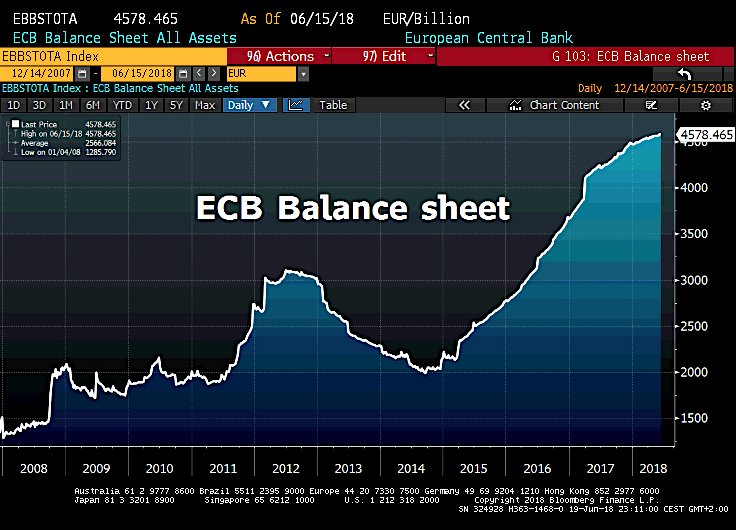

The answer’s quite complex but certainly one of, if not THE most powerful, factor is the ability of the ECB to hold the purse strings to member states financial present and future.

As mentioned in my recent article about Italian politics:

Strip away all the bluster and noise and it’s clear that the nuclear weapon in the ECB arsenal is their ability to manage sovereign bond spreads and the liquidity in member states banks.

Things change, though, and given the mounting pressures on governments by the “silent majority”, which we promised on this site some two years ago would inevitably come to dominate the debate, what we’re seeing in Italy was as inevitable as snow on the Alps.

And here we are today, with Italy threatening to leave the EU and openly flouting current EU laws on the handling of migrants.

The pointy shoes in Brussels are none too happy but quite honestly, what are they going to do about it?

Italy is, I will remind you, not only the country that taught the rest of Europe how to cook but the third largest economy in the EU. Losing them would be like losing a leg. Crippling!

And so when this week Italy flouted EU laws and regulations, they did so knowing full well that the suits in Brussels were watching closely. And now that it’s done things will never be the same again.

You see, Italy this week realised how powerful they really are in this relationship.

They realised that the odds of their funding lifeline being cut off is highly unlikely as it would, of course, spell the end of the entire EU experiment. And this is now where the show will get really interesting, because both the upstart ruffians in Rome as well as the pointy shoes in Brussels now know it.

Two

And the second thing that made the week fun was that while this has been happening, Frumpy Frau herself found herself mired in crisis as her own ranks divide over — you guessed it — the migrant issue.

Doubted at home, bypassed abroad: is Merkel’s reign nearing a frustrated end? https://t.co/k5Do76vLRP

— Capitalist Exploits (@capitalistexp) June 19, 2018

Now, keep all this in mind as I’ll come back to it in a minute because it’s important.

Three

The third thing this week was Kuroda-san, head honcho at the BOJ, just told us in no uncertain terms that nothings changed. The BOJ grabbed their favourite blankie, clung tightly to it, and promised never to let it go.

- Existing monetary policy remained unchanged.

- The BOJ’s aggressive asset-purchase and yield-curve targets would be maintained.

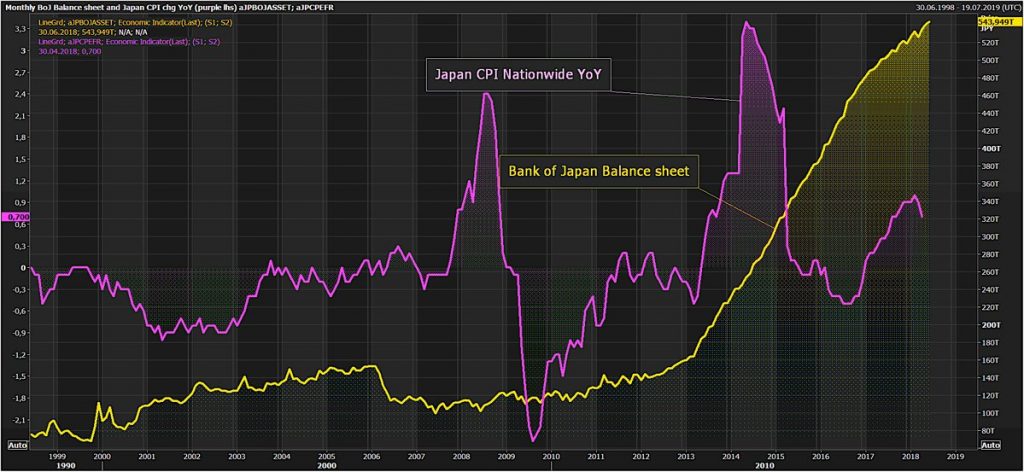

- Japan’s balance sheet expansion and subsequent low interest rates would be maintained.

As the saying goes, the beatings will continue until morale improves.

Which is all well and good, but what we’re finding interesting isn’t so much this Guinness Book level monetary experiment but rather the context within which it is happening.

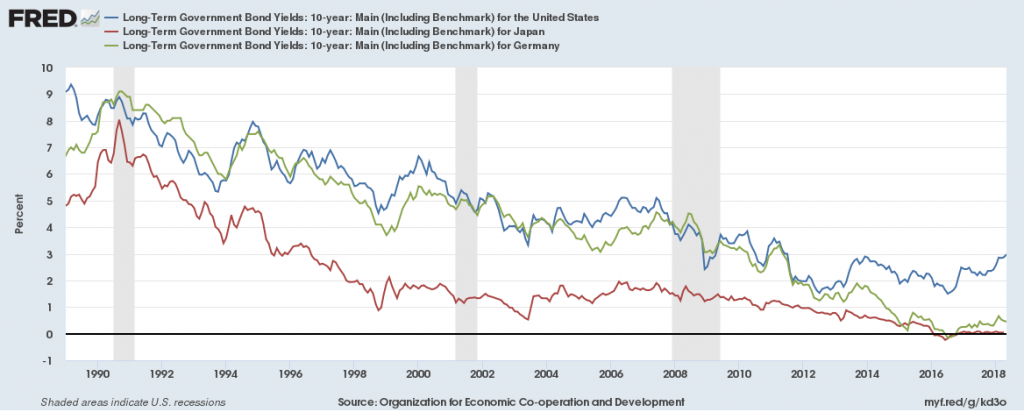

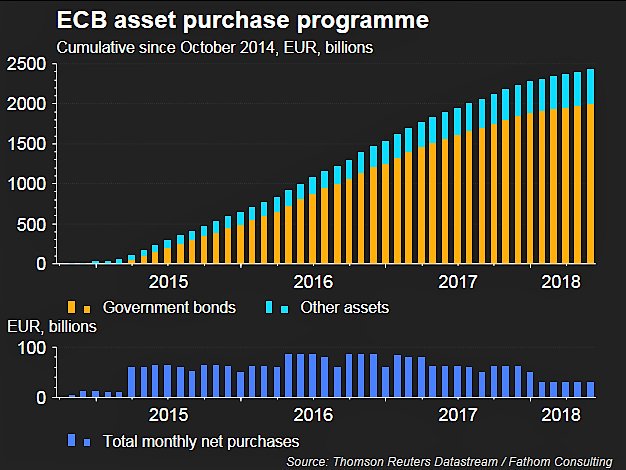

Consider that this is happening at exactly the same time that the European Central Bank just mapped out an exit from its crisis-era policies, which, I may add, comes just days after the US Federal Reserve again raised interest rates.

And so the divergence between interest rates in the world’s sovereign debt markets just got quite a bit bigger.

As the FT points out:

The Fed’s long-awaited moves to trim its balance sheet and a substantial increase in issuing US Treasuries to pay for tax cuts. Given the rapid rise in the size of the US deficit, the Fed must respond by slowing plans to shrink its balance sheet. If it does not, Treasuries will absorb such a large share of dollar liquidity that a crisis in the rest of the dollar bond markets is inevitable.

So to summarise: Europe is in turmoil and the ECB has nowhere near the level of control that both the FED and BOJ have.

Here’s the ECB’s balance sheet:

And here’s their asset purchase programme:

We can all agree that it’s not particularly good.

But we know this isn’t a phenomenon particular to the ECB alone. For example, while these are scary numbers for sure, they’re made to look petty by Japans standards.

Based on debt alone, one would think that Japan is the weakest link in the sovereign debt daisy chain, but I think that’d be a mistake.

Reviewing Japan and their debt, four things are evident:

- Japan is a homogeneous society, with relatively egalitarian income and wealth distribution. Hence, pain has been shared fairly evenly, thus preserving economic and societal coherence (this is not the case in Europe).

- Japan has managed to maintain credibility by selectively funding and adjusting national commitments to the elderly and medical care while simultaneously bumping up consumption taxes. Domestically this has been popular and internationally it’s placated global markets.

- Japan borrows in yen and the bulk of JGB holders are Japanese residents with less than 12% owned by foreign interests. This massively reduces the degree of external vulnerability. This is not so in Europe, where the ECB increasingly is the buyer of member states debt, which ironically they cannot stop doing, even when member states go and do as they please, as mentioned above. The ECB, in contrast, is damned if they do and damned if they don’t.

- The BOJ has been exceptionally aggressive in driving money supply up and rates down. This strategy has coincided with the global disinflationary trend and allowed the government to finance ever greater debt loads at ever lower servicing costs.

And it’s the last point that I think is the most important.

Because this global deflationary trend is no longer in play across the globe.

Things are fracturing. The dynamics have changed.

The US is not only reducing their balance sheet but as they’re doing so, capital is moving back into the US which will increasingly have inflationary effects. This, in turn, will signal to the Fed to raise rates, which itself makes yield differentials between sovereign debt markets that much more interesting for fixed income traders.

While that’s happening, Europe won’t be able to do the same thing. And yeah, I know Draghi just came out saying that the ECB intends to end its bond buying program in December with their first rate hike in the second half of 2019.

How do I say this politely?

That dog won’t hunt.

Pray tell, how the ECB can keep short-term interest rates at these absurd levels, charge negative rates for deposits, and then go end QE and expect to sell bonds to the public at anything other than much, much higher levels?

Consider that the ECB is the only net buyers of BTPs, for example.

If they stop buying them, the Italian government becomes insolvent. And if the Italian government becomes insolvent, they’ll definitely blame it on Brussels, which will provide them more, not less, political ammunition to leave the euro and EU.

And as I’ve said before, the foie gras-eating suits in Brussels absolutely cannot have that. And so, Draghi… and whoever replaces him next year will continue with QE. Watch!

And when markets figure THAT one out, we’re in for some fun because it is at that point, my fine friends, that the euro becomes THE carry currency.

Back to Japan…

What are they going to do?

Well, to hear about that, you’ll have to wait for Friday when we’ll look back at a bit of history and see what we can glean from it and how it may pertain to the good ol’ Japanese markets.

Stay tuned…

– Chris

“An imbalance between rich and poor is the oldest and most fatal ailment of all republics.” — Plutarch