The below list (h/t to @silverguru22) caught our attention this week. It shows the performance — or rather underperformance — of the stocks CNBC host Jim Cramer urged the unsuspecting rubes investors to buy earlier this year.

Most of these stocks were high-flying “growth” names completely disconnected from fundamentals. Not that that stopped folks from flocking to them. In their defence, the Jim Cramers of the world were hyping up these stocks as the best thing since sliced bread.

Rather than buying what’s popular, we prefer to buy what’s out of favor (even hated) here at Capitalist Exploits. Which reminds us of the below headline we shared with Insider members last year.

Yes, Jim Cramer called oil “a perma short” in September 2020. You probably don’t need a reminder of what happened to oil prices since then, but just in case…

And in case you’re wondering what’s on Jim Cramer’s radar right now…

Time to load up on gold?

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. This pesky stuff is now part of our daily lives.

We found this Wall Street Journal article particularly curious. Faced with roaring inflation, over in the US restaurants — including fine-dining spots — now have no choice but to revamp their menus:

Chefs who once planned exciting dishes for in-person dining say increasing food costs and staffing shortages are often limiting them to dishes that are practical and cost-effective. Many were preparing for a comeback after trimming menus for takeout and delivery at the start of the pandemic.

This year, 60% of restaurants reported reducing their menu size, according to Datassential, a food-industry market-research firm that studied more than 4,800 menus in the U.S. The menus at fine-dining establishments were hit especially hard, with the number of items declining 23% over 2021, says Datassential’s Sean Jafar, who studies menu trends. The consumer-price index for food away from home, which includes purchases from restaurants, rose 5.8% over the past year, the largest 12-month increase since 1982, according to Bureau of Labor Statistics data.

Today’s restaurants are focused on reining in appetizer and dessert offerings. Pricey proteins such as tuna, steak and salmon are also harder to find at some upscale spots. “A lot of restaurants are trying to keep the quality, not quantity,” Mr. Jafar says.

Perhaps that’s the reason the pointy shoes finally woke up to the fact that inflation might not be so transitory, after all.

INFLATION: NOT DEAD

INFLATION: NOT DEAD

Staying with inflation for another minute, remember this magazine cover from the April 2019 edition for Businessweek?

Our first thought at the time was, “Hmm, don’t get too cocky here.” All magazine covers tend to do is portray the mood of the market, which — back in 2019 — was 100% convinced that deflation was here to stay. Experience tells us that when an investment theme hits the covers of the press of popular opinion it is either at, or near the end of that theme.

Businessweek was within 12 months of calling the bottom of the “inflation cycle”. Will this article be a replication of the famous “death of equities” front cover of 1979? Well, as they say, time will tell, but it seems to us we are well into an inflationary cycle today.

WEEK’S HUMOR

WEEK’S HUMOR

We touched on the NFT (non-fungible tokens) craze in these missives last week. We said NFTs show what it must’ve been like living during the Dutch tulip mania of the early 17th century.

We got a good laugh out of this South Park depiction of the state of the NFT market.

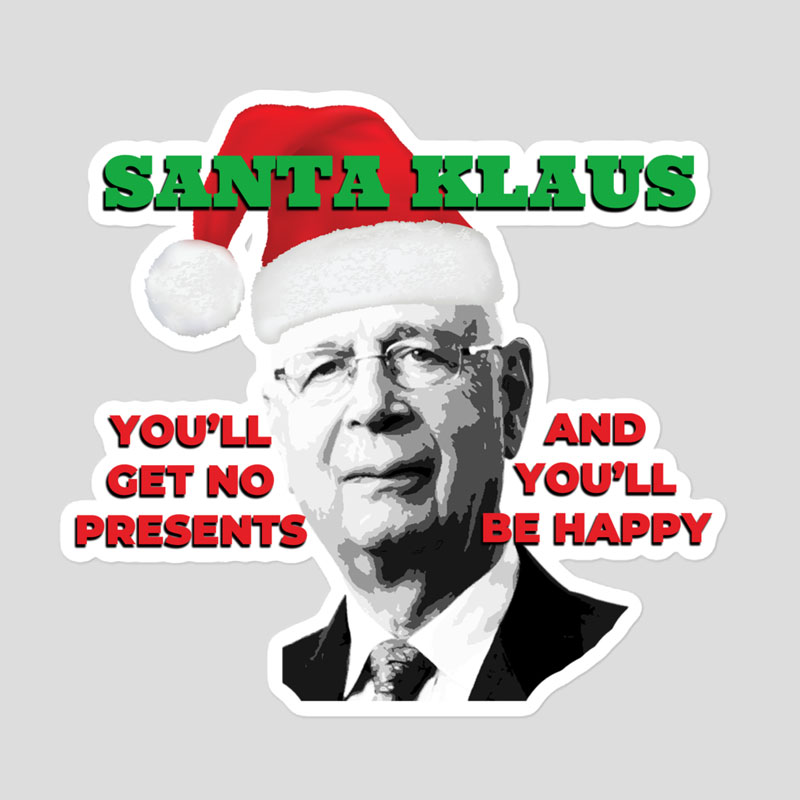

SANTA KLAUS IS COMING TO TOWN

SANTA KLAUS IS COMING TO TOWN

We were alerted to this “Great Reset” meme making the rounds (h/t to subscriber Esben)… so we made our own version, now available as a sticker:

Happy holidays everyone!