Don’t underestimate this fertilizer/agriculture fiasco. It is going to be far more severe and prolonged than what the vast majority has led themselves to believe.

As Europe’s farmers prepare to spread fertilizers on fields after winter, sky-high nutrient prices are leaving them little choice but to use less and try to pass on the cost down the food chain.

For growers of staples like corn and wheat, it’s the first time they’ve really been exposed to a fertilizer crisis fueled by an energy crunch, export curbs and trade sanctions. It now costs much more to buy chemicals needed for winter crops coming out of dormancy, and the extra expense could prompt smaller spring plantings that make up roughly a third of European grain.

Europe has been hardest hit by fertilizer-plant cutbacks on soaring costs of natural gas used to run them — and nutrient prices there remain at a record even as the pressure eased in North America. Europe could face a deficit of about 9% of its annual nitrogen-fertilizer needs in the first half, VTB Capital estimates. Food may get even pricier if harvests suffer or crop prices rise.

Who would have ever thought that the closing of the Dutch Groningen gas field would lead to a fertilizer, agricultural production, food, and inflationary crisis? Well, we did actually, but never mind that. It wasn’t critical to our analysis at the time. Rather, our thinking was along the traditional energy lines. Simple rising costs of all energy components due to insufficient capex spend in the fossil fuel industry.

The thing is there were multiple reasons (or moving parts) here, and we only needed one or two of them to rear their inevitable and ugly head for profits in this space to come. It’s not always about being right but about running the probabilities and positioning oneself to get lucky.

So we positioned ourselves to get lucky in an asymmetric way. And what do you know, the “Gods of Chance” looked kindly upon us. We mention this because a few subscribers have been thanking us for “our bullish call” on SDF, having bought it in mid 2020. Well, consider yourselves lucky!

By the way, if you think being up 250% is time to “take profits,” we are thinking the upside is just getting into gear.

Here, take a look at the long-term chart on this bad boy. Perspective is everything.

Now, here is something to consider. What if you had bought SDF 2 years ago, before the Corona hit (we were bullish on SDF back then)? Some 6 months later you would have been down 40%. Now, you are up about 120%. Were we wrong when you were down 40%? Equally, are we right now that you are up 120%?

Be gentle with yourself, ensure your position sizing allows you to weather this sort of thing and be patient.

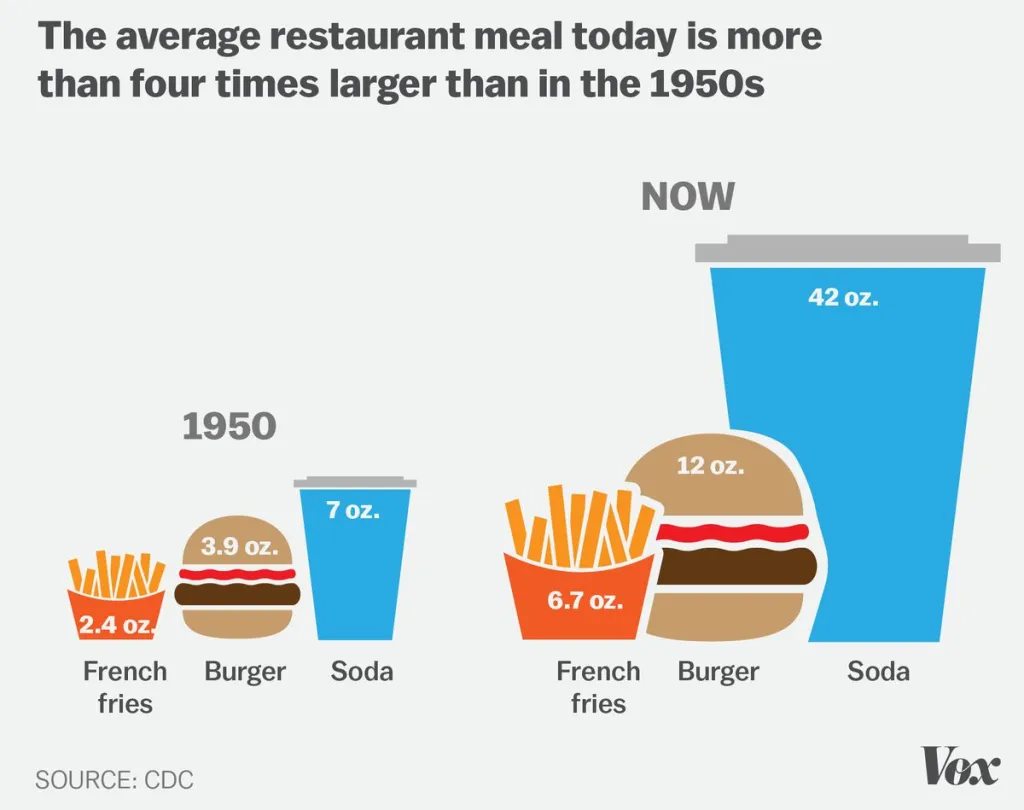

RISING COST OF MCDONALD’S: A GOOD THING

You may be thinking that the rising cost of your Big Mac, soda, and French fries is a bad thing…

Portion sizes shrinking:

And…

If you believe in mean reversion, then there are significant price rises in agricultural products (grains, meats, oils) to come.

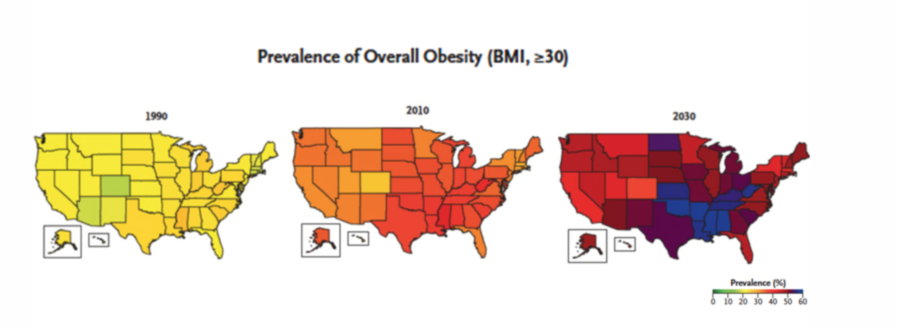

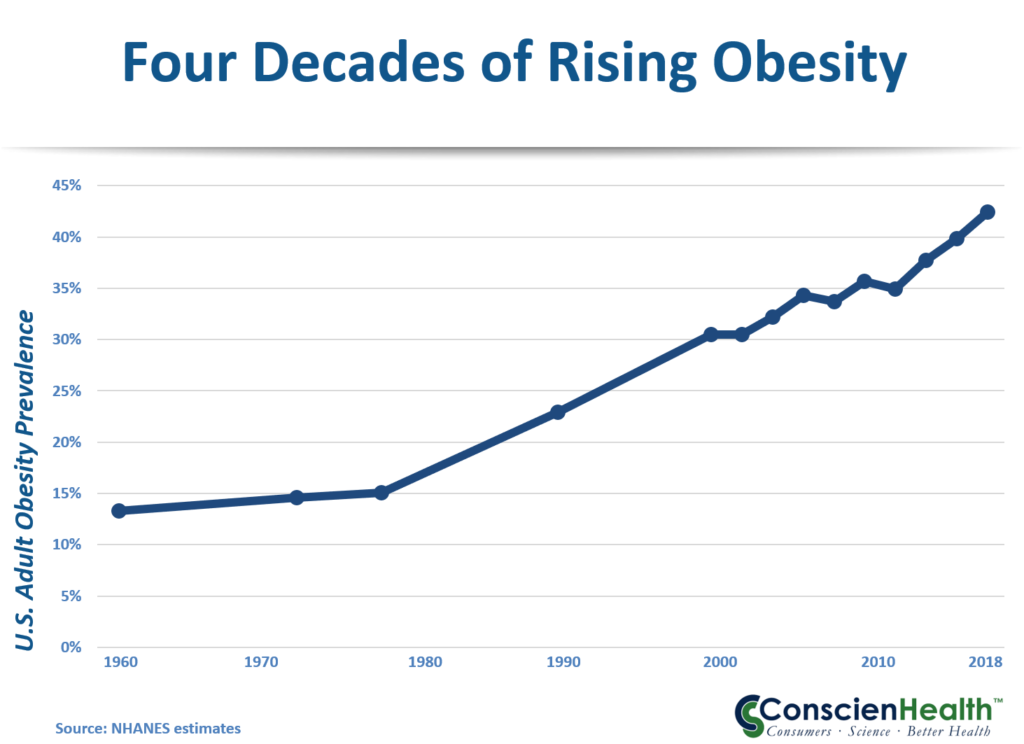

Now, here is a thought… are rising obesity levels correlated with falling bond yields (remember bond yields have been in a bear market since 1980)?

Certainly, I think it valid to say that the ease of buying junk food and the lack of self-discipline in financial markets and household budgets correlates highly with the lack of self-discipline in healthcare.