NEW PODCAST WITH CHRIS MACINTOSH

NEW PODCAST WITH CHRIS MACINTOSH

Chris was recently on the CapitalCosm podcast to talk about today’s macro landscape and the opportunities it presents.

Here’s just a handful of the topics they discussed:

- A deep dive into one of our worst (and certainly most frustrating trades) here at Capitalist Exploits HQ. It went nowhere for nearly four years and then, within 18 months, it blasted higher anywhere from 5-8X

- The “I” word: is the worst of inflation behind us (and what that means for sectors such as energy and gold)?

- Why Chris doesn’t particularly care if we are in a recession… or if we are heading into a recession

- Investing in sectors vs. individual companies (and why, as lazy investors, we prefer the former)

- Why real estate in countries like Canada, Australia, and New Zealand is a ticking time bomb

- And much more…

You can listen to the entire conversation here.

ARGENTINA

ARGENTINA

Staying with the biggest opportunities in today’s market…

How about Argentina? Yes, you read that right.

You’ll be hard pressed to find any positive commentary on Argentina on the internet (or in the news, for that matter). And yet, something bullish has been building in the land of silver.

In the Insider Newsletter we recently highlighted a dirt cheap Argentinian energy company — trading at 3X earnings and half book value. The market seems to believe this company is worth more dead than alive, but we beg to differ…

Our buddy Kuppy just wrote an entire article about Argentina. Specifically, why the upcoming presidential election could light a fire under Argentinian stocks:

Here’s an excerpt:

Let’s start with the obligatory note that we love Argentina; friendly people, beautiful countryside, great wine. We’ve been there a few times and are fans. More importantly, it’s always been stunningly cheap to visit. Doug Casey famously says that “Argentina is the cheapest civilized place on earth,” and we agree. Given the current (persistent) currency crisis, we assume that it’s even cheaper to visit today. However, this isn’t a tourist guide. The listed securities are also cheap, unusually cheap, stunningly cheap. Why are they so cheap?? Well, that should be obvious, the country is bankrupt, the currency is effectively worthless, they owe money to every global acronym, and the economy is in shambles. Fortunately, most of this is fixable. There’s Western infrastructure everywhere, the roads are paved, things actually (sorta) work.

If you’re interested, you can read Kuppy’s full article here.

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

Looking at the headlines, raging inflation is no longer an issue. But the devil, as they say, is in the details. Here’s a report from Insider member Kathryn:

My house insurance just went up $1000.00 over last year, an 83% increase. Nothing has changed except for the fact that apparently I live in New Zealand and must help shoulder the cost of increased climate change. In a brief fit of fury I contacted several other providers and discovered they were even more expensive than my current provider. So I just have to pay my “extra” costs due to increased risk of problems from “climate change.” We are still arguing with the company regarding this rate of increase.

And as the following note from Vitalie shows, no part of the economy has been safe from inflationary pressures:

CFA Institute membership dues have risen 30% this year, from $100 to $130.

Now, what’s causing this persistent inflation? It’s not the excessive money printing or the government pointy shoes “stimulating” the economy. Instead, blame it on Beyoncé (h/t to Insider member Anton for this gem)!

HERE WE GO AGAIN…

HERE WE GO AGAIN…

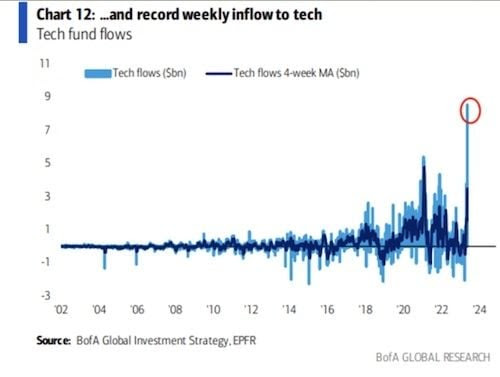

Here we go again. Take a look at this:

The Nasdaq now sits on a P/E of 31X. For comparison, it was 32X at the end of 2021. The saying, “history never repeats itself, but it often rhymes” comes to mind.

The market is behaving as if deflation will prevail for the next 10 years, interest rates have peaked and are coming down, there’s no chance oil will rise above $100, demand for coal will plummet, there will be an endless supply of cheap natural gas, wind and solar will dislodge coal and gas as primary electricity generating sources, endless supplies of copper, lithium, nickel, etc. are about to be discovered, and everything in between.

Call us grumpy old farts, but we don’t think so.

WEEK’S HUMOUR

WEEK’S HUMOUR

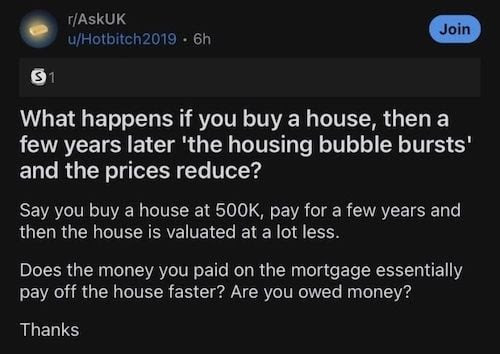

Sometimes it’s hard to distinguish truth from fiction. The following question is one of those situations (h/t/ to Insider member Sean):

File this under “Things you see in a zero-rate environment.”

Have a great weekend!