📈 INFLATION: THE CAT IS OUT OF THE BAG

Over in the US, the core CPI just hit the highest level in nearly 30 years:

Not to mention the fact that food prices are up 40% in some cases over the past year.

But don’t fret. The pointy-shoed experts have it all under control (or so they say):

As far as markets go, the “irony” of the prevailing belief that any inflation will be temporary is that the weighting to sectors which are the best inflation hedges (commodities) is the lowest in about 100 years. In other words, we are at the point in history in which investors are the least prepared for inflation.

💰 THE NEXT LEG UP IN GOLD

These days, the average investor is too enamored chasing the next Dogecoin, hot SPAC deal, or hype-up growth stock to even bother paying attention to gold, even though the shiny metal is hovering near all-time highs. But, as Resource Insider’s Jamie Keech explains in his new article, the price of gold is destined to soar even higher, thanks to two powerful tailwinds:

“Today, at $1,900/oz Au, we’re still in the nascent stages of a buyer’s market, though few have woken up to this fact.

You don’t need a Ph.D. in economics to understand what’s driving this trade. You just need to understand two simple concepts:

- Real Rates; and

- The U.S. Fiscal Deficit.”

As an aside, Jamie has been absolutely crushing it with gold deals in his Resource Insider service. Across the board, the average deal is up 96% (vs. 46% for gold). If — like us — you believe we’re only in the early innings of a commodities supercycle, we can’t recommend Jamie and his service highly enough. You can learn more here.

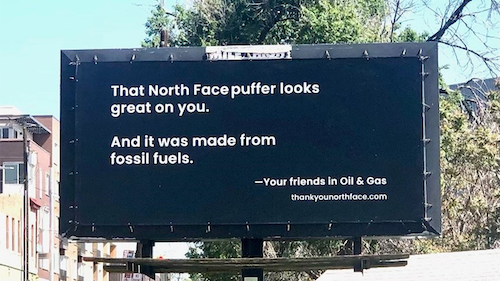

🚨 CORPORATE VIRTUE SIGNALING

We highlighted the virtue signalling hypocrisy of big brands in Insider Weekly late last year. As a refresher, at the time, The North Face rejected an order for jackets from an oil company simply because it was an oil and gas company. The way we saw it then (and still do):

The truth is, take away oil and coal and you take away North Face’s products. What a bunch of virtue signalling twats. We have had a guts full of this hypocrite world we live in. We are going to profit handsomely from it, but to be honest we’d be content without the profit and a world not completely mad.

We’re glad to see we’re not the only one who picked up on this. One oil and gas company now pushed back against this narrative with a brilliant campaign, highlighting just how critical oil is to our daily lives… and to The North Face’s existence.

🛢️ IS ENERGY CRISIS NOW GUARANTEED?

It would seem an energy crisis is not just inevitable, but essentially guaranteed — not just by societal trends, but now by law.

This isn’t anything new as the emissions thing has been going on for a while now. But it just stepped up a gear. We would be surprised if other countries (in the West) don’t follow in the footsteps of the Dutch.

In fact, other majors like Chevron, Exxon, and ConocoPhillips are already in the firing line as well.

It’s hard not to see a repeat of the 1970s oil crisis brewing on the horizon. We simply can’t see any other way out of this. The price of oil (and hence the cost of EVERYTHING else) is going much, much higher. The catch this time is when (not if) oil gets to $130 a barrel (or somewhere up there), there won’t be the ability to bring new supply online in any material sense to bring the price back down.

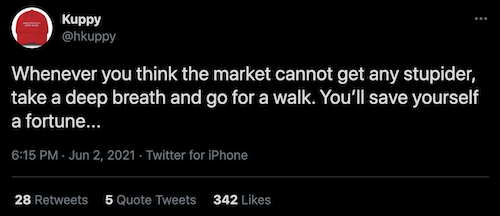

💡 ADVICE FOR CRAZY TIMES

And lastly, sage advice from Kuppy on how to navigate today’s markets.

This Post Has 2 Comments

A nice Blog

Thanks for sharing this information and for your excellent blog.