How come the iShares ESG USA Index (ESGU) has a 2.5% weighting to oil and gas stocks?

And how come that weighting is more or less the same as the S&P 500? It’s almost as if we’re being played.

While this might get us termed “climate deniers” or whatever the label du jour is, the ESG thing is complete, total, unashamed bollocks… and this includes ESG ETFs. They are designed to separate brainwashed fools from their money, while providing their ill informed terrified (“we’re all going to die from climate change”) victims with an ability to virtue signal their friends via a Zoom call (with their masks on) and lecture them how they’re simultaneously saving the planet and curing every freshly minted “ism”.

Providers of these woke investments spend so much time focussing on marketing, and then their portfolio construction (if we can even call it that) is simply taking a mirror of the S&P 500. It is so transparently blatantly ridiculous and yet… it works.

There is never a shortage of fools out there who wish to part with their money.

INFLATION. INFLATION EVERYWHERE.

INFLATION. INFLATION EVERYWHERE.

By now, you’re probably sick of us banging on about inflation. So be it. It has been our contention that — as the inputs to what makes up our world as we know it rise in price (due to constraints in supply) — the follow-on effects will be felt throughout supply chains.

With that in mind, it shouldn’t come as a surprise to hear Warren Buffett sounding the alarm on inflation at Berkshire Hathaway’s annual shareholder meeting last week:

“We are seeing very substantial inflation,” the Berkshire chairman and CEO said at the conglomerate’s annual shareholder meeting Saturday. “It’s very interesting. We are raising prices. People are raising prices to us and it’s being accepted.”

And it’s not just Buffett. This Bloomberg interview with real estate billionaire Sam Zell caught our eye:

“Oh boy, we’re seeing it all over the place,” Zell said of inflation. “You read about lumber prices, but we’re seeing it in all of our businesses. The obvious bottlenecks in the supply chain arena are pushing up prices. It’s very reminiscent of the ’70s.”

This is now a trend across the board:

“The number of mentions of “inflation” during first quarter earnings calls this month have tripled year-over-year, the biggest jump dating back to 2004, according to fresh research from Bank of America strategist Savita Subramanian. Raw materials, transportation, and labor were cited as the main drivers of inflation.”

Don your helmets, strap on your boots, and gird your loins. Stagflation is here and just warming up.

🤷 CENTRAL BANKERS’ HEADS DEEP UP THEIR ARSES IN THE SAND

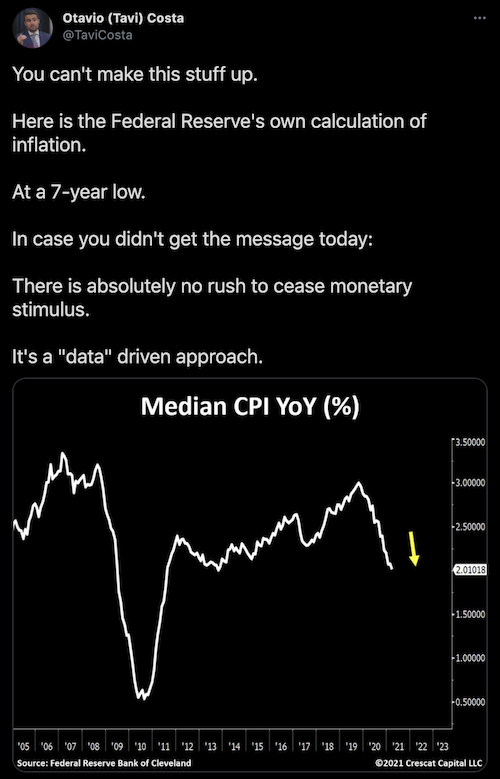

Well, we suppose we should be more clear earlier. By now, inflation is obvious to everyone… but central bankers. Crescat Capital’s Tavi Costa shared this the other day:

You really can’t make this isht up!

The truth is that central bankers have backed themselves up into a corner. They can’t raise rates as this would immediately bankrupt governments due to an inability to service debts. And they can’t or won’t acknowledge that they’ve created a monster they have no control over.

Now, you can agree or disagree all you like over this and even bitch and moan about what they should do or what should have been done. None of that matters a jot because markets don’t care about you… or us. The best thing we can do is prepare and profit from this.

THE SHIFT FROM WEST TO EAST CONTINUES…

THE SHIFT FROM WEST TO EAST CONTINUES…

Capital always moves to where it is treated best. Always. And increasingly — as long-term readers know — that’s from West to East. As Reuters reported last week:

“Major Chinese investors are in talks to buy a stake in Saudi Aramco, several sources told Reuters on Wednesday, as Saudi Arabia’s state oil firm prepares to sell another slice of its business to international investors.”

Unlike Western governments, who are hellbent on virtue signalling away their energy security for brownie points at the “woke table”, China knows you have no political security without energy security. As we outlined it to Insider members recently: