It seems as if all the present focus in financial markets is on Europe and “solving” their debt crisis. Debt is by far the biggest problem facing the developed world. What is interesting is that there lurks a far greater crisis on the horizon in my opinion, one that dwarfs the present European drama. Let me explain.

Shorting the JGB (Japanese Government Bond) market has been a graveyard of hedge fund manager’s capital for well over a decade now.

It has seemed both inevitable as well as imminent to many an astute market observer, that the Japanese government would not be able to sustain ZIRP (Zero Interest Rate Policy) indefinitely while debts ballooned. At some point the bond vigilantes would have their say.

Betting on rates rising to compensate for the additional risk attached to skyrocketing debt has been both logical as well as completely wrong for over a decade.

The reasons for the Japanese government’s ability to maintain ZIRP in the face of increasing debts could make for an entire and very long blog post so I’ll keep it brief… very brief.

- A xenophobic society with a very high savings rate.

Yep, that’s it. The Japanese keep their money at home preferring to invest their cash in the perceived safety of JGB’s, which has allowed their government to fund insane and wasteful infrastructure projects. Fully 98% of the population are pure Japanese. It’s nearly impossible to acquire citizenship if you are not Japanese. Outside of small tribes still living in the jungles of Papua New Guinea or the Amazon basin, the Japanese are possibly the most homogeneous society on earth.

How we got here – Achieving the impossible

Japan for the last 20 years has been China’s largest trading partner. A period that has seen arguably the largest Asian boom in history. How is it that Japanese tax revenues in nominal dollars today are the same as they were in 1985? At the same time expenses are over 200% of what they were in 1985.

- Does this make sense?

- Can it last and if so, for how long?

- What would a Chinese slowdown do to Japanese exports and subsequent tax receipts?

The BOJ has engineered rates lower as their debts have gone hyperbolic. ZIRP is great for the income statement, but absolutely destroys the balance sheet which eventually destroys the income statement itself, once ZIRP collapses under market discipline.

What ZIRP has done is to have future expenses spring-loaded like a tightly coiled spring. This has been achieved due to the debts of the government being internally financed. (Roughly 96% of JGB’s are domestically held). Xenophobia, coupled with deflation have allowed for this extraordinary situation to develop. This cannot last much longer for a number of reasons.

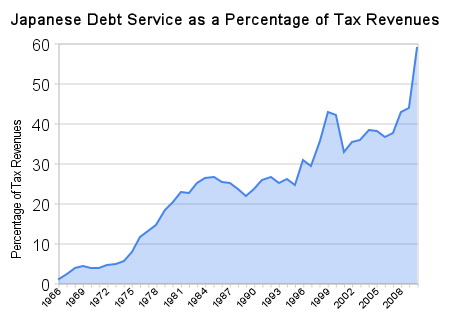

- Interest expense on this debt is over 20% of government revenues, add in social security to the mix and over 50% the government expenditures are swallowed. To put this into perspective a mere 2% move in their interest expense overwhelms their entire annual revenues. Even if they could decrease their interest expenses somehow (can we go lower than zero?) we’re moving rapidly into an environment where GDP shrinks due to demographics. This says nothing about a potential slowdown in China, which my sources tell me is already underway. If this was my personal balance sheet I think I’d find some strong poison or a balcony to jump off.

There is no way that interest rates can be moved higher by the BOJ. It’s just not mathematically possible. When you realize that they cannot maintain both ZIRP as well as the integrity of their currency, then you realize too that the Yen is headed for a very large iceberg.

2. The tax base in shrinking due to demographics, shown in the chart below

This is important since those same tax revenues are now declining. Furthermore with nearly 1/4 of the population now entering retirement they will be selling their bonds to finance their existence. Japan cannot grow its way out of debt.

The Japanese have financed themselves for 20 years now, and while their debts began piling up, so too their overall interest expenses actually declined. This is due to pushing their capital costs rate down to zero. Now interest costs have begun to rise even while their cost of capital has remained at zero. Simple math tells me they have no means of financing their debts other than looking offshore.

In all honesty I’ve been puzzled in the past that we can get to the stage we’re presently at, and I have to confess to losing money on shorting both US Bonds and JGB’s in the recent past.

A couple months ago I began to build a position. The way I’m playing it is NOT to enter the futures market in order to short the JGB’s but to simply go long gold vs the Yen in the FX market. This allows me a number of things.

- I don’t have to worry about timing this, unlike a futures position.

- If gold continues to do well, as I expect it to, then I actually don’t need a collapse in the JGB’s in order to profit.

- If JGB’s collapse then the Yen follows.

When the Japanese government is forced to seek bond buyers offshore, which will happen due to the demographics, I expect a rise in rates. We only need a very small move to tip the boat. This is what happens when you’re highly leveraged. Lehman and LTCM found out the hard way, and Japan is going to find out too.

If for some reason that I’m not smart enough to see at this point in time, they manage to pull it off for another couple of years, then all that will happen is the “future expenses spring” gets depressed even further. The plus side (if you’re short) to this is that I cannot see any means of letting this balloon down lightly. The ensuing panic will be historic.

There is no mathematical way that this can last in the face of the fundamentals. All arguments I’ve heard against this idea fall into two categories. Namely the “yeah its been a losing trade for so long” followed closely by “I’ve been burnt alive already and don’t have the stomach for it any longer”. Neither of these objections present a mathematical reason why this can continue.

Am I missing something?

– Chris

“A parabolic move and all parabolic moves end badly”. – Jim Rogers

This Post Has 29 Comments

Chris,

Yes you are missing something; a citation to Kyle Bass’ work! Sorry, sorry, that was a cheap shot! If one considers the facts regarding Japan, it is difficult to rationally get to a different conclusion.

Timing is still key; as the saying goes, just because something is inevitable doesn’t mean it’s imminent.

I don’t think the BoJ’s current intervention in the FX market will be the tipping point. The Yen may or may not be at its peak, but the BoJ’s actions are not going to force bond investors to demand higher rates, which is the real catalyst for the ZIRP-trap to slam shut.

I have a suspicion that we’ll see a change in attitude towards Japan and its debts after other sovereigns default / restructure. Once Greece is followed by [fill in the blank], then I think we’ll see other defaults happen quite quickly. Historically, sovereign defaults cluster and become more frequent once the stigma attached to them is overcome and it is sold to the electorate as being in their long term interests.

Once sovereign default is seen as the inevitable consequence of the developed world’s past credit binge, then and only then (I think), will other larger nations (e.g. Japan) become victims.

There is a disconnect in the market between what is inevitable and what being focused on right now. The market see’s the Yen as a safe haven which is ludicrous to anyone who has, like you, studied Japan’s position. Once some sovereigns default, Japan’s future will be sealed.

One question, how does your trade work? Sell JPY/USD and buy gold? Or am I the one now missing something?

Thank you for your posts. I always look forward to seeing what you guys are thinking about.

Thanks Matthew

Kyle Bass is one of many.

David Einhorn, Hugh Hendry and of course Julian Robertson who has been sending the BOJ checks for nearly a decade now.

Timing clearly is important which is why I prefer the FX play I mention. You are quite correct in that the market presently sees Japan as a safe haven but if you look at the numbers you realise that fundamentals are going to overwhelm perceptions and I’m prepared to bet its going to happen within the next couple of years. I believe the key lies not in external sovereign defaults but in the BOJ seeking offshore purchasers for their bonds (which they will have to do since the only other option is monetizing their debt). Incidentally they are less likely to monetize their debts since they are domestically held unlike the US for example. Even if they choose this route though the outcome for the Yen will be the same.

Gold trades in many currencies not just USD. As such many trading platforms will allow you to trade gold and silver against major currencies such as Euro, Yen, HKD and AUD.

Chris

All good points well made.

Have you been monitoring the JGB auctions and their internals for signs of increasing non-domestic purchases? If so, could you point me towards the data source?

Also, why does the large domestic JGB participation reduce the likelihood of monetization? I’m not sure I follow.

Many thanks

Go to the BOJ’s website. More data than you can shake a stick at.

To answer your question. If I owe you money and monetize the debt its YOUR problem. If I however owe that money to my mother I don’t really want to monetize the debt since she will know I’m diddling her.

Take a look at Greece. The bonds are held largely by French and German banks. Its therefore their problem more than it is Greek citizens problem. If Greece could monetize that debt (which they can’t) they probably would.

If those debts were held by Greek citizens however then monetizing it would be much more unpopular and likely lead to a change in Government. At such a late stage in the game it might still be the course of action taken as their exist few alternatives.

Basically the Japanese Govt wont want to default on their own citizens either outright or via monetization so they’ll first look offshore.

Great minds…

Anyway, I’ve been focused on this trade for a week. It is my top priority. I know its early but that’s fine by me because my gut says now is the time to start building a postion here BEFORE the spotlight leaves Europe and heads East. I think Japan will come under pressure as Europe’s crisis subsides.

My connect the dots goes like this: Japan cannot tolerate a significant move up in rates as it leads to checkmate much quicker so external borrowing is not an answer because external investors will want higher rates the minute they stop viewing the Yen as an appreciating safe-haven which could happen in less than 18 months, easy. Therefore, BOJ will become a major buyer of JGBs via money creation, so the Yen will depreciate BEFORE rates rise on JGBs.

Kyle Bass rocks. Have you read and listened to his Japan presentations?

At some point after the Yen has fallen further and before JGBs crack, I’d like to talk about how to make a small/modest but highly leveraged bet on higher rates in Japan. I hate short-term ideas so the further out the expiration the better for my style.

-Mark S.

Have you taken into consideration how much “foreign” assets are in the Japanese pension funds? I assume as more Japanese retire they will also be selling those assets and be buying the Yen. Extrapolating from my pension fund’s portfolio structure, it could be significant.

Yes an important consideration. If we look at the household savings rate we can see that this is collapsing (in 1992 it was around 15% of disposable income and in 2010 a hair over 2%).

The demographics are the reason for concern. What would you as a retired Japanese citizen do with your foreign held assets once sold? I believe you’ll be converting to Yen deposits in order to pay for your utilities etc….not buying long dated JGB’s. Furthermore those JGB’s that you do hold in your portfolio you’ll be looking to sell in order to finance your retirement.

Hmm…whatever happened to the idea from a few years back of a bunch individual US states going insolvent?

Not sure I follow Vik.

Almost all states are insolvent if we used GAAP. Of course the pundits say its a “liquidity” crisis. Yeah Europe is having a “liquidity” crisis but of course the real issue is solvency.

You are missing something. Read MMT (Modern Monetary Theory) blogs. The predicted both the Euro trouble and the non-issue with Japanese and US sovereign debt.

Thanks Jason

Just read it. Some very good points made. The theory works up until a point however. Mathematically the only means of supporting bonds AND maintaining low interest rates is via monetary inflation where for some reason citizens don’t mind their cost of goods rising due to the monetary inflation. (unlikely).

His theory is typical professor speak I’ve read before. Since the legislature dictates a particular ccy is what is needed to pay taxes etc then there will always be demand for that ccy. This is nonsense. Unlike these professors, myself and friends (who manage hedge funds etc) deal in the real world rather than textbook theories.

And no I don’t much care if any of these guys get a nobel prize for their papers. I’m sorry but I can’t find any hard facts that back up this thesis. Its all theory supported by the contention that legislature ultimately matters. It doesn’t.

Chris,

Go to Warren Mosler’s blog. He ran a hedge fund for many years and is an MMT founder not an academic,

Thanks Jason

I’ve actually read Moslers thoughts before. They boil down to “deficits don’t matter” and “confidence” is what will hold it together. Aggregate demand will remain due to necessity to pay taxes blah blah.

If you think debt doesn’t matter then this approach is fine and you should buy government bonds at 1%, stocks with avg P/E of 19 and Real estate.

Thing is debt has mattered since man began walking. I’m of the opinion we’re in the blow of stages of this cycle. As always we place our bets and watch.

Hey Chris,

That’s actually a gross oversimplification of MMT to the point of misrepresenting it. Bonds have been in a 30 year bull market yet the deficit terrorists continue to ignore reality and insist ‘one of these days interest rates will skyrocket’. What will it take, fifty years before the terrorists admit, perhaps we were mistaken? Perhaps government deficits are necessary for the private sector to be able to save in a riskless asset?

You state that it’s “nonsense” that there will always be a demand for US dollars to pay federal, state and city taxes. Simply stating it’s nonsense doesn’t make it so. How are you going to pay your tax obligations? Gold? (sorry IRS doesn’t accept it, you’ll have to sell your gold and use US dollars to pay those taxes). Do you know anyone who refuses to be paid in dollars? I don’t. Even gold dealers want dollars in payment when they sell precious metals to you. Think about that. It’s actually quite astounding.

You are correct. I’ve oversimplified it.

Bonds being in a bull market for 30 years does not mean they will continue in a bull market for the next decade either. RE was in a long bull market…until it ended. Ditto stock markets etc. History shows us that oftentimes bull markets blow off in a mania.

Having to pay your bills or taxes in a specific currency is NOT a reason why any sane person might utulize that currency as a store of value. If this was so then Zimbabwe, Argentina, Yugoslavia etc would still have currencies that people would use. Their bond markets didn’t need to implode, all that needed taking place was a loss of faith in the currency. Bonds after all are simply long dated currency, which incidentally we’re not being compensated for. Why would a US citizen not store his ccy in say a mix of CAD, SGD and CHF and then simply pay his taxes with a wire from an account denominated in any of those ccy’s?

It is true that governments such as the US and Japan are self funding which is part of the argument of MMT. I don’t disagree. As long as one has control of the printing press then an overt default is impossible. As we have already begun to see (for the past 10 years) this has an effect on the currency in question. One needs only look at gold, oil, agriculture vs currency to see that investors are free to choose an alternative to playing the bond game.

As to your question: Does anyone refuse to be paid in dollars? The answer is increasingly yes. Here in Asia where I spend a lot of time increasingly Dollars are not a preferred currency. In some instances not accepted at all.

Chris,

Now you’ve broached on something I do agree with you on. Odd as it may seem from my positions above, I do own gold and gold miners. MMT although an accurate description of how a sovereign currency functions tends to ignore one of the uses of currency which is as a store of value instead of just a medium of exchange. However when you pull the Zimbabwe card (something always used to counter MMT) you lose some credibility. Hyper-inflation is as much a political failure as an economic one. With a 3% 10 year Treasury, the US is in no danger of hyper-inflation.

OTOH, it doesn’t shock me that some in Asia prefer not to be paid in dollars as it’s not their national currency. Here in the U.S. I’ve never heard anyone refuse dollars (even if like me they choose to later exchange some of those dollars for gold).

Hello and thank you for a refreshing read of intelligent opinions without cursing! I am long in gold and silver and have just been introduced to Kyle bass via the bbc..I love him! So calm and erudite in the face of the rude interruptions. I live in tokyo and want to learn how to short j gov bonds…am wondering what my sweet Japanese broker will do when I ask her!!

Thank you Donna.

Glad you enjoy our site. Shorting via CDS’s is very difficult (impossible as far as I’m aware) for the retail investor. The futures market is the viable alternative. Alternatively if you wished to do some DD you may look at highly levered institutions who are holding large amounts of JGB’s on their balance sheets. Buying long dated puts or shorting them outright would be easy for a retail investor to achieve.

Best of luck….and profits!

I’m not sure the BoJ decision process regarding monetization to support JGBs and any resulting inflation is the way you’ve described though I do think the break point will be the Yen rather than the JGB, at least initially.

Japan has chronic deflation, a very strong currency, and funds itself externally via its current account surplus, not JGB sales. The BoJ has a substantial amount of room to monetize JGBs to weaken the currency and support the current account surplus. Indeed, they’d love to weaken the Yen for this purpose and create some inflation. Japan has certainly tried on the fiscal side to create inflation and weaken the Yen. Japan’s monetary dilemma is the opposite of the conventional bond crisis (in a country with debts denominated in its own currency), where the problem is inflation, a weak currency, and a current account deficit. Japan, in other words, is still not irresponsible enough.

Of course, eventually not even the current account surplus will support Japan’s fiscal deficits and JGB requirements (a problem China will also have) but this is likely to take years, a lot of currency depreciation, an even greater amount of expected currency depreciation, and a huge amount of domestic non-governmental JGB sales to fund consumption and investment in yet another lost decade. In short, Japan’s “spring-loaded convexity” (to use a Kyle Bass term) is going to get a lot worse before it explodes but, and this is critical, it has to be preceded by substantial and ineffective Yen weakness. As long as the Yen is strong and expected to stay strong the BoJ can monetize all it wants to support JGBs and the current account surplus without worrying at all about inflation.

Am I missing something?

Very astute observations..Thank you.

Japan is still funding their deficit via the current account surplus. The problem now is that the current account surplus has been falling and will go into a more radical fall moving forward.

At the same time the fiscal imbalance is about 11%. Current account surplus is running about 3% so we are NOW at the point where they can no longer finance their deficits. I don’t think this is a situation that can be maintained for another 5 years or so. As I mentioned a slow down globally but especially China would further hurt the current account surplus. Look around the world and tell me who is in great shape to take up the slack here as consumer of Japanese goods? US?, Europe?, China?

Interest rates at this point don’t even matter. Lowering them to absolute zero would still result in a deficit.

So very soon they will either have to source external funding or monetize. I think they’ll do the latter but what does it matter really. The end game is the same.

Festive Greetings!

Hopefully you guys will still see comments on this post…

I’ve just come across the PowerShares 3x Inverse Japanese Government Bond Futures ETN (ticker: JGBD). It listed mid-November this year. It provides investors with: 3x notional exposure to the 10-year JGB future + exposure to 3m T-Bill index – fees, converted into USD from JPY.

Clearly it has drawbacks:

• It’s sponsored by Deutsche Bank’s London branch, making investors senior unsecured creditors to a subsidiary of a wobbly Euro bank

• The 3x returns won’t be achieved over the long term due to monthly resets and fees

• There is some exposure to US 3m T-Bills

• Deutsche Bank can call the securities at any time (albeit at a prescribed market value)

Nonetheless, it could be an interesting way to get exposure to a short of long dated JGBs.

Do you have an opinion on it?

Thanks

Fact sheet: http://www.powersharesetns.com/ps/pdf/P-DBSJG-ETN-PC-1.pdf

Prospectus: http://www.powersharesetns.com/ps/pdf/P-DBSJG-ETN-PRO-1.pdf

Glad I found this discussion because I agree the Yen is doomed _ but thanks to MMT I have my doubts. I know that I don’t know.

Just playing devil’s advocate here:

If Japan is finally entering a period of dissaving, doesn’t that also mean that _ one way and another _ government debt will decline?

Doesn’t dissaving imply that finally they’ll get a little economic dynamism, as the saved money gets spent?

Don’t the massive foreign holdings of the Japanese mean that there will be consistent demand for Yen, as that money flows home?

And aren’t repatriations (corporate, private) foreign assets going to be a source of tax revenue for the government?

I don’t find my own arguments above extremely compelling, but I do think the debate is missing something. It was well said by an earlier poster that in a shrinking society with low unemployment, the most important thing is just shifting around how you want to allocate the wealth that’s already there.