We interrupt this broadcast to bring you some terrific news – Direct to you from the BOJ…

“Beloved citizens,

“On the 24th of December, 2011 the Japanese Cabinet approved a draft budget for the 2012 fiscal year. The numbers reveal that we, Japan, have proved once and for all that those opinionated morons over at CapitalistExploits.com, who are betting on an inevitable and overlooked crisis, don’t have a clue what they’re talking about!

“We have proved that ‘BIG in Japan’ isn’t just a song, but rather how we do things around here. They’ve even have had the nerve to suggest that our life insurance companies aren’t bulletproof. Capitalist bastards, they’re probably shorting us right now!

“When it comes to earthquakes and Tsunamis we set the records, and when it comes to sovereign debt, frankly we hit the ball out of the park.

“While it’s impolite to say so, after all we are a very polite people, we are secretly laughing in the face of those Greek wimps, with their paltry ‘debt burdens.’ We are so confident in fact that we are now considering providing consulting services to central banks on how to do it ‘Japan style.’

“To ensure you understand how superior we are in this game we proudly present you with this years budget:

- Outlays – ¥ 90.3 Trillion

- Estimated tax revenues – ¥ 42.3 Trillion

- Deficit – ¥ 48 Trillion

“These are the base figures, however to prove how truly great we really are, we need to add in the expense items for reconstruction, which tally up to ¥ 3.8 Trillion and rising, as well as pension payments which were left out of the budget – another ¥ 2.6 Trillion.

“Now that we have some truer figures to work with, you will notice (after picking your jaw up of the floor and cleaning up the coffee you just spat across your keyboard) that we will be borrowing north of 56% of our entire budget for the fiscal year 2012. Impressed yet?

“Now that we have your attention and you are in stunned awe of our capabilities, we’d like to point out that we routinely pass supplementary budgets, so we believe that we can quite easily throw a few trillion more into the borrowing pot.

“Our present forecasts indicate we will eat through roughly ¥ 22 trillion servicing our existing debts with our present sub 1% interest rates. This in itself accounts for about 52% of present tax revenues. We realize that we may need to push rates down a bit further actually, but we have a plan for that… please read on.

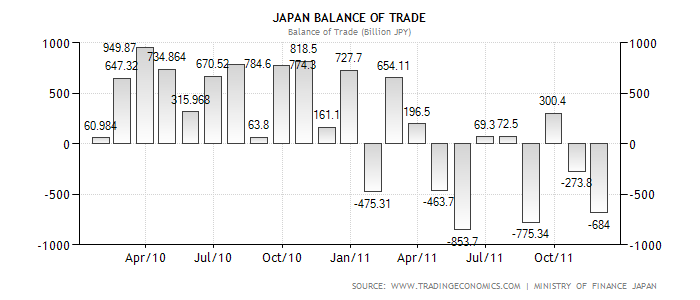

“In years gone by we have managed to maintain our deficits with a large trade surplus which has been reinvested in JGB’s. This combined with a historically high savings rate, with that savings being reinvested in our bond markets, has allowed us to break Guinness records.

“Unfortunately 2011 has not been kind to our trade surplus as shown below, and our savings rates are now running sub 3% down from 15% in the 80’s.

“Some of you may be concerned that this combination of rising outgoings and collapsing inflows is not sustainable, but you have not figured into your calculations the ingenuity, and sophisticated resources that we at the BOJ have available to us.

“After looking at the graph shown above and reviewing our data, we have decided to mobilize these resources and propel Japan into a new era of prosperity.

“We are instituting a ‘Love Japan’ policy. This will be a joint initiative with our very own department of immigration, Japanbrides.com and Hugh Hefner.

“We will be running an advertising campaign utilizing YouTube, Twitter, Facebook and various other social media sites which will showcase young, good-looking, sexually frustrated Japanese ladies seeking ‘relief.’ Our market research indicates that with the use of social media, these campaigns will go viral and the flood of male immigration applicants will be enormous. We have already mobilized teams of outsourced telemarketers in Mumbai and Manila to deal with the impending demand.

“Acceptable applicants must be under the age of 35 and earn in excess of US$200,000 annually. They will receive permanent residency in Japan and choice of one of the ladies in the program as their bride. All that will be required is a statutory declaration enabling the Japanese Government to have pay packets docked an additional 20% (we’re calling it a ‘love Japan tax’) which will be used to fund our bond issuance.

“We are very excited about this new initiative and look forward to many more years of humongous deficits! Meanwhile we invite you to ‘love Japan!’

Yours Sincerely,

Masaaki Shirakawa”

OK, obviously that was satire, however the reality is that Japan’s budget situation is completely out of control. I firmly believe, as do quite a few others, that shorting Japanese government debt could be one of the most profitable trades ever!

Supporters of this thesis include hedge fund seer Kyle Bass of Hayman Capital, who recently said, “Japan is a giant Madoff-like Ponzi Scheme that will blow up starting in the next few months.” You may remember Bass as the guy who made millions gambling against the sub-prime mortgage bond market.

I’m reviewing some ways that individual investors, you know, guys like us without $10M to throw at the CDS market, can trade this. Long USD/JPY and XAU/JPY are how we’re playing it for now as my contention is that the currency will be used as the escape valve with a desire to keep the bond market in tact.

Meanwhile, tell us what you think. Do you have an opinion on this situation or a way to play it? Drop us a comment below.

– Chris

“… When you look at Japan, they’ll sell more adult diapers than kids diapers by 2013.” – Kyle Bass

This Post Has 25 Comments

Hi Guys,

Interesting article. But its not a sure bet. Japanese bonds are held by Japanese investors so they are internal creditors. japan has little external debt. what this means is the ponzi scheme can go on a lot longer. this trading idea has been around for about 10 years. also central banks have unorthodox weapons available as the ECB will testify to. Japan can simply put on the printing press, and supply unlimited liquidity to their banks to reinvest in JGB. Thats what you can do on a fiat currency

trading ideas.

JGBS is the government bond inverse ETF

JGBD is the triple levered inverse ETN

you could short the yen or buy put options on the Yen.

You could buy put options on out of the money long term JGB bonds.. http://www.tse.or.jp/english/market/eqderiv/option/e_option.html

i wouldnt advise spreadbetting on the price. thats just madness.

interesting articles below

http://www.forbes.com/forbes/2010/0208/debt-recession-worldwide-finances-global-debt-bomb.html

http://info.moneyweek.com/article.php?bbcam=adwds&bbkid=funds+japanese&x=&jtid=13075911&UID=&p_id=27784&jchk=1&nolog=1&jdid=gg702818&gclid=CN2Y5c6Wua0CFS9ItAodn0_n8A

Shola,

Thanks for the feedback. You are correct as far as the “fiat” goes. Certainly nothing is for sure in trading, and as you point out, Japan has been blowing up for years. However, the music will stop sooner or later, and a lot of really smart people believe that it’s near, as do we.

We appreciate the other trading ideas. I typically don’t like the levered ETF’s, and I’m not balsy enough to short Yen. The options are good alternatives. We’re also working on something, as we said, so we’ll keep readers updated on what we find.

Mark

I dislike the leveraged ETF’s unless you’re day trading them.

The option chain runs very short so theta eats you (basically the worst time to be holding out of the money options)

As I mentioned in a previous article I’m short the Yen in the FX market and naturally you can leverage this if you wished to. That said the massive anomaly lies in the pricing of risk on rates. This is where we believe the greatest risk/reward setup exists.

Stay tuned

Chaps

Guess you read this http://www.economist.com/node/21538745 if not, might be interesting to you. The two points of note from the article are (i) large amounts of net foreign assets held; and (ii) consumption tax is low in Japan versus the RoW.

Given the ageing demographics, Japanese citizens are likely to sell assets (foreign and domestic) to fund retirement. Do you have a view as to why the Japanese would not sell foreign assets first? Placing the pension capital tied up in “risky” foreign assets into “safe” JGBs would be a possible con-job the Japanese government could promote, giving the JGB market one last crutch, IMHO.

I don’t think that raising consumption taxes is going to get them out of the economic / debt / demographic whole as that’s just redistribution.

Looking forward to what you are thinking regarding investment implications.

My work has been getting in the way of analysing the balance sheets Japanese domestic insurers. King Turd of Crap Island anyone? But I will get round to it at some point soon!

Cheers

Thanks Matthew

Even where JGB’s are NOT sold for retirement funding we still have a situation where net inflows will continue to dry up. Selling simply adds gasoline to this fire but the gasoline isn’t even required. Run the math…there is no way out.

Hi,

Assuming that Japan is able to implement the consumption tax hike to 10%. Would it be safe to say that this move has the potential to postpone the debt crisis by a couple of years.

I understand that even with a 10% tax, the numbers would still not get better, but it may help reinforce the trust of investors (non quantitative) on the willingness of the government to put its financial house in order.

I look forward to JGB carnage, all of us know it would happen but only a few of us would get the timings of the trade right.

I think March 2012 is the month to watch out for because:

a. Over $600B worth of JGB’s would roll over that month

b. Noda may have to announce an election when consumption tax increase, SS reforms are rejected in the upper house

Kunal Dixit

Do you really think big balls are needed to short the yen?

You have the country and the BoJ on your side 🙂

They all want a weaker currency and even short WITH you on the market… Shorting JGB is another story, you’re fighting against the government supported by the BoJ so they may use their tricks AGAINST you. What could prevent them to buy all the bonds at 0.5%?

If the BoJ do buy all the bonds (they already officially admit doing it on ‘massive’ scale) the JPY will be the weakest link and should be the first to loose ground. I see Japan as good candidate for H****inflation.

Anyway, in the end the very Yen and JGB will go in the same direction, it seems to me that it’s basically the same trade. FX is just much more liquid and cheap to hold. It may also move first. You can hedge it according your convictions JPY/USD, JPY/SGD, JPY/XAU, JPY/XAG, etc.

I look forward hearing about what you found for a JGB short that would not ruin the holder if the trade doesn’t play this year or next one. If you have a support with virtually no downside and time decay that would be heaven!! BTW, CDS may sound good but I wonder who would be able to pay the guaranty if a country of the size of Japan default. This is big systemic situation and more or less a global financial nuke that would make Fukushima look like a country side hanabi… not sure which counterpart will be left standing after such event?

Cheers, Sebastien

Disclosure: I live in Japan and used to hold 1/3 of my cash in JPY. I have been selling most of it, will keep on selling and start looking for selling yen I don’t have 😀

Sebastien,

I guess I should watch how I talk about my balls, lol. My comment was coming more from the perspective of shorting from a levered forex account. My partner plays forex un-levered, which is the way to do it, and in that case I think “no balls required!” It just ties up a bit more capital than I would normally commit. I agree with you; short Yen is likely a no-brainer as well.

Yeah, we’re excited about what we’ve found regarding shorting the JGB. There is no “perfect” trade, but this one seems to check the most important boxes. We will be reporting on it soon.

Another thing I wanted to bring up is the possibility of continued environmental “Black Swans.” The world is becoming much more geologically active again, especially the Rim of Fire, and Japan has already had one recent environmental/industrial disaster. Any additional, unexpected events like Fukushima could really put the nail in the coffin there. Unfortunately my “Spidey Sense” on that front is giving me a tingling sensation that isn’t pleasant…

Mark

Sebastien

I’m personally already short the Yen as per my comments here: http://www.capitalistexploits.com/2011/11/betting-on-an-inevitable-and-overlooked-crisis/

It is my contention that the BOJ will monetize first which will pressure the Yen. Since bonds are basically long dated ccy eventually bonds follow a falling currency and a circular feedback loop ensues. Given the size of the problem Japan is going to do an “Argentine”.

So we have the same view.

There is a good news actually, we will have time to take position on JGB as the Yen will give us the signal before! But things can still take time, why not one more year or two…

Also, I wonder what is the benefit shorting JGB rather than simply playing against the Yen. It the capital risk lower or reward potential much better?

BTW, do you live in Japan?

I think you’re correct in the Yen going first but one thing I’ve learned is that nothing is guaranteed EVER!

What we do know is that mathematically the end point is nearing with each passing day. When the boat tips it will likely go under very quickly due to the enormity of the problem.

Buying a CDS offers substantially more leverage than does playing the Yen due to the pricing of risk, while the costs of purchasing them is incredibly cheap. This is the attractiveness.

I don’t live in Japan no.

Chris

Mark, Chris and Sabestien,

I think the risk/reward for shorting Yen may be overstated as Japanese individuals and institutions hold a substantial portion of financial assets abroad, during a crisis they would not only liquidate domestic assets (JGB’s) but also foreign assets and would settle for nothing short of cash in Yen (Holding cash somehow makes individuals think they are in a risk free asset)

I’m not saying yen is a good asset to hold, neither am I against the idea of shorting yen, I just think that we need to rethink the hypothesis of looking at yen price as a leading indicator of shorting JGB’s.

Looking forward to your informative responses,

Kunal Dixit

I was thinking about that Kunal; I tried to look at the amount of Japanese holdings in foreign currencies (the FX accounts, foreign denominated investments incl. stocks, bonds, etc.), but I am not sure if this number is tracked somewhere, and if yes I couldn’t find it.

Anyway, it’s true that it may keep the Yen high if these numbers are significant. That’s what I think about when I hear about the Yen carry trade deleveraging during Yen increase phases in fact.

On the other hand imagine a return of inflation in Japan, let’s say 2~5% nothing crazy, and considering the impossibility of the government to raise interest rates because of the debt, all these cash deposits in JPY and Bond at 0.1% to 1% won’t be attractive anymore. People might want to sell their Yen to buy higher interest rates currencies, maybe emerging market stocks or foreign properties… just guessing here.

So we’re still searching for the best indicators of a turn!

BTW, do you know where to find the JGB sales information and BoJ JGB purchase data?

Regarding CDS there are few problems:

1- How to buy them 😀

2 – Will really any counterpart be able to pay the guarantee is such event?

Sebastien

Firstly, Great comments everyone.

In a crisis (which we’re basically in….Europe breaking down) the Yen has typically rallied strongly. In theory this could happen…but lets go back to the premise I made earlier which is essentially looking at the pure math. The trade surplus is shrinking and the savings rate is collapsing. These two things would not change substantially in a crisis. In fact the trade surplus would be pressured by a rising Yen. Financing the further bond issuance is not likely to be “fixed” by an ever greater crisis here.

Another point I’d like to make is that in a crisis the first port of call is cold hard cash not long dated bonds. One could argue that Japanese citizens may prefer to hold Yen rather than JGB’s thus sending this boat keeling over.

There are many scenarios I’ve played out in my mind and the only thing I would not put a bet on is which goes first rates or ccy. Either way it doesn’t matter really as the end results will be the same.

My personal conviction (and this is a target from 2007) is a bottom USD/JPY at 70 and EUR/JPY at 90. If I look at the overall rise in Yen from 2007 we are at the end of the pattern and going toward these final targets. These numbers should be adjusted a bit, maybe the top is already in in USD, maybe 70~75 will make it soon when Greece defautls.

The point being here that I don’t believe in a sustained and significant rise of the yen anymore and expect a trend reversal in matter of months now (no matter what happens to JGB).

BTW, I was looking at an interview of Kyle Bass and he mentioned NOT using CDS for Japan, do you guys know what support he plays? I heard about swaption but I’m not sure not familiar with this.

you guys are typing words but, like Kyle Bass, have no actual understanding of the dynamics of Japan.

Japan Inc. basically won the game ca. 1985 but its wider economy proceeded to blow itself up with malinvestment and the “victory disease” of buying into future growth.

Now, I don’t know anything other than having lived in Japan for most of the 1990s, but I do see a country that is not as screwed up as people think — if the yen were back at Y240 then Japan would be rather out of options, but Japan is WAY on the other side of that particular spectrum of difficulty.

And Japan, for all its faults, does not light money on fire on the scale the US does. Their per-capita health expense is ~$2000, while the US’s is 4X that. Their total defense budget — $50B — is a rounding error on annual our defense appropriation.

Yes, they owe one quadrillion yen to themselves but only people who don’t understand economics thinks this is significant. In reality, there can be no savings or debt, since unless you have your money in a coffee can your savings is somebody else’s debt.

When this relationship is across countries (and non-sovereign currencies), there is the frictions of default and becoming dependent on the charity of foreigners.

Japan doesn’t have any of this kind of problem. Perhaps Japanese savers aren’t as wealthy as they think they are, but at the end of the day the only thing that’s going to matter is whether Japan Inc can continue to produce the wealth to pay the country’s way in the world. Included in this capability is Japan’s ownership of foreign capital, including their rather large $1T position in US treasury debt.

With this, each Japanese person (notionally) owns a $10,000 savings bond. This is not a form of poverty!

I don’t want to come across as a pollyanna Japanophile apologist, for I do believe the country has some tough rows to hoe going forward. But, honestly, I think they’re a lot less screwed up than most of the world, and people analyzing the situation don’t know WTH they’re talking about.

One example of the latter is Japan’s demographics. Japan has too many people already and as long as they can maintain their health care cost overheads they will be able to pension off their baby boom without too much problem, since their baby boom is a measly 20M people and lung cancer is going to take most of them out sooner rather than later anyway.

Troy

I respectfully disagree. I believe you are confusing citizens with Government assuming they are the same thing. They are not. Case in point. If you were to take the net worth of Greek citizens and divide it into the Govt debt then one could argue that Greece does not have a debt problem.

The Japanese Govt is insolvent. The fact that the US spends enormous amounts on their military etc is not lost on us however they are not as far down the debt road as the Japanese Govt is.

Saying that they owe the debt to themselves does not mean the problem disappears. On the contrary the fact that such a large amount of debt is owned by a single group of people increases the risks not decreases. There is only one seller and no other source of buyers at anywhere near present rates of return. This line of thinking is mumbo jumbo, keynesian, ivory tower academic speak that pervades the world at present. If you believe that deficits don’t matter then you are correct. If you care to read history you’ll find that deficits always matter, every time.

Your comment regarding demographics misses the core point. The issue isn’t so much with people getting older per se. The issue lies with the shrinking trade surplus which is the result of demographics and the very real fact that pension funds are massively long JGB’s. Its no secret that pensioners draw on funds in retirement years. These factors are already pressuring net capital inflows into the JGB market wile at the same time bond issuance is rising. The confluence of this is rising rates and/or currency printing. Both of which I’ve discussed at length.

Troy,

Your ideas could be valid if:

– The budget would be balanced, but the government is spending twice it’s incomes (borrowing more than 100% of its budget!)

– The interest rates were not consuming 50 of tax incomes at only 1~2%; raise it 1 or 2% and you eat 100% of the budget (at this point you need to increase taxes 4x to balance the budget)

– There was a population growth in Japan to compensate retirements and buy bonds (not even considering retiree withdrawals); but now the government need to look outside to sell his bonds (ask China)

– The government would be strong enough to raise tax massively; Unfortunately the population can’t understand the need and a MAJOR issue will need to arise for the minds to shift

For now it’s business as usual but I’m there to see the smallest blip in inflation or shift in mentalities.