🥊 SPACS ARE GETTING SPANKED

It was just a few weeks ago when SPACs were all the rage and we saw headlines like these:

What a wonderful contrarian indicator that was. Whenever you see the media crowning the next Warren Buffett, we are probably either close to the top or the top is already in.

In the case of SPACs, it took just a few short weeks for the whole thing to come unglued. And the “next Buffett”?

“All six of Palihapitiya’s Social Capital Hedosophia-linked blank-check companies, including three that already completed mergers, have plunged more than the broader SPAC market since it hit its peak in mid-February. One of them — Virgin Galactic Holdings Inc., a space tourism business that’s backed by Richard Branson — is down more than 50%. All of these losses are greater than the 23% average decline in SPACs, as measured by the IPOX SPAC Index, over that time.”

As the saying goes, history never repeats itself, but it often rhymes.

🛒 INFLATION: COMING TO YOUR SHOPPING CART SOON

It’s official now:

And this…

At this point, you’d have to be a central banker not to see inflation showing up in nearly every aspect of our lives.

We think this is just the beginning, and it’s something we’ve been positioning for some time. Bill Miller nailed it in his recent market letter:

“I also think the market is likely underestimating the risks of inflation. So far, the Fed’s liquidity provisioning via bond purchases and increasing the money supply have resulted in higher stock prices but not significantly higher inflation expectations. Money velocity remains quite depressed by historic standards. But savings rates are unusually high and, as the economy becomes more “normal” in the second half of the year, it is likely that consumption will accelerate and, with it, money velocity. Lots of liquidity and increasing money velocity could quickly put upward pressure on inflation. Commodities markets have been unusually strong since bottoming in late April and are now considerably higher than they were pre pandemic.”

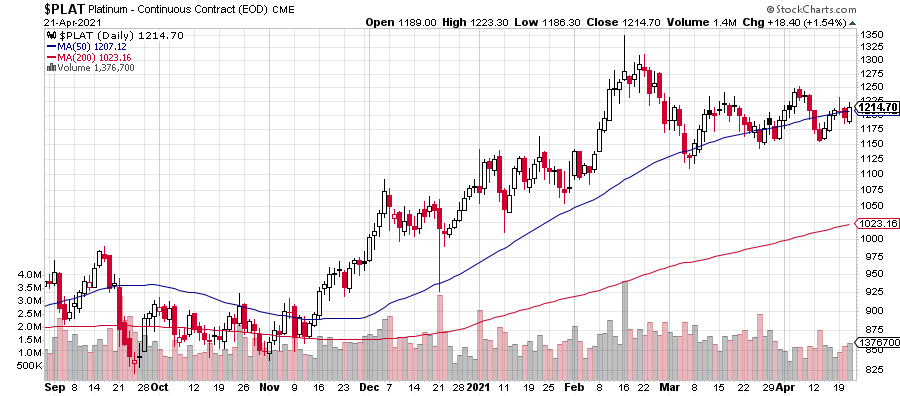

📈 PLATINUM: READY TO TAKE OFF?

Platinum looks like it’s getting ready to break out.

Tim Staermose chimed in in the Hedgies Uncut channel (if you haven’t already, join for free here) with an investment idea to play it:

“I am very long ZIM on the ASX. Don’t let the fact it mines in Zimbabwe put you off. Been operating very successfully there since 2001 or so. Very well put together company. Guernsey incorporated. Listed on ASX. Not subject to Australian or UK takeover rules, so when Implats made a grab for it back in 2003 they had to keep it listed. No compulsory acquisition threshold in Guernsey. All the hard currency transactions are outside Zim, aside from what they spend on Capex. Implats subsidiary effectively, but with an independent board and its own listing on ASX. A$25 last I looked but still only 3.5x forward earnings. And that’s without another leg up in Pt price.”

A platinum miner in Zimbabwe? We dare you to pitch this at a (Zoom) cocktail party. These are exactly the kind of unloved and dirt-cheap opportunities we get excited about here at Capitalist Exploits.

🔥 WILL ENERGY STOCKS EVER BE “HOT” AGAIN?

We’ve been harping on about opportunities in energy, be it coal, offshore oil, natural gas, etc. Many clients have been asking us whether these sectors will ever come back in favor with investors. The answer is, we don’t know. Maybe they never come back into favor where pension funds, for example, are piling into these sectors. But just because a sector never “comes back into favor” doesn’t mean that it can’t go up 10x over the next 10-15 years.

Consider tobacco stocks. Did that sector ever come back into favor with investors (where you heard of investors talking about how much they loved tobacco stocks) after the litigation trials of the late 1990s? No, no one would dare talk about investing in tobacco stocks. And yet, tobacco has been one of the best performing sectors since then.

Take a look at Altria, the company behind Marlboro, Black & Mild, and other brands. And this chart doesn’t account for dividends, which, at 5-10% yields, would make a hell of a difference to your total return (particularly if you reinvested those dividends).

The way we see it, many of the opportunities we are interested in may never be popular again. And we’re perfectly fine with that as we’ll be in no rush to sell them.

🤔 BIZARRO WORLD

We’re living in a truly Bizarro World where everything and nothing are the same. Just take a look at this:

Now, which one would you rather own — a joke crypto currency… or an entire basket of companies that keep our lights on (quite literally)?