♻️ GOING GREEN? NOT SO FAST!

People with experience in politics and none in business tell us oil and gas and coal are energy sources of the yesteryear and we’re instead “going green.“

Not to be a wet blanket, but here’s where our energy currently comes from:

We’re being told those tiny slivers of yellow and blue will power everything by 2030. Hmm…

🌎 DECARBONIZATION: THAT DOG WON’T HUNT

Then there’s another “tiny” obstacle standing in the way of the world going green: countries (and entire continents) with the majority of the world population. Here’s BBC:

India lambasted the richer world’s carbon cutting plans, calling long term net zero targets, “pie in the sky.”

Their energy minister said poor nations want to continue using fossil fuels and the rich countries “can’t stop it”.

China meanwhile declined to attend a different climate event organised by the UK.

What the greenies in the West seem to forget (or refuse to acknowledge) is that about ¾ the planet is expected to see exponential growth in fossil fuel usage over the next 40 years.

And while Western oil and gas companies are being peer pressured into becoming “woke” and divesting their assets for cents on the dollar, their non-Western counterparts are happily buying them up.

In fact, the entire energy sector is littered with bargains right now, and the asymmetry building in many of them is truly spectacular.

HOWARD MARKS: “IT CAN’T GO ON FOREVER”

HOWARD MARKS: “IT CAN’T GO ON FOREVER”

We briefly touched on what we call a “bubble in dumb money” last week: a shift from active to passive investing we’ve been witnessing in recent years. To give you an idea of the magnitude of the situation, here’s a chart we recently shared with Insider members:

We noticed Oaktree’s Howard Marks weighing in on this very topic recently:

“Certainly the trend toward passive investing, like through ETFs, has been very strong … If the ETFs are receiving a disproportionate amount of the cash flow into the market, then the stocks that they feature will do better than the market as long as it continues,” he told The Korea Economic Daily in a recent video interview.

“They’ve outperformed because they got more demand. But I believe it can’t go on forever. Nobody is studying the companies, and nobody is saying ‘this one is overpriced, this one is underpriced,’ they just buy what’s on the list,” Marks said in reference to ETFs.

You can watch the entire interview with Marks here.

HINTS FROM CENTRAL BANKERS

HINTS FROM CENTRAL BANKERS

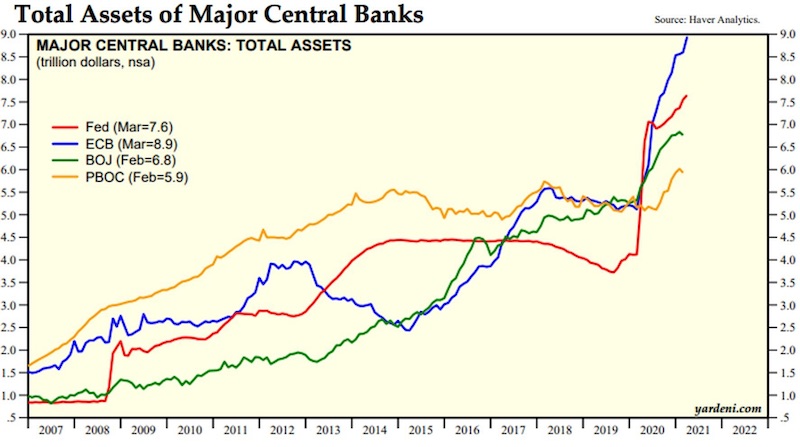

Here’s something that might make blood shoot from your eyeballs — balance sheets of major central banks.

In a world where central bankers are all going bananas with the printing presses and governments are borrowing obscene amounts of money to “pay for corona” this shouldn’t come as a surprise. And in case you wondered what Uncle Jerome thinks of this all…

“When it comes to this lending, we’re not going to run out of ammunition. That doesn’t happen.”

— Jerome Powell, March 26, 2020

Thanks Jerome, so kind of you to let us know exactly what we need to be invested in!

SIGN OF THE TIMES

SIGN OF THE TIMES

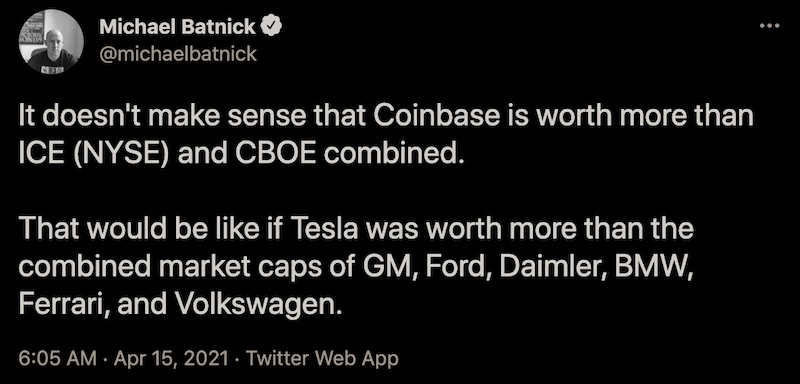

Presented with no further comment…

This Post Has One Comment

All the countries in this world called home have to be realistic, regarding the danger of Global warming or alternatively what we call going green