Market dislocations occur when financial markets, operating under stressful conditions, experience large widespread asset mispricing.

Welcome to this weeks edition of “World Out Of Whack” where every Wednesday we take time out of our day to laugh, poke fun at and present to you absurdity in global financial markets in all it’s insanity.

While we enjoy a good laugh, the truth is that the first step to protecting ourselves from losses is to protect ourselves from ignorance. Think of the “World Out Of Whack” as your double thick armour plated side impact protection system in a financial world littered with drunk drivers.

Selfishly we also know that the biggest (and often the fastest) returns come from asymmetric market moves. But, in order to identify these moves we must first identify where they live.

Occasionally we find opportunities where we can buy (or sell) assets for mere cents on the dollar – because, after all, I’m a capitalist.

In this week’s edition of the WOW we’re covering Brexit.

In a show of just how disjointed British society has become with previously held cultural values, London’s mayor just banned all advertisements of models who are essentially non-sharia compliant.

“Sadiq Khan, London’s first Muslim mayor, announced Monday that “body shaming” advertisements will no longer be allowed in London’s public transport.”

I admit to having a fondness for London, having previously called it home for 6 years of my life. One of the reasons I chose to live there – instead of say Kabul or Riyadh – was because I never much fancied girls dressed like ninjas. And together with friends I quite liked the fact that we could enjoy a few pints at the pub and wouldn’t be jailed and flogged for doing so.

As little as ten years ago it would have been unthinkable that either of these things would have been in question. And yet here we stand today, watching events unfold in real time. These little pieces of culture are under ever increasing threat, and it’s not just in Britain. Is it any wonder we are having a sweeping backlash and change in the zeitgeist?

What the political class in both Europe and Britain has miraculously failed to understand is that Brexit is much more about failures on multiple levels than it is about the concept of the EU. The EU has been so bastardised that it’s completely unrecognisable from the creature first established 23 years ago. This is understandable as the business of government is to grow cancer like never relinquishing power once established.

Having seen the slow but accelerating effects of a bureaucracy on tilt, the average Joe Citizen is now waking up to the fact that he finds himself with an oppressive and suffocating external form of government, an imperial overseeing force which understands his needs less and less.

Like an intestinal worm, the bureaucracy has grown to the point where the following areas of governance are now essentially dictated by a foreign imperial power:

- Immigration (the freedom of movement between EU member states works only if the EU’s external borders are controlled)

- Crime (closely tied to the flood of immigrants already pouring into Britain and other EU countries)

- Trade (44% of trade is with EU member states and nobody wants to see that hurt)

- Law (laws applying to British Citizens are increasingly made by the EU and not by the UK judicial system)

- Jobs (closely tied to trade)

- Finance (as the financial centre for Europe, London is subject to EU laws)

- Sovereignty (Britain’s parliament is no longer sovereign)

- Defence (Does Europe have defence?)

Is it any surprise that Joe Citizen is questioning the status quo?

It certainly shouldn’t be. This questioning has been met with a level of desperation by the establishment which can only be described as unprecedented.

Yes to Brexit or no to Brexit is less important a question than why Brexit in the first place?

The vote to stay or leave the EU is as much a vote for or a rejection of the establishment than any other European or British referendum I can think of.

We’re seeing an increasing divide across the developed world. The Trump vs Hillary debate is characterised by Hillary Clinton representing the establishment vote and Donald Trump positioning himself as a rejection of the establishment.

This is less a Republican vs Democrat vote than ever before and the rejection vote grows every day across the developed world.

Consider the following:

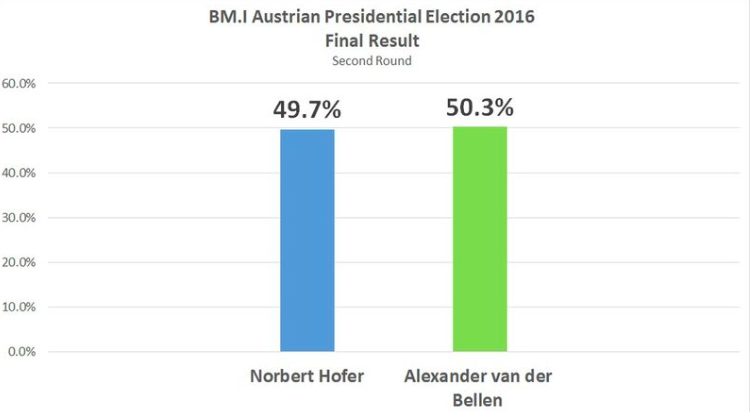

- Austria recently experienced something which would have been completely unimaginable just a decade ago. They came within a whisker (just 0.6%) of electing to power the Austrian Freedom Party, an openly racist, extremely anti-immigrant and anti-muslim party.

- According to a recent poll, over 90% of Dutchmen want a referendum on leaving.

- Italy’s right-wing party, Beppe Grillo’s Five Star Movement, look like they’ll have their guy elected mayor of Rome.

- Marine Le Pen, France’s right-wing hopeful, looks like an increasingly likely candidate for presidency next year. (You think I’m kidding…I’m not)

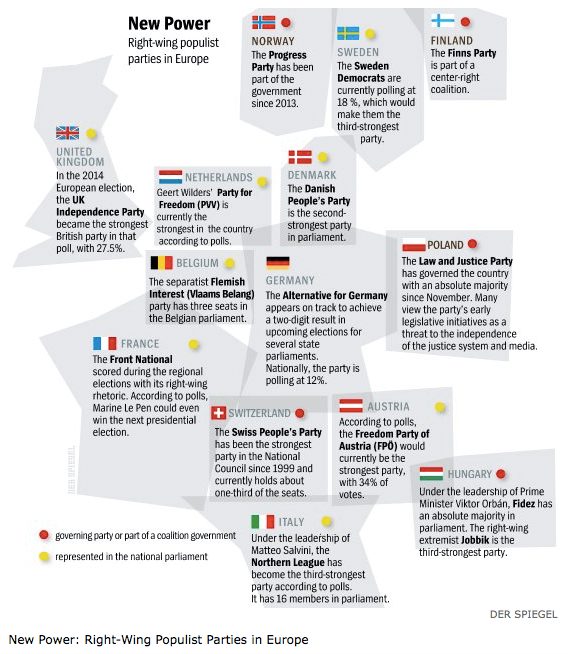

Der Spiegel has a nice map showing the trend. Countries with far right parties which have a presence in parliament are shown with yellow dots and those where far right parties are already part of the government are shown with red dots.

The xenophobic right-wing and rising backlash – a direct result of the European Union having lost control of its borders – has seen countries such as Sweden, Holland, and the UK experiencing surging right wing popularism.

Previously moderate Europeans no longer watch from the safety of their living rooms the Jihadi cauldron boiling in Damascus, Khartoum, or Islamabad, but instead find it exploding onto the streets of their own cities.

Nearly half of citizens in eight European countries polled want to hold a referendum on membership. Bottom line: Europe is in trouble and Brexit is simply bringing it to life in vivid colour for all to see.

As traders and investors it’s of no consequence what we may wish to happen. As incredibly important, wonderful, talented, intelligent, good looking, and well deserving readers of Capitalist Exploits are, the market doesn’t actually give a toss about us. Depressing, I know. But what actually takes place and how that affects asset prices is what matters.

And so the question to ask isn’t whether Britain leaves the EU, but rather from where will the next crisis of confidence come?

[yop_poll id=”7″]

Or do you think it will be some other country? Let me know in the comments below.

Know anyone that might enjoy this? Please share this with them.

We’d love your feedback and if you have a market you think worthy of covering please send it to me here.

– Chris

“Darlin’ you got to let me know, should I stay or should I go?” – The Clash, Should I Stay Or Should I Go?